The game of low float. It is an old trick but some of the players have mastered this. Let's understand how it is played and what is the risk and lesson for us?

— Niteen S Dharmawat (@niteen_india) September 25, 2020

The game starts with identifying a good company with a low float. What is a good company and what is a low float?

1/n pic.twitter.com/uxXEsOmv6x

Showing posts with label trading. Show all posts

Showing posts with label trading. Show all posts

September 25, 2020

The game of low float

August 30, 2020

Transaction charges in options vs futures

- futures trading is very expensive thanks to high charges

- in this example, I considered a nifty trade in futures and options

- brokerage is Rs.40 (buying and selling)

- excl brokerage, charges for futures is Rs.150 vs Rs 27 in options

- options trading is super cheap

- note I am ignoring time decay risks here

- source - zerodha calculator

January 5, 2020

Intraday Margin Likely to Increase Sharply Even for Cover & Bracket Orders

In the recent circular, issued by NSE and BSE it is clarified that brokers have to collect additional intraday margins for equities & derivatives (Equity, Commodities, Currencies). This new regulation seems to be applicable even for exotic leveraged tools like cover orders & bracket orders.

Currently, brokers charge only VAR margins for Intraday Equity trades which will soon likely be VAR + ELM margin. And for FNO trades it is likely to be Initial Margin (Span + Exposure Margin) for intraday trades has to be collected upfront from the trader.

These newer regulations directly affect the traders & brokers community. It is negative news for the traders who looking for higher leverage to boost up their returns.

This Increase in margin will push more traders towards Option Buying or Short term Investing Strategies as higher margins reduce the liquidity supply from the retail segment.

Intraday based portfolio level algo traders/Systematic Traders are also the impacted ones.

Expiry Day Option Sellers are the most impacted ones as it simply destroys the higher returns the intraday option sellers make on those expiry day trades.

Overall, Controlled greed is good as it protects many entry-level traders from taking bigger leverage and thereby brings reasonable expectations in the markets.

Source: https://www.marketcalls.in/market-regulations/intraday-margin-likely-to-increase-sharply-even-for-cover-bracket-orders.html

Currently, brokers charge only VAR margins for Intraday Equity trades which will soon likely be VAR + ELM margin. And for FNO trades it is likely to be Initial Margin (Span + Exposure Margin) for intraday trades has to be collected upfront from the trader.

These newer regulations directly affect the traders & brokers community. It is negative news for the traders who looking for higher leverage to boost up their returns.

This Increase in margin will push more traders towards Option Buying or Short term Investing Strategies as higher margins reduce the liquidity supply from the retail segment.

Intraday based portfolio level algo traders/Systematic Traders are also the impacted ones.

Expiry Day Option Sellers are the most impacted ones as it simply destroys the higher returns the intraday option sellers make on those expiry day trades.

Overall, Controlled greed is good as it protects many entry-level traders from taking bigger leverage and thereby brings reasonable expectations in the markets.

Source: https://www.marketcalls.in/market-regulations/intraday-margin-likely-to-increase-sharply-even-for-cover-bracket-orders.html

January 4, 2020

Thread on proposed SEBI rules on FnO trading

4. Even a trader with 1 Crore in account can only sell, 100 lots in Bank Nifty. 100 * 20 * 10 rs option can give only 20k which is 0.2% return.— Sunder (@SunderjiJB) January 4, 2020

5. Penny Option Sellers may be out of the industry.

6. Workshops based on Weekly Options / Expiry trading may be no more.

2/

December 13, 2019

Quick thought about trading & success rates.

Quick thought about trading & success rates.— Steven Goldstein (@AlphaMind101) December 12, 2019

There’s a myriad of claims as to how low or high the percentage of successful traders are. The success rates of often said to be anywhere from 10-20%. No one know the true rate, but also there are certainly qualifying factors 1/11

November 18, 2019

Mitesh Patel: The angry young man of options trading

Mitesh Patel is one of the most visible twitter handle in the options trading in India. Not one to shy away from a confrontation, he is as aggressive on social media as he is with his trading.

A man with humble roots, Patel is by-and-large a self-trained trader who does not mince words to protect his territory. Having paid the market a part of his salary as tuition fees for nearly a decade before he could find his mojo, it is no surprise that Patel is possessive about his achievement.

Behind the aggressive mask is a shrewd and calculative trader who has discovered the secrets of making money. Patel is among those traders who post and discusses his trades, wins and losses with much fervour

Read more at https://www.moneycontrol.com/news/business/markets/mitesh-patel-the-angry-young-man-of-options-trading-4645741.html

A man with humble roots, Patel is by-and-large a self-trained trader who does not mince words to protect his territory. Having paid the market a part of his salary as tuition fees for nearly a decade before he could find his mojo, it is no surprise that Patel is possessive about his achievement.

Behind the aggressive mask is a shrewd and calculative trader who has discovered the secrets of making money. Patel is among those traders who post and discusses his trades, wins and losses with much fervour

Read more at https://www.moneycontrol.com/news/business/markets/mitesh-patel-the-angry-young-man-of-options-trading-4645741.html

Choose your cup of poison carefully

#Futures Has High Reward High Risk Low Win Rate#OptionBuying Has High Or Low Reward, Lesser Risk Low Win Rate#OptionSelling Has High Win Rate, Smaller Rewards, Can Be High Or Low Risk Depending On Strategy— Zafar Shaikh (@InvesysCapital) November 18, 2019

Choose Your Poison Carefully https://t.co/DxjMdzSiBN

October 23, 2019

October 18, 2019

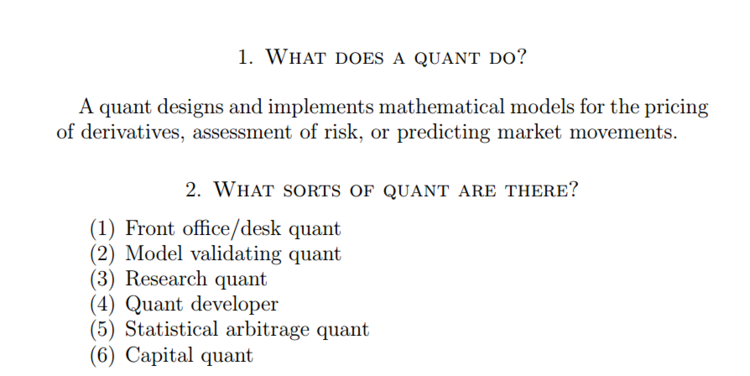

What constitutes Quant Trading and what does not?

The operative word here is “mathematical models”. Of course this can include probabilistic and statistical models as well.

So to sum it up, Quant trading is the application of Mathematics, Statistics and Probability theory in the area of trading.

For example, if you are looking at a simple Moving Average Cross over system, you may want to calculate the Conditional Probability and the Probability Distribution for various outcomes in terms of price. But merely trading a Moving Average Cross over system without having done the statistical work does not qualify as Quant trading.

Read more at https://www.niftyscalper.com/blogs/2019/10/18/what-constitutes-quant-trading-and-what-does-not

August 29, 2019

Ask your guru to trade in front of you

#mainebolatha trading gurus showing WhatsApp messages after trading hours .— Subhadip Nandy (@SubhadipNandy) August 29, 2019

Ask the guru to trade in front of you , ask him to trade with you . That's the only way to ascertain a trader from a faker 😋 https://t.co/gedOAj7B88

July 6, 2019

Market Wizard Linda Raschke’s Technical Trading Rules

- Buy the first pullback after a new high. Sell the first rally after a new low.

- Afternoon strength or weakness should have follow through the next day.

- The best trading reversals occur in the morning, not the afternoon.

- The larger the market gaps, the greater the odds of continuation and a trend.

- The way the market trades around the previous day’s high or low is a good indicator of the market’s technical strength or weakness.

- The previous day’s high and low are two very important “pivot” points, for this was the definitive point where buyers or sellers came in the day before. Look for the market to either test and reverse off these points, or push through and show signs of continuation.

- The last hour often tells the truth about how strong a trend truly is. “Smart” money shows their hand in the last hour, continuing to mark positions in their favor. As long as a market is having consecutive strong closes, look for up-trend to continue. The up trend is most likely to end when there is a morning rally first, followed by a weak close.

- High volume on the close implies continuation the next morning in the direction of the last half-hour. In a strongly trending market, look for resumption of the trend in the last hour.

- The first hour’s range establishes the framework for the rest of the trading day.

- A greater percentage of the day’s range occurs in the first hour then was the case in the past, and thus it has become increasingly important to trade aggressively if there are early signs of a strong trend for the day.

- In the world of money, which is a world shaped by human behavior, nobody has the foggiest notion of what will happen in the future. Mark that word – Nobody! Thus the successful trader does not base moves on what supposedly will happen but reacts instead to what does happen.

June 25, 2019

Price action trading... nice by @ForNifty

Trade 1: +22— Nifty For Living (@ForNifty) June 25, 2019

Trade 2: +4

Trade 3: +22

Trade 4: +19

Trade 5: -6

Trade 6: +15#DayTrading #Nifty #OptionsTrading #PriceActionTrading #NakedTrading pic.twitter.com/7tF1exdagC

June 14, 2019

From a maths teacher to India's leading option seller: The inspiring journey of PR Sundar

From a person who managed to lay hands on his first pair of slippers when he reached the 10th grade to be one of the largest individual option sellers in the country is an inspiring journey. The fact that the person was a teacher for the most part of his life makes one wonder about the hidden potential of this individual.

PR Sundar, a math teacher, learned about options from the most basic source - the stock exchange booklet - that every dealer working in a broker’s office reads. He still maintains that the book is his primary source of knowledge. While the source of information was the same, the knowledge that Sundar could extract from that source was much higher than what most are capable of.

Born in a poor family, Sundar, a post graduate in mathematics, took to teaching as there were few job opportunities back then. A teaching assignment in Singapore helped him save capital to think about returning back to India and starting a business. A strange happenstance brought Sundar to the market and he has never looked back.

A successful trader who earned his spurs in the options market, Sundar continues to teach, only this time the subject has changed to options. But like every good teacher he is more interested in clearing the cobwebs and imparting knowledge, which can remain lifelong, than spoon-feeding strategies.

Read more at https://www.moneycontrol.com/news/business/moneycontrol-research/from-a-maths-teacher-to-indias-biggest-option-seller-the-inspiring-journey-of-pr-sundar-2832331.html

PR Sundar, a math teacher, learned about options from the most basic source - the stock exchange booklet - that every dealer working in a broker’s office reads. He still maintains that the book is his primary source of knowledge. While the source of information was the same, the knowledge that Sundar could extract from that source was much higher than what most are capable of.

Born in a poor family, Sundar, a post graduate in mathematics, took to teaching as there were few job opportunities back then. A teaching assignment in Singapore helped him save capital to think about returning back to India and starting a business. A strange happenstance brought Sundar to the market and he has never looked back.

A successful trader who earned his spurs in the options market, Sundar continues to teach, only this time the subject has changed to options. But like every good teacher he is more interested in clearing the cobwebs and imparting knowledge, which can remain lifelong, than spoon-feeding strategies.

Read more at https://www.moneycontrol.com/news/business/moneycontrol-research/from-a-maths-teacher-to-indias-biggest-option-seller-the-inspiring-journey-of-pr-sundar-2832331.html

February 26, 2019

Why You Get Stop Hunted and How to Avoid it

Why You Get Stop Hunted and How to Avoid it— Rayner Teo (@Rayner_Teo) February 26, 2019

Learn more: https://t.co/TPknJ1Qtgq pic.twitter.com/k40TDEzFpz

February 19, 2019

The secret of not getting trapped

The secret of never getting trapped. Very precisely explained by @Prashantshah267. Every time I read the book, I improvise. Looking forward to meet you and @ap_pune on 22nd Feb . pic.twitter.com/oxIB7UGYgW— Vithal (@srvithal388) February 19, 2019

February 10, 2019

How to trade nifty weekly options?

All options expire last Thursday of every month and now with the introduction of weekly options, we will now have an expiry every week.

It should be noted that premium in options drops faster as one heads towards expiry. So if traded properly, it will mean even more income for an option writer.

Look at this from an option writer's perspective. Assume a trade in NIFTY 11000 CE (at the money) with IV of 15 and expiry of 7 and 30 days.

The options will be priced at Rs.100 and Rs.200 respectively. Note: this is approx and rounded off for convenience. Also, I am using the option calculator at vfmdirect.

Here if I write a monthly option, I will collect Rs.200 as premium income in monthly option. But if I sell a weekly option (current series), I can earn Rs.100/- EVERY week or Rs.400/- in a month. This is fantastic.

For the buyer of the call, it means he will earn a profit only IF the price on expiry is ABOVE 11200 for monthly options and 11100 in case of weekly options.

A simple strategy assuming trend is up would be to:

- buy 10500 CE around 500 and write 11000 CE around 100... SL 100 points in futures

It should be noted that premium in options drops faster as one heads towards expiry. So if traded properly, it will mean even more income for an option writer.

Look at this from an option writer's perspective. Assume a trade in NIFTY 11000 CE (at the money) with IV of 15 and expiry of 7 and 30 days.

The options will be priced at Rs.100 and Rs.200 respectively. Note: this is approx and rounded off for convenience. Also, I am using the option calculator at vfmdirect.

Here if I write a monthly option, I will collect Rs.200 as premium income in monthly option. But if I sell a weekly option (current series), I can earn Rs.100/- EVERY week or Rs.400/- in a month. This is fantastic.

For the buyer of the call, it means he will earn a profit only IF the price on expiry is ABOVE 11200 for monthly options and 11100 in case of weekly options.

A simple strategy assuming trend is up would be to:

- buy 10500 CE around 500 and write 11000 CE around 100... SL 100 points in futures

By buying a deep ITM CE, the premium (time decay factor) will be almost nil so the position becomes fully hedged. This trade can be taken every Friday in current series.

One can devise strategies depending on whether one expects to be bullish, flat / rangebound or bearish. There are hundreds of possibilities. Try the options strategy builder at http://opstra.definedge.com/strategy-builder and experiment with different strategies.

NOTE: as a buyer, your enemy is time decay... you need to be fast with your traders and do the maths accordingly.

February 3, 2019

December 26, 2018

What all things required to make consistent and decent money for living through trading?

What all things required to make consistent and decent money for living through #DPTrading pic.twitter.com/Te49CTRufd— Ravii (@Only_Nifty) December 26, 2018

December 9, 2018

This options trader has a unique strategy to double money in 2 years — check it out

I went to the US and got trained with the best. I enrolled for a course with SMB Capital founded by Mike Bellafiore author of One Good Trade and The Playbook, for a structured program in trading. I also went through the course offered by the famous Dr. Van Tharp.

SMB has a very intensive and structured training program where they take you through the entire trading process. We worked from 6.00 in the morning to 9.30-10.00 pm every day. Those under training were attached to one of the 6-7 super traders who were all multi-million dollar traders.

Every morning the super traders came up with a list of what was called ‘stock in play’. These were based on analysis and certain setups which picked up stocks that the team felt was likely to see increased activity during the day. The team leader would then discuss it with his team and how they should handle it.

These were generally intraday or swing trades which the traders held for 2-3 days. I was not comfortable with this trading style. One day, during lunch Seth Freudberg who was heading the options desk asked me if I had ever traded options. Since I had not he asked me to try it out.

I took to options more easily and learned many commonly used and proprietary strategies used by traders in SMB Capital under the mentorship of Seth.

Dr. Van Tharp’s training helped me with the psychology aspect. The training session helped in analyzing myself, to understand my strength and weakness. It helped clear up the path in for me in knowing what kind of trades I can do and what I cannot. For me one of the main takeaways was I knew what not to trade. Another important thing I picked up was the importance of position sizing.

These training helped cut down my learning curve by at least 3-4 years.

I traded the US markets for nearly two years and along with it the Indian markets. However, I soon realized that trading options in Indian markets are different than that in the US markets. Strategies that worked very well in the US markets were not giving the desired returns in India.

The main reason for this is the strange margining system we have in India. In a defined risk strategy, say a spread, the margin to be paid in the US was the spread between the strikes, but in India complete margin on both the legs of the trade is needed. This makes a number of strategies like the butterfly or the Iron Condor unattractive.

As trading both the US and Indian markets was stressful I decided to hone my skills in the Indian market.

Read more at https://www.moneycontrol.com/news/business/this-options-trader-has-a-unique-strategy-to-double-money-in-2-years-check-it-out-3267041.html

For many of his trading strategies, I strongly recommend following his twitter handle at https://twitter.com/KatariyaPran

SMB has a very intensive and structured training program where they take you through the entire trading process. We worked from 6.00 in the morning to 9.30-10.00 pm every day. Those under training were attached to one of the 6-7 super traders who were all multi-million dollar traders.

Every morning the super traders came up with a list of what was called ‘stock in play’. These were based on analysis and certain setups which picked up stocks that the team felt was likely to see increased activity during the day. The team leader would then discuss it with his team and how they should handle it.

These were generally intraday or swing trades which the traders held for 2-3 days. I was not comfortable with this trading style. One day, during lunch Seth Freudberg who was heading the options desk asked me if I had ever traded options. Since I had not he asked me to try it out.

I took to options more easily and learned many commonly used and proprietary strategies used by traders in SMB Capital under the mentorship of Seth.

Dr. Van Tharp’s training helped me with the psychology aspect. The training session helped in analyzing myself, to understand my strength and weakness. It helped clear up the path in for me in knowing what kind of trades I can do and what I cannot. For me one of the main takeaways was I knew what not to trade. Another important thing I picked up was the importance of position sizing.

These training helped cut down my learning curve by at least 3-4 years.

I traded the US markets for nearly two years and along with it the Indian markets. However, I soon realized that trading options in Indian markets are different than that in the US markets. Strategies that worked very well in the US markets were not giving the desired returns in India.

The main reason for this is the strange margining system we have in India. In a defined risk strategy, say a spread, the margin to be paid in the US was the spread between the strikes, but in India complete margin on both the legs of the trade is needed. This makes a number of strategies like the butterfly or the Iron Condor unattractive.

As trading both the US and Indian markets was stressful I decided to hone my skills in the Indian market.

Read more at https://www.moneycontrol.com/news/business/this-options-trader-has-a-unique-strategy-to-double-money-in-2-years-check-it-out-3267041.html

For many of his trading strategies, I strongly recommend following his twitter handle at https://twitter.com/KatariyaPran

November 14, 2018

Subscribe to:

Posts (Atom)