On daily charts, trend is up and will reverse on close below 15600. Swing low is at 15000 levels.

October 31, 2014

NF monthly charts

The month has ended and nifty trend remains strongly up. Unlike daily charts, there is no hint or indication of any correction so this still remains a buy on dip market.

First sign of any trend reversal will be close below 7700.

Note good support near 6200 levels... this level would be an excellent level to buy stocks whenever we have a correction.

First sign of any trend reversal will be close below 7700.

Note good support near 6200 levels... this level would be an excellent level to buy stocks whenever we have a correction.

Weekend update

Trend is up and will reverse on close below 7800. Above 8200, rally possible to 8500 spot.

Any correction from here will likely form a higher swing low (ideally around 7800 or above).

Option writing points to support at 8000 (NOV series).

Any correction from here will likely form a higher swing low (ideally around 7800 or above).

Option writing points to support at 8000 (NOV series).

October 30, 2014

Market outlook

Trend is up and will reverse on close below 7800. Above 8200, rally possible to 8500 spot.

Any correction from here will likely form a higher swing low (ideally around 7800 or above).

Option writing points to support at 8000 (NOV series).

Any correction from here will likely form a higher swing low (ideally around 7800 or above).

Option writing points to support at 8000 (NOV series).

October 29, 2014

Market outlook

Trend is up and will reverse on close below 7800.

Option writing points to support at 8000 (NOV series).

Option writing points to support at 8000 (NOV series).

October 28, 2014

Market outlook

Markets close above 8000 first time this month. So while technically the trend has shifted to "buy" on EOD charts, one has to consider the previous day's bar high at 8060 showing selling.

October 27, 2014

Markets form "dark cloud cover"

Markets form a "dark cloud cover" or "piercing bar pattern". This happens when we have a nice gapup opening followed by a selloff which closes within the range of the previous day's candlestick.

Because of above, preferred strategy on EOD charts is to do nothing and let markets give some clear direction. As of now, I expect markets to be directionless between 7800 and 8200.

Because of above, preferred strategy on EOD charts is to do nothing and let markets give some clear direction. As of now, I expect markets to be directionless between 7800 and 8200.

October 26, 2014

Weekend update

Current trend is down and will revert to buy on close above 8000 spot.

Note strong resistance at 8200 levels.

Option writing points to support at 7800 (OCT series).

Note strong resistance at 8200 levels.

Option writing points to support at 7800 (OCT series).

October 21, 2014

BANK NIFTY closes at new high

BNF closes at new high... first buy signal was few days ago on 5 day swing charts and today would be a buy signal on 20 day swing charts.

Note that signal reliability is likely to be low as this index has been rangebound for last few months.

Note that signal reliability is likely to be low as this index has been rangebound for last few months.

Market outlook

Current trend is down and will revert to buy on close above 8000 spot.

Today was the second day of "higher high higher low" formation. Within a downtrend, upto 2-3 "UP" days are considered normal. Advance decline was marginally positive.

Option writing points to support at 7800 (OCT series).

Today was the second day of "higher high higher low" formation. Within a downtrend, upto 2-3 "UP" days are considered normal. Advance decline was marginally positive.

Option writing points to support at 7800 (OCT series).

October 20, 2014

Market outlook

Current trend is down and will revert to buy on close above 8000 spot.

Today was the first "higher high higher low" formation. Within a downtrend, upto 2-3 "up" days are considered normal.

Option writing is not giving any clues as we are heading into expiry week. NOV series clues point to support at 7500 (this is preliminary, basic and based on insufficient data).

Today was the first "higher high higher low" formation. Within a downtrend, upto 2-3 "up" days are considered normal.

Option writing is not giving any clues as we are heading into expiry week. NOV series clues point to support at 7500 (this is preliminary, basic and based on insufficient data).

October 19, 2014

October 18, 2014

US markets

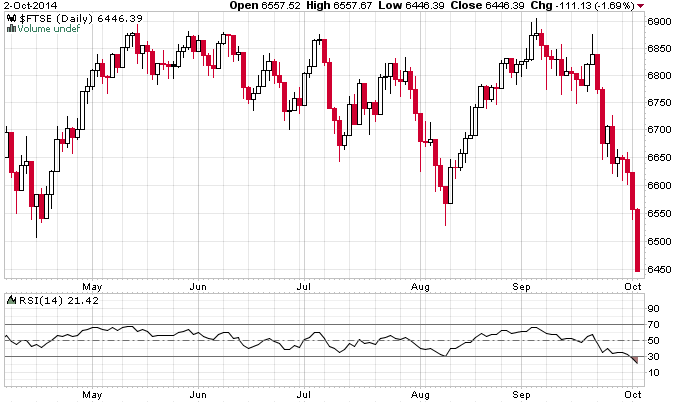

UK market charts

The FTSE is staging a dead cat bounce from oversold levels both on daily and weekly charts.

Expect strong resistance at 6500 levels.

Expect strong resistance at 6500 levels.

October 17, 2014

Weekend update

Current trend is down and will reverse to buy on close above 8000 (more strength above 8200).

Option writing points to resistance at 8000.

Option writing points to resistance at 8000.

October 16, 2014

Markets break 7800

Current trend is down and will reverse to buy on close above 8000 (more strength above 8200).

I was expecting 7800 to hold this series but this did not happen and markets broke this quite strongly.

Now option writing points to resistance at 8000.

I was expecting 7800 to hold this series but this did not happen and markets broke this quite strongly.

Now option writing points to resistance at 8000.

October 14, 2014

Markets likely to bottom out

Current trend is down and will reverse to buy on close above 8000 (more strength above 8200).

For all the weakness in global markets, our markets have still been holding above 7800 and have barely corrected 100 points this month. Option writers are winning so far and there is no change in open position status.

Since markets are refusing to go down, the chances increase that they will go up. Let's see how this happens. Close above 8000 spot AND near day's high will be the first confirmation.

For all the weakness in global markets, our markets have still been holding above 7800 and have barely corrected 100 points this month. Option writers are winning so far and there is no change in open position status.

Since markets are refusing to go down, the chances increase that they will go up. Let's see how this happens. Close above 8000 spot AND near day's high will be the first confirmation.

October 13, 2014

Market outlook

Current trend is down and will reverse to buy on close above 8050 (more strength above 8200).

Expect support at 7800 and resistance at 8050 on daily charts.

Option writing points to support at 7800 and resistance at 8200 this series.

Expect support at 7800 and resistance at 8050 on daily charts.

Option writing points to support at 7800 and resistance at 8200 this series.

October 10, 2014

Weekend update

Current trend is down and will reverse to buy on close above 8050 (more strength above 8200).

Expect support at 7800 and resistance at 8050 on daily charts.

Option writing points to support at 7800 and resistance at 8200 this series.

Expect support at 7800 and resistance at 8050 on daily charts.

Option writing points to support at 7800 and resistance at 8200 this series.

October 9, 2014

Market outlook

Current trend is down and will reverse to buy on close above 8050 (more strength above 8200).

Expect strong support at 7800 and resistance at 8050 on daily charts. I expect this level (7800) to be retested again before any meaningful rally happens.

Expect strong support at 7800 and resistance at 8050 on daily charts. I expect this level (7800) to be retested again before any meaningful rally happens.

Question on buying stocks in a falling market

I am a little confused here. On the one hand you have indicated that we may be looking at a long correction phase and on the other hand you have given buy calls.

Now, from my experience when markets correct, at some point or the other, ALL stocks fall, irrespective of their strengths. The strong ones will maybe fall less but they WILL fall.

So why the buy calls? Can you please elaborate your thought process here. It would be very helpful in taking a decision.

Thanks and Regards,

Hiren

October 8, 2014

Falling wedge on hourly chart

Current trend is down and will reverse to buy on close above 8050 (more strength above 8200).

Expect strong support at 7800 and resistance at 8050 on daily charts.

Interestingly, highest OI has now shifted to 8100 call while there has been a cut in 7800 put OI. This can have bearish implications.

5 min and hourly charts have different views.

Expect strong support at 7800 and resistance at 8050 on daily charts.

Interestingly, highest OI has now shifted to 8100 call while there has been a cut in 7800 put OI. This can have bearish implications.

5 min and hourly charts have different views.

October 7, 2014

Market outlook

Trend is down and will reverse on close above 8200. Minor swing level is at 8040 spot.

Question on investment amount

Question: What to earn by investing 10k in stock ??..its foolishness or waste of time and money. I think either we have to invest more or better to do fixed deposits. How can we do wealth creation in small piece of money?? asked by bears and bulls

October 3, 2014

October 1, 2014

Weekend update

This is a short week! Markets will be closed for 5 days and will now reopen on Tuesday. Not aware of any other country where this happens. With so much interlinking of markets, it is high time the powers-that-be provide a trading session on an alternate day like Saturday.

Back to charts....

On EOD charts, trend remains down with reversal level at 8200. Support exists at 7800.

Both these levels also have highest open interest for options.

Back to charts....

On EOD charts, trend remains down with reversal level at 8200. Support exists at 7800.

Both these levels also have highest open interest for options.

NIFTY monthly charts

NIFTY has formed a doji (open equal to close) - this indicates a tussle between bulls and bears. It can also mean indecision with neither party willing to take aggressive trades.

Subscribe to:

Posts (Atom)