September 30, 2020

NIFTY daily, monthly and quarterly charts

September 29, 2020

NIFTY EOD charts

September 28, 2020

How the rich become rich

Figure out how to generate enough cash flow to just service the debt (interest). Forget how big the principle is, it just doesn’t matter!

— Shivam Shankar Singh (@ShivamShankarS) September 28, 2020

People with car loans and house loans need to bother with paying off principle, businesses surprisingly don’t it seems.

NIFTY EOD charts

September 25, 2020

NIFTY EOD charts

The government with a "difference" in books of accounts

The government with a "difference' in the books of accounthttps://t.co/ArsDfRMCct

— R. Balakrishnan (@BalakrishnanR) September 25, 2020

The game of low float

The game of low float. It is an old trick but some of the players have mastered this. Let's understand how it is played and what is the risk and lesson for us?

— Niteen S Dharmawat (@niteen_india) September 25, 2020

The game starts with identifying a good company with a low float. What is a good company and what is a low float?

1/n pic.twitter.com/uxXEsOmv6x

September 24, 2020

NIFTY EOD charts

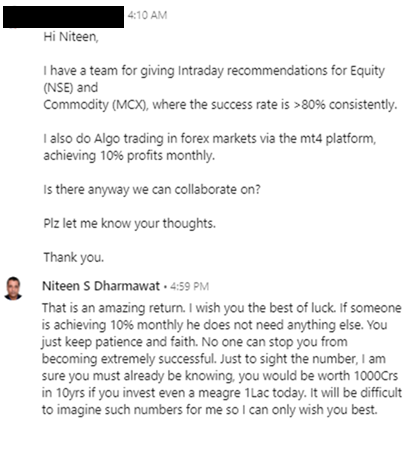

Why successful students fail in life

“I believe that our society’s “mistakephobia” is crippling, a problem that begins in most elementary schools, where we learn to learn what we are taught rather than to form our own goals and to figure out how to achieve them. We are fed with facts and tested andthose who make the fewest mistakes are considered to be the smart ones, so we learn that it is embarrassing to not know and to make mistakes. Our education system spends virtually no time on how to learn from mistakes, yet this is critical to real learning. Asa result, school typically doesn’t prepare young people for real life unless their lives are spent following instructions and pleasing others. In my opinion, that’s why so many students who succeed in school fail in life”.

-Ray Dalio

September 23, 2020

NIFTY intraday charts

NIFTY EOD charts

September 22, 2020

NIFTY intraday charts

NIFTY EOD charts

September 21, 2020

NIFTY EOD charts

September 18, 2020

NIFTY EOD charts

September 17, 2020

September 16, 2020

September 15, 2020

NIFTY EOD charts

Jio Financial Services?

For the uninitiated, the real jewel in Reliance crown is neither telecom, nor retail nor oil.

— Liberated Soul (@Liberated_Soul3) September 9, 2020

It's Jio Financial Services.

The impregnable moat which will be created with telecom & retail customers will make it the most valuable financial institution in years to come.

September 14, 2020

NIFTY EOD charts

- trend is up on daily charts

- today nifty closed 0.3% in negative at 11440

- AD was 2:1

- banknifty was very weak

- while small cap index was up 5%

September 12, 2020

September 11, 2020

NIFTY 30 min charts

NIFTY EOD charts

What connects beer, reptiles basking in the sun, a dangerous yeast infection, 98.4 Fahrenheit, an asteroid collision and finally, coconut toddy?

Read complete thread at https://threadreaderapp.com/thread/1304077632233861121.htmlThe answer is the thermometer. You see, it’s one thing to make small batches of beer in a monastery but a wholly different enterprise to brew hundreds of millions of bottles of beer that taste exactly same

— Krish Ashok (@krishashok) September 10, 2020

September 9, 2020

NIFTY options open interest distribution

NIFTY EOD charts

- today nifty closed 0.34 in negative at 11278

- AD was 1:2

- despite gap down opening, markets managed a close near day's high