March 31, 2021

NIFTY EOD charts

March 29, 2021

March 27, 2021

BANKNIFTY weekly charts

NIFTY weekly charts

Is the correction over?

March 26, 2021

Mindset of a successful trader - thread by @kirubaakaran

A small thread on Mindset of a successful trader. What differentiates best traders from the bad ones? Why 95% of the traders don’t make money? Trading is an unpredictable game, how could one win in that?

Many people think some magical strategy or indicators is all they need to be successful at Trading. But what really goes in the minds of a successful trader? Professor Hichman Benjelloun did a research on this.

Successful traders have poker face. If you talk to successful traders or chat with them, you can’t figure out if they are happy or sad. Having good time or bad time.

For them making money or losing money is same thing, as they say a good trader feels great after a good trade, but a great trader feels NOTHING after a great trade. They control their emotions not only in trading but also outside their trading life. They are highly disciplined

Whether they are making money or losing money, they continue with their daily routine, going to gym, cycling etc they don’t skip it because of a losing trade. It doesn’t affect them. They have probability mind set. What does that mean?

Just because there is a continues Tails in flip of coin doesn't mean occurrence of Tails will be more, if you flip 10000 time, you will realise heads 50% tails 50%. They the know the probability of success or failure, and they believe in law of large numbers.

Successful traders keep doing the same boring thing over and over dozen times without worrying about the next trading outcome, bcoz they know over the long run probability is in their side. But 95% of the traders don’t do this.

Professor Hichman Benjelloun interviewed one guy who told him that he wanted to be the next #WarrenBuffet and if hired he said he can give his 100%. Becoming the next WarrenBuffet, next Bill Gates, next Steve Jobs is highly impossible. Why?

Because these people are called as outliers in statistical terms. When Bill Gates was asked “How he became richest person in the world?” He replied Am just lucky. This is true fact. You do good, work hard, have realistic expectations to succeed but don’t try to become next Gates

It’s not success that is pure luck, it’s the extent of the success that is pure luck. By doing exactly the same thing over and over again, statistics will be in your favour. That’s why they say “Good trading is Boring”. That’s the actual secret behind Successful traders mind.

March 25, 2021

NIFTY EOD charts

Will nifty bottom around 14000?

Wave 5 of #Nifty in progress & objective is around 13950-14000

— Zafar Shaikh (@InvesysCapital) March 25, 2021

If we get there in next 2-3 sessions, expect decent Pullback from 14k

But 14850-14900 is likely to be strong hurdle for whole of April Series .We may spend most of Apr series in 14000-14800 Range as per Trend Model https://t.co/cz9wyMt6ol

March 24, 2021

NIFTY EOD charts

March 22, 2021

NIFTY EOD charts

March 19, 2021

NIFTY EOD charts

March 18, 2021

NIFTY EOD charts

March 17, 2021

NIFTY EOD charts

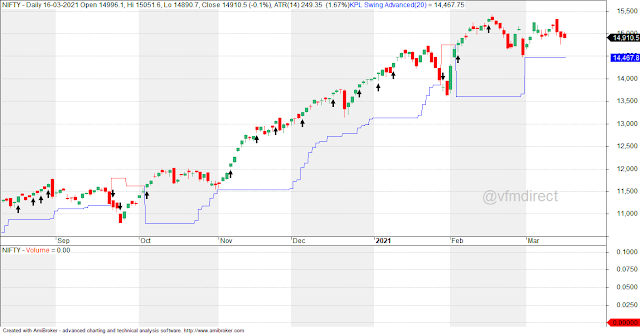

March 16, 2021

NIFTY EOD charts

March 15, 2021

NIFTY EOD charts

March 12, 2021

Cumulative Open Interest at record highs

The build-up in March has been phenomenal pic.twitter.com/I4UIXpbUt2

— Subhadip Nandy (@SubhadipNandy) March 11, 2021

NIFTY EOD charts

March 10, 2021

NIFTY EOD charts

March 8, 2021

NIFTY EOD charts

US Dollar Index chart

CNX 500 charts

March 5, 2021

NIFTY EOD charts

Major top in sight?

Whenever such phenomenon occurs, a major top or bottom is usually created in far month.

— Gautam Mazumdar (@gautam_icma) March 4, 2021

I am generally a little humble in posting my views. However, mark my words, we will revisit this tweet on expiry of May series.

Plan your trades well.#MidnightOil studies