Oil traders that still have contracts are selling at whatever price they can get because they do not (all) have the ability to take physical delivery.— (((Alex Gilbert))) (@gilbeaq) April 20, 2020

Storage and refiners are not buying. The $1/barrel is a trading dynamic when there are many sellers and limited buyers

Showing posts with label commodities. Show all posts

Showing posts with label commodities. Show all posts

April 21, 2020

Crude: this is what happens if you cannot take delivery

A simple explanation on how crude became negative

Explanation of negative #crudeoil price..— RM (@ravi__mehata88) April 20, 2020

Sari raat ki neend uda di aaj crude moves ne...

Who is still awaking...??? pic.twitter.com/a2jX9cwy5d

Crude oil futures trade at negative price for first time

BREAKING: WTI crude oil futures trade at negative price for first time https://t.co/pOSyH6AVtP pic.twitter.com/XsoH1jG8WH— Bloomberg (@business) April 20, 2020

And Jim Rogers gets proven wrongThis breaks the standard Black - Scholes model into pieces. The BS model assumes that the price of a commodity can never turn negative. At the most it can become zero.— V. Anand | வெ. ஆனந்த் (@iam_anandv) April 20, 2020

This is of course BS, because there are no physical world rules. https://t.co/9zquHkePVB

March 9, 2020

CRUDE down 30% this year but no benefit to Indian end customers

Will indian govt. Slash petrol/diesel prices by 30% with CRUDEOIL move??— Pathik (@Pathik_Trader) March 9, 2020

Or we have to just work hard to add value in govt. Pocket??

Have seen crude at 80$ odd 2 years back, petrol were trading at 80 INR. Now crude at 30$ odd and petrol still at 70 INR.#RamBharoseIndia

February 29, 2020

September 1, 2018

December 12, 2017

October 5, 2016

July 19, 2016

June 26, 2016

May 10, 2016

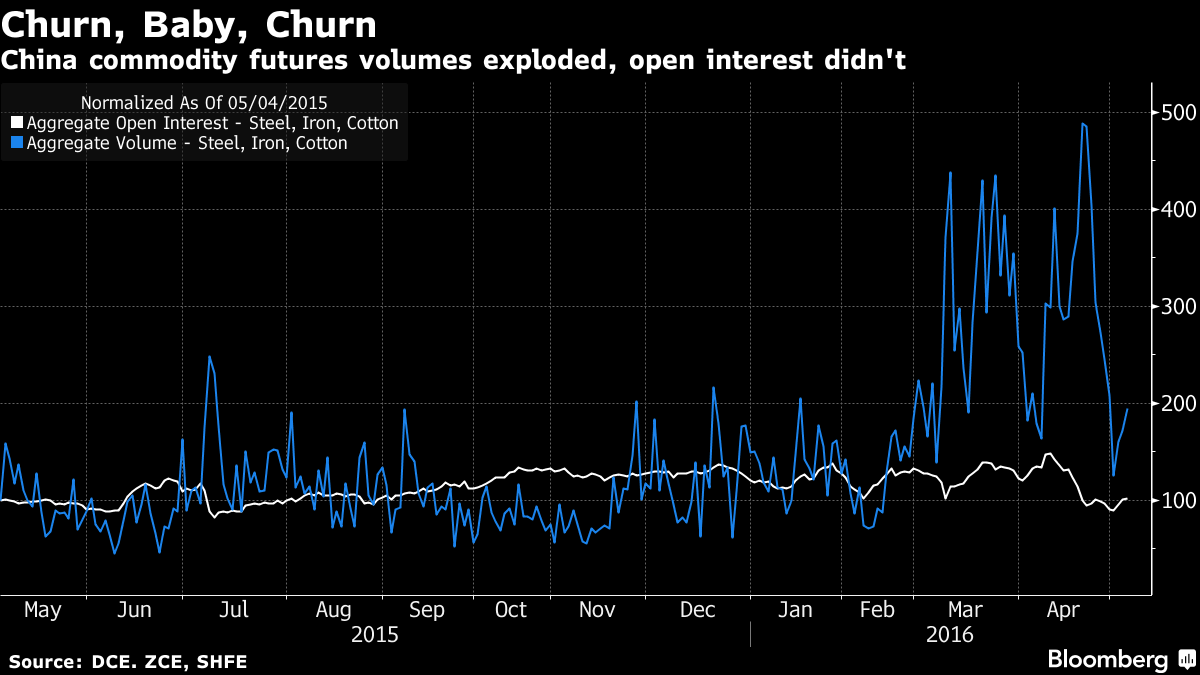

The World's Most Extreme Speculative Mania Unravels in China

From the Dutch tulip craze of 1637 to America’s dot-com bubble at the turn of the century, history is littered with speculative frenzies that ended badly for investors.

But rarely has a mania escalated so rapidly, and spurred such fevered trading, as the great China commodities boom of 2016. Over the span of just two wild months, daily turnover on the nation’s futures markets has jumped by the equivalent of $183 billion, outpacing the headiest days of last year’s Chinese stock bubble and making volumes on the Nasdaq exchange in 2000 look tame.

Read more at http://www.bloomberg.com/news/articles/2016-05-09/world-s-most-extreme-speculative-mania-is-unraveling-in-china

February 2, 2016

January 10, 2016

January 8, 2016

December 12, 2015

Subscribe to:

Posts (Atom)