December 31, 2019

Market topping out?

Today's closing has confirmed a top-out signal based on my VIX based model. 12286 on Nifty spot may become a top for January— Subhadip Nandy (@SubhadipNandy) December 31, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.7% in negative at 12168

- AD was 5:4 (good sign)

- VIX up 5%

- highest open interest 12300 CE (weekly expiry) and 12000 PE (monthly expiry)

- note trading range is 100 points in 2 days

- swing low around 12120 spot (hourly chart - https://www.tradingview.com/x/usaE5QLq/)

- trend is up on daily charts

- today nifty closed 0.7% in negative at 12168

- AD was 5:4 (good sign)

- VIX up 5%

- highest open interest 12300 CE (weekly expiry) and 12000 PE (monthly expiry)

- note trading range is 100 points in 2 days

- swing low around 12120 spot (hourly chart - https://www.tradingview.com/x/usaE5QLq/)

December 30, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed flat at 12256

- AD was 11:7

- VIX up 4%

- highest OI at 12200 PE

- trend is up on daily charts

- today nifty closed flat at 12256

- AD was 11:7

- VIX up 4%

- highest OI at 12200 PE

December 28, 2019

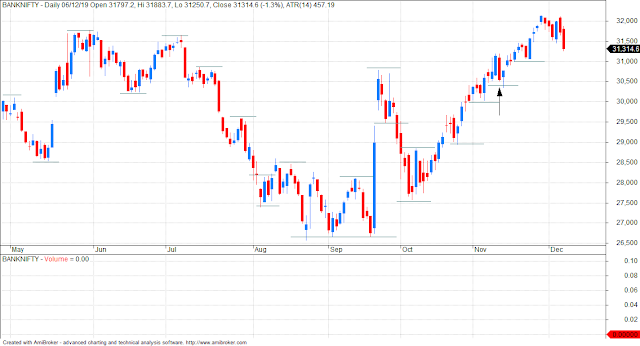

BANKNIFTY charts

- trend is up

- index at all time highs

- immediate support 32000

- ATR is 365

- min SL will be twice ATR

- this will be approx 31270

- if index closes above 32000, then SL will increase by 365

NOTE: tradingview.com and investing.com are showing different values for ATR inspite of using same charting application.

- index at all time highs

- immediate support 32000

- ATR is 365

- min SL will be twice ATR

- this will be approx 31270

- if index closes above 32000, then SL will increase by 365

NOTE: tradingview.com and investing.com are showing different values for ATR inspite of using same charting application.

Learn RENKO charts ... emotionless trading w/o indicators

Recent 5 min chart of nifty

15 min charts:

Hourly charts:

Daily charts:

Read more at https://www.investopedia.com/terms/r/renkochart.asp

December 27, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today markets closed 1% in positive at 12248

- AD was 11:7

- VIX down 6%

- highest OI shifts to 12200 PE

- trend is up on daily charts

- today markets closed 1% in positive at 12248

- AD was 11:7

- VIX down 6%

- highest OI shifts to 12200 PE

December 26, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.7% in negative at 12126

- AD was 10:9... good

- VIX down 6%... good sign for bulls

- trend is up on daily charts

- today nifty closed 0.7% in negative at 12126

- AD was 10:9... good

- VIX down 6%... good sign for bulls

December 24, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today markets closed 0.4% in negative at 12212

- AD was 4:5

- VIX down 5%

- trend is up on daily charts

- today markets closed 0.4% in negative at 12212

- AD was 4:5

- VIX down 5%

December 23, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed flat at 12266

- AD was 4:5

- VIX down 4%

- support developing around 12200

- trend is up on daily charts

- today nifty closed flat at 12266

- AD was 4:5

- VIX down 4%

- support developing around 12200

December 22, 2019

December 21, 2019

December 20, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today markets closed flat at 12272

- AD was flat

- option writing support 12200

- trend is up on daily charts

- today markets closed flat at 12272

- AD was flat

- option writing support 12200

December 19, 2019

Nifty may touch 13,400; Sensex 45,500 in 2020: Kotak Securities

The benchmark Nifty may touch 13,400 levels and Sensex 45,500 next year, and sectors like healthcare, agro chemicals, oil and gas are likely to do well, Kotak Securities said on December 19. "Market mood is more positive than what is reflected in the real economy mainly due to jump in earnings led by reduction in corporate tax rate and strong FPI flows supported by steady local SIP flows," Rusmik Oza, Senior Vice President and Head of Fundamental Research-PCG, Kotak Securities said at a press meet here.

Nifty-50 is trading closer to its peak valuations and is expected to touch 13,400 by end of December 2020. For BSE Sensex the target would work to 45,500 by next year, the Mumbai-based firm added.

Read more at https://www.moneycontrol.com/news/business/markets/nifty-may-touch-13400-sensex-45500-in-2020-kotak-securities-4747041.html

Nifty-50 is trading closer to its peak valuations and is expected to touch 13,400 by end of December 2020. For BSE Sensex the target would work to 45,500 by next year, the Mumbai-based firm added.

Read more at https://www.moneycontrol.com/news/business/markets/nifty-may-touch-13400-sensex-45500-in-2020-kotak-securities-4747041.html

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.3% in positive at 12260

- AD was flat (slightly positive)

- option writing support 12000 (monthly expiry)

- trend is up on daily charts

- today nifty closed 0.3% in positive at 12260

- AD was flat (slightly positive)

- option writing support 12000 (monthly expiry)

December 18, 2019

Awesome thread on free training session

Once a broker offered ZERO brokerage. I asked him whether he does charity. Why a broker should offer free brokerage, how he will run his business? This means he plans take some money through some other routes. Check Transaction charges, some brokers charge more.— P R Sundar (@PRSundar64) December 18, 2019

(2/2)

The set up looks super bullish......

Market looks set for a mad rally fuelled by the US China trade deal & proposed budget proposals. Blaming the set of companies that are going up will never be the same like buying them - better participate than crib. We track this data very carefully - set up looks super bullish. https://t.co/olB3WLQeVC— Basant Maheshwari (@BMTheEquityDesk) December 18, 2019

December 17, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.9% in positive at 12165

- AD was 11:7

- VIX down 6%

- highest OI is now at 12100 PE

- trend is up on daily charts

- today nifty closed 0.9% in positive at 12165

- AD was 11:7

- VIX down 6%

- highest OI is now at 12100 PE

The Beginning of a New Bull Market In Stocks

People don’t like it when I tell them we’re near the beginning of a new bull market in stocks. For some reason, they prefer that cozy feeling of going to bed thinking stocks are near an important high, and they’ve somehow outsmarted the system by selling stocks in uptrends instead of buying them.

I’m convinced some of these people must be looking at their charts upside down.

Anyway, let’s take a look at the markets so I can show you why I think we’re closer to the beginning of a new bull market and not near the end of an old one:

Read more at https://allstarcharts.com/beginning-new-bull-market-stocks/

I’m convinced some of these people must be looking at their charts upside down.

Anyway, let’s take a look at the markets so I can show you why I think we’re closer to the beginning of a new bull market and not near the end of an old one:

Read more at https://allstarcharts.com/beginning-new-bull-market-stocks/

December 16, 2019

December 15, 2019

Indian economy headed for ICU?

Headlines may be sensational. But the content has merit. He had a ring side view as well. What he says should disturb all of us. @nsitharaman pic.twitter.com/gk4LaIcR8C— D.Muthukrishnan (@dmuthuk) December 14, 2019

Negative divergence on NIFTY RSI?

Getting some queries on whether there is a RSI negative divergence on Nifty fut. Traders seem to be making a very basic mistake. Clarifying why it's not a divergence now and when it will be a divergence— Subhadip Nandy (@SubhadipNandy) December 14, 2019

The crash of 1929 - a nice thread

The sequence of events which led to the 1929 crash in Wall Street. (Comments welcome)— Gautam Mazumdar (@gautam_icma) December 14, 2019

1920—1928

For almost eight straight years stock market was rising and there was no upper limit. The dollar was king. This decade was also named as “Roaring Twenties”. pic.twitter.com/VTfLW26ReQ

December 13, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 1% in positive at 12087

- AD was 2:1

- this is highest ever weekly close for nifty

- option writing support 12000

- swing low/ double bottom support 11800

- resistance 12200

- rejecting H&S as nifty opened above 12000

- confirmation would be break of 11800.

- trend is up on daily charts

- today nifty closed 1% in positive at 12087

- AD was 2:1

- this is highest ever weekly close for nifty

- option writing support 12000

- swing low/ double bottom support 11800

- resistance 12200

- rejecting H&S as nifty opened above 12000

- confirmation would be break of 11800.

Quick thought about trading & success rates.

Quick thought about trading & success rates.— Steven Goldstein (@AlphaMind101) December 12, 2019

There’s a myriad of claims as to how low or high the percentage of successful traders are. The success rates of often said to be anywhere from 10-20%. No one know the true rate, but also there are certainly qualifying factors 1/11

December 12, 2019

Stocks today at 52 week high versus low

Stocks at 52 week high:

AAVAS - AGROPHOS - AVTNPL - BIOFILCHEM - CAMLINFINE - CRISIL - DIVISLAB - DLF - KOTAKBANK - MANAPPURAM - SRF - TATAGLOBAL -

Stocks at 52 week low:

ARVIND - ATLASCYCLE - CAPLIPOINT - CCL - CESCVENT - CHEMBOND - CLEDUCATE - CMICABLES - DHFL - ELECTHERM - EVERESTIND - FSL - GENESYS - HATSUN -

HINDOILEXP - HSCL - HTMEDIA - IGPL - INDIANHUME - INDNIPPON - IPAPPM - IZMO - KALYANIFRG - KARDA - KHADIM - KIRIINDUS - KIRLOSBROS - KTIL - MINDTECK -

NETFMID150 - NEULANDLAB - NUCLEUS - OPTIEMUS - ORIENTABRA - PANACEABIO - RAMCOSYS - RAMKY - RELCAPITAL - REMSONSIND - RSWM - SAGCEM - SANGHIIND - SASTASUNDR - SIMPLEXINF - STEL - SUNDARMHLD - SWELECTES - TATASTLLP -

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.5% in positive at 11972

- AD was 11:7

- market is at all time highs

- but more stocks made 52 week lows than 52 week highs

- and PE ratio is 28!

- double bottom support around 11800

- if this breaks, H&S play can happen

- trend is up on daily charts

- today nifty closed 0.5% in positive at 11972

- AD was 11:7

- market is at all time highs

- but more stocks made 52 week lows than 52 week highs

- and PE ratio is 28!

- double bottom support around 11800

- if this breaks, H&S play can happen

December 11, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.4% in positive at 11910

- AD was 7:10

- trend is down on hourly charts

- VIX down 8%

- option writing resistance 12000 (weekly expiry, tomorrow)

- trend is up on daily charts

- today nifty closed 0.4% in positive at 11910

- AD was 7:10

- trend is down on hourly charts

- VIX down 8%

- option writing resistance 12000 (weekly expiry, tomorrow)

Gormint Mathematics

Gormint Mathematics:— V. Anand | வெ. ஆனந்த் (@iam_anandv) December 11, 2019

1. Our estimated GST revenue is 1L crore a month (50% miss on average).

2. Increase in GST Rate by 1% will increase revenue by 1,000 Crore, even when growth is sliding to < 4%

3. Tax increase will not affect demand.

Harvard should teach this!!!

December 10, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.7% in negative at 11857

- AD was 5:13

- option writing resistance 12000

- swing low around 11800 spot

- note trend is already down on hourly charts

- trend is up on daily charts

- today nifty closed 0.7% in negative at 11857

- AD was 5:13

- option writing resistance 12000

- swing low around 11800 spot

- note trend is already down on hourly charts

NOV 2019 was best month for the two wheeler industry

Thread on the strong recovery in 2W Sales and how you can strongly benefit from it. Presented below is the 2W registration data over the past 22 months. As you can interpret, November 2019 was the highest sales month in the past 22 months...{1/n} pic.twitter.com/KhnAVgVFaj— JEEVAN JYOTI RATH (@JEEVANRATH) December 6, 2019

Read complete thread at https://twitter.com/JEEVANRATH/status/1202932886866776069

December 9, 2019

Learn Renko Charts from experts at nominal fees

Renko charts can help traders to pick potential outperformers thus makes price trends easier to spot.— elearnmarkets (@elearnmarkets) December 7, 2019

Learn from the market renowned expert @Prashantshah267 on 14 Dec.

Check- https://t.co/a4u8sAZqF0

Use coupon SOCIAL20 to avail 20% OFF. pic.twitter.com/XtayjwZB4I

This is what a typical option writing trade would look like

Nov 9, 10 had a workshop in Chennai.— P R Sundar (@PRSundar64) December 9, 2019

Participants wanted a folio suggestion for Rs 25 lakhs.

They wanted few days time to arrange money, wanted to take positions on 15.11.2019.

This is the folio I suggested.

Now calculate the profit. pic.twitter.com/LYHs1xoaSC

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed flat at 11937

- AD was 7:11

- option writing resistance 12000

- VIX up 8% today

- of late, this is showing wild swings

- trend is up on daily charts

- today nifty closed flat at 11937

- AD was 7:11

- option writing resistance 12000

- VIX up 8% today

- of late, this is showing wild swings

10 Things (Foreign) Fund Managers Say and What They Actually Mean

“What we have witnessed is a 10 standard deviation event”

“This didn’t show up in our backtest”

—

“The rise of passive investing and quantitative easing has materially distorted how markets function”

“Performance hasn’t been great”.

—

“Cognitive diversity is incredibly important to us”

“We have one woman on the team”.

Read more at https://behaviouralinvestment.com/2019/12/04/10-things-fund-managers-say-and-what-they-actually-mean

“This didn’t show up in our backtest”

—

“The rise of passive investing and quantitative easing has materially distorted how markets function”

“Performance hasn’t been great”.

—

“Cognitive diversity is incredibly important to us”

“We have one woman on the team”.

Read more at https://behaviouralinvestment.com/2019/12/04/10-things-fund-managers-say-and-what-they-actually-mean

Why is diesel demand contracting in India

India’s demand for diesel is slowing as the country’s car fleet shifts predominantly to gasoline, trucks get more efficient and solar pumps displace diesel-fed units across the countryside.

The combination of these changes has led analysts, academics and company officials to speculate that diesel demand growth in the world’s third-largest crude oil consumer may have peaked, with significant repercussions for the firms that produce and sell the fuel.

WHY HAS DIESEL DEMAND FALLEN?

In addition to the longer term trends mentioned above, 2019 diesel demand was also curtailed by a prolonged monsoon which brought rural demand to a near standstill this autumn.

Widespread flooding hampered mining, construction and freight movement across parts of the country.

Slowing factory output also stymied diesel demand.

India’s industrial output fell at the fastest pace in more than six years in September, while power demand in October posted its steepest decline in over 12 years.

Read more at https://in.reuters.com/article/india-diesel-explainer/explainer-why-indias-diesel-demand-is-contracting-and-what-it-means-idINKBN1Y80BL

The combination of these changes has led analysts, academics and company officials to speculate that diesel demand growth in the world’s third-largest crude oil consumer may have peaked, with significant repercussions for the firms that produce and sell the fuel.

WHY HAS DIESEL DEMAND FALLEN?

In addition to the longer term trends mentioned above, 2019 diesel demand was also curtailed by a prolonged monsoon which brought rural demand to a near standstill this autumn.

Widespread flooding hampered mining, construction and freight movement across parts of the country.

Slowing factory output also stymied diesel demand.

India’s industrial output fell at the fastest pace in more than six years in September, while power demand in October posted its steepest decline in over 12 years.

Read more at https://in.reuters.com/article/india-diesel-explainer/explainer-why-indias-diesel-demand-is-contracting-and-what-it-means-idINKBN1Y80BL

December 7, 2019

Asit Baran Pati | An options buyer journey to financial freedom

............. The ‘Probability of Profit’ also known as POP in the trading world is only around 30 percent for an option buyer. POP is the probability of an option closing ITM on expiry. It also indicates that a trader will make a profit or barely breakeven only 30 percent of the time. This is also the reason why option selling is catching up as their POP is 70 percent.

............. The ‘Probability of Profit’ also known as POP in the trading world is only around 30 percent for an option buyer. POP is the probability of an option closing ITM on expiry. It also indicates that a trader will make a profit or barely breakeven only 30 percent of the time. This is also the reason why option selling is catching up as their POP is 70 percent.In trading, POP is all that matters. For an option buyer, it goes down with time and for an option seller, it increases with time. Thus, for an option buyer, it becomes imperative to trade only when the momentum is good. The Greek gods that an option buyer can worship are Delta and Gamma while Theta is their biggest enemy.

An option buyer should not hold his position for a long time as Theta or time decay starts playing on the position and erodes its value. Secondly, an option buyer should buy such an option which has more intrinsic value than extrinsic value – which means a slightly in-the-money (ITM) contract. Further, your timing should be such that the momentum is strong and is building up. One needs to exit the trade as the momentum slows down. The only way an option buyer can end up with a winning trade is if the underlying stock or index moves significantly in his direction.

If you are buying option in a trending market the Greeks Delta and Gamma in an option premium will ensure that they not only nullify the effect of Theta but also overpower it. I always enter a trade where the momentum is about to enter an active zone..........

Read more at https://www.moneycontrol.com/news/business/markets/asit-baran-pati-an-options-buyer-journey-to-financial-freedom-4708501.html

What fund managers said and what they meant

I've always found it funny when investors believe whatever fund managers say. That's because what they say and what they mean is almost always the exact opposite. Here's a handy guide of what they say and what they actually meant. https://t.co/0x0nt1Gd9S— Passive Rajnikanth (@passivefool) December 7, 2019

Will new/ increased GST rates lead to "stagflation"?

Stagflation = stagnating economy + persistent high unemployment and inflation

Stagnating economy = declining GDP, IIP, demand, reducing consumer spending etc

This is a nightmare because measures designed to solve one problem usually lead to another bigger problem.

Now GST rates are being increased because of falling tax revenues (drop in demand). Increase in GST rates will be lead to higher inflation and even more reduced demand thus creating a vicious circle.

Read more at https://economictimes.indiatimes.com/news/economy/policy/gst-rates-set-to-increase-as-council-eyes-major-revamp/articleshow/72410952.cms

Stagnating economy = declining GDP, IIP, demand, reducing consumer spending etc

This is a nightmare because measures designed to solve one problem usually lead to another bigger problem.

Now GST rates are being increased because of falling tax revenues (drop in demand). Increase in GST rates will be lead to higher inflation and even more reduced demand thus creating a vicious circle.

Read more at https://economictimes.indiatimes.com/news/economy/policy/gst-rates-set-to-increase-as-council-eyes-major-revamp/articleshow/72410952.cms

Sebi scans matrimonial website to nail fraudster in front-running case

Sebi found out that the PAN provided by Avi was registered in Vaibhav Dhadda's name. His passport details named Alka Dhadda as his mother. Further, his profile on the matrimonial site showed Alka as his mother. Also, she used the email id avidhadda92@gmail.com.

The market watchdog said Vaibav was operating from Hong Kong and had access to the trading accounts of his mother and his sister Arushi.

The market regulator pointed out that there was aprima facie case of a trading pattern that had emerged in the accounts held by Arushi and Alka. It claims that the Dhaddas' modus operandi was to start picking up a stock just ahead of a buy placed by a Fidelity group entity on the same scrip. Likewise, the family would start sellling a particular stock just ahead of a sell order placed by the Fidelity company on the same scrip.

Read more at https://www.business-standard.com/article/markets/sebi-scans-matrimonial-website-to-nail-fraudster-in-front-running-case-119120501537_1.html

The market watchdog said Vaibav was operating from Hong Kong and had access to the trading accounts of his mother and his sister Arushi.

The market regulator pointed out that there was aprima facie case of a trading pattern that had emerged in the accounts held by Arushi and Alka. It claims that the Dhaddas' modus operandi was to start picking up a stock just ahead of a buy placed by a Fidelity group entity on the same scrip. Likewise, the family would start sellling a particular stock just ahead of a sell order placed by the Fidelity company on the same scrip.

Read more at https://www.business-standard.com/article/markets/sebi-scans-matrimonial-website-to-nail-fraudster-in-front-running-case-119120501537_1.html

December 6, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.8% in negative at 11888

- AD was 5:12

- swing low support around 11800

- wild swing observed in VIX for past few days

- today it ranged from -9 to + 3 creating havoc in option pricing

- option writing resistance 12000

- trend is up on daily charts

- today nifty closed 0.8% in negative at 11888

- AD was 5:12

- swing low support around 11800

- wild swing observed in VIX for past few days

- today it ranged from -9 to + 3 creating havoc in option pricing

- option writing resistance 12000

Worrying trend in personal loans and unsecured credit

Also, *unsecured* is the point to be noted. These are loans not given against ANY collateral whatsoever. So there is a necessity for a cushion for the system to absorb shocks on account of non-payment or delays in payment.— Mayank (@AZenGuy) December 6, 2019

It's a story we have seen before. 2/n

Millennial lives and the new age debt trap

...A few months after Mahapatra’s first brush with new-age credit, he got to know that many of his friends who’d also taken loans from the same fintech firm had started getting calls from recovery agents. “Their pocket money wasn’t enough but they didn’t realize how high the interest was. They hadn’t even informed their parents. The interest kept mounting and they were just not able to repay," he says.

Mahapatra gave Mint access to a WhatsApp group where students and young professionals, who have been unable to repay their loans, discuss the harassment they’re dealing with. “When I saw the torture people on the group were subjected to, I closed my ongoing loan and uninstalled the app. The problem is huge and has penetrated deep within the student community," says Mahapatra. One of the members of the WhatsApp group, Kishore (name changed), is a 21-year-old student preparing for MBBS in Kota, Rajasthan. Kishore would take loans from the fintech firm very often to meet his lifestyle expenses: from going out with friends, ordering take-out food, and so on. But the last time he borrowed ₹2,000, he wasn’t able to repay.

“I am a student. How can I repay if the amount keeps increasing?" says Kishore. The fintech firm tried to recover the loan, but when Kishore still didn’t pay his dues, he started getting calls from recovery agents. “The agents are threatening to inform all the contacts on my phone about the default. They can do this because I’d given the app access to my contacts. I’d also uploaded a video on the app promising to repay all my loans on time and accepting all the terms and conditions. The agents are blackmailing me with this," says Kishore.

Read more at https://www.livemint.com/news/india/millennial-lives-and-the-new-age-debt-trap/amp-11575474961876.html

Mahapatra gave Mint access to a WhatsApp group where students and young professionals, who have been unable to repay their loans, discuss the harassment they’re dealing with. “When I saw the torture people on the group were subjected to, I closed my ongoing loan and uninstalled the app. The problem is huge and has penetrated deep within the student community," says Mahapatra. One of the members of the WhatsApp group, Kishore (name changed), is a 21-year-old student preparing for MBBS in Kota, Rajasthan. Kishore would take loans from the fintech firm very often to meet his lifestyle expenses: from going out with friends, ordering take-out food, and so on. But the last time he borrowed ₹2,000, he wasn’t able to repay.

“I am a student. How can I repay if the amount keeps increasing?" says Kishore. The fintech firm tried to recover the loan, but when Kishore still didn’t pay his dues, he started getting calls from recovery agents. “The agents are threatening to inform all the contacts on my phone about the default. They can do this because I’d given the app access to my contacts. I’d also uploaded a video on the app promising to repay all my loans on time and accepting all the terms and conditions. The agents are blackmailing me with this," says Kishore.

Read more at https://www.livemint.com/news/india/millennial-lives-and-the-new-age-debt-trap/amp-11575474961876.html

December 5, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.2% in negative at 12018

- AD was 4:5

- VIX was volatile... up 12% one time, it closed marginally in negative

- VIX has been volatile past few days

- today was weekly expiry day

- as expected, this happened between 12000 and 12100

- bias is bullish for next week with 12000 expected to hold

- trend is up on daily charts

- today nifty closed 0.2% in negative at 12018

- AD was 4:5

- VIX was volatile... up 12% one time, it closed marginally in negative

- VIX has been volatile past few days

- today was weekly expiry day

- as expected, this happened between 12000 and 12100

- bias is bullish for next week with 12000 expected to hold

December 4, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.4% in positive at 12043

- AD was 5:4

- VIX down 9%

- highest OI at 12000PE followed by 12100 CE

- difference is not much so bias can be neutral

- all positions are hedged in both directions

- trend is up on daily charts

- today nifty closed 0.4% in positive at 12043

- AD was 5:4

- VIX down 9%

- highest OI at 12000PE followed by 12100 CE

- difference is not much so bias can be neutral

- all positions are hedged in both directions

December 3, 2019

Market outook

Daily charts:

- trend is up on daily charts

- today nifty closed at 0.4% in negative at 11994

- AD was 1:2 (not bad)

- swing low 11800

- option writing resistance 12100

- trend is up on daily charts

- today nifty closed at 0.4% in negative at 11994

- AD was 1:2 (not bad)

- swing low 11800

- option writing resistance 12100

December 2, 2019

December 1, 2019

NIFTY monthly chart

- trend is up

- support 10000

- rising wedge seen

- resistance 12300

- rising wedges are bearish

- cumulative market breadth disappoints

- this month bullish candle was the smallest in 3 months

- 11800 is the key level

- option writers are bullish that 12000 will not break

- let's see

- nifty PE around 28+... big red flag

- support 10000

- rising wedge seen

- resistance 12300

- rising wedges are bearish

- cumulative market breadth disappoints

- this month bullish candle was the smallest in 3 months

- 11800 is the key level

- option writers are bullish that 12000 will not break

- let's see

- nifty PE around 28+... big red flag

Don't memorize patterns, candlesticks, and etc

Don't memorize patterns, candlesticks, and etc.— Rayner Teo (@Rayner_Teo) December 1, 2019

If you want to get better at this game, ask yourself:

What are traders on the sideline thinking?

Where will other traders get trapped?

Where’s the path of least resistance?

Where will new players enter?

Where will losers cut loss?

November 30, 2019

BANK NIFTY daily and weekly charts analysis

Daily charts:

- trend is up

- support 31000

- options data shows highest OI at 31500 PE followed by 32000 CE

- trend is up

- support 31000

- options data shows highest OI at 31500 PE followed by 32000 CE

November 29, 2019

Money lost on "divergence"......

Awesome!— Shai (@Am_Shai) November 29, 2019

The amount of money lost in the markets by traders due to this one word - "Divergence" is mind boggling https://t.co/O2Oqe2dARq

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.8% in negative at 12056

- AD was flat (good sign)

- 12000 retested and still holding (good sign)

- trend is up on daily charts

- today nifty closed 0.8% in negative at 12056

- AD was flat (good sign)

- 12000 retested and still holding (good sign)

Dark Ages

All-India power demand declined by a huge -12% YoY in October 2019.— Uday Tharar (@udaytharar) November 27, 2019

Power demand fell across the nation with industrial states like Maharashtra (-22%), Gujarat (-22%) and Karnataka (-20%) leading the way. pic.twitter.com/0eb3hAcKiw

November 28, 2019

So now the slowdown is because of Supreme Court...not millenials?

Economy down down. Why? SC Judges hai hai. https://t.co/EpQuBPhwkq— V. Anand | வெ. ஆனந்த் (@iam_anandv) November 28, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.4% in positive at 12152

- AD was flat

- VIX down 4%

- highest OI at 12000 PE

- trend is up on daily charts

- today nifty closed 0.4% in positive at 12152

- AD was flat

- VIX down 4%

- highest OI at 12000 PE

Swing trading signals :: 28-NOV-2019

Swing trading signals :: 28-NOV-2019

- This report is for your personal use only and is valid for next trading day.

- Signals are generated using the kplswing indicator.

- Algorithm: BUY signal is generated if a stock closes above 20 days high and vice versa.

- Ignore signal if stock is rangebound for extended periods of time.

- Hint: give preference to stocks making 52 week highs or all time highs or breaking out from a range.

- Stock name is highlighted in case of first signal of the trend.

- Exits: There are no targets and exits are based on a trailing stoploss. Returns are whatever the market gives - 20%, 100%, etc.

- Trailing SL: For long positions, use last week's low or 10 days low.

- Click on stock name link for charts, more info etc

- Risk Management: Limit investment per stock to 3% of trading capital.

- Important: Trade in cash only and never in futures.

This information is for your study only and is not a recommendation to buy or sell

All signals:

Buy signals:

BALKRISIND - BANKBARODA - CANBK - CRISIL - CUB - IBULHSGFIN - ICICIBANK - IIFL - JSWSTEEL - LICHSGFIN - MASTEK - NIFTY - ORIENTELEC - RELIANCE - SANOFI - TATACHEM - TATASTEEL - UNIONBANK -

BALKRISIND - BANKBARODA - CANBK - CRISIL - CUB - IBULHSGFIN - ICICIBANK - IIFL - JSWSTEEL - LICHSGFIN - MASTEK - NIFTY - ORIENTELEC - RELIANCE - SANOFI - TATACHEM - TATASTEEL - UNIONBANK -

Interesting thread about a China visit by @baboonzero

2/ The first great thing that happened a couple of days before I was leaving was that both Alipay and Wepay allowed foreigners to create temporary bank accounts with pre-loaded cards so that they could easily transact all across China. I used zero cash on my entire trip!— Anshumani Ruddra (@baboonzero) November 27, 2019

November 27, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.5% in positive at 12100

- AD was flat

- support 11800

- weekly close above 12000 will be bullish

- trend is up on daily charts

- today nifty closed 0.5% in positive at 12100

- AD was flat

- support 11800

- weekly close above 12000 will be bullish

No more gurus

There is a difference between an expert, whose talent should always be celebrated, and a guru, whose bad ideas should never be questioned.

With few exceptions we should praise experts but be terrified of gurus.

This problem afflicts tech, where several one-time god-like leaders have been revealed to be something between showmen and fraudsters. Or even the innocent version: normal people susceptible to incentives and the desire to maintain a narrative.

Same in investing, where one right call can sustain a subsequent career of unquestioned dart throwing.

And in politics, where a politician who does a few things people support can get those people to nod their heads at lot of things they otherwise wouldn’t.

Success has a way of making those around you question whether they should point out your flaws or question your crazy ideas. This is partly a desire to not damage your career or be rejected from the tribe, and part a flawed assumption that if someone’s crazy ideas in the past turned out to be right, their crazy ideas today must be the same. It can also be driven by the assumption that skill in one field translates to wisdom in all fields.

But guru-ism is dangerous for everyone, for a few reasons.

Read more at https://www.collaborativefund.com/blog/no-more-gurus/

With few exceptions we should praise experts but be terrified of gurus.

This problem afflicts tech, where several one-time god-like leaders have been revealed to be something between showmen and fraudsters. Or even the innocent version: normal people susceptible to incentives and the desire to maintain a narrative.

Same in investing, where one right call can sustain a subsequent career of unquestioned dart throwing.

And in politics, where a politician who does a few things people support can get those people to nod their heads at lot of things they otherwise wouldn’t.

Success has a way of making those around you question whether they should point out your flaws or question your crazy ideas. This is partly a desire to not damage your career or be rejected from the tribe, and part a flawed assumption that if someone’s crazy ideas in the past turned out to be right, their crazy ideas today must be the same. It can also be driven by the assumption that skill in one field translates to wisdom in all fields.

But guru-ism is dangerous for everyone, for a few reasons.

Read more at https://www.collaborativefund.com/blog/no-more-gurus/

November 26, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.3% in negative at 12037

- AD was 4:5

- 12000 was tested intraday and this held

- trend is up on daily charts

- today nifty closed 0.3% in negative at 12037

- AD was 4:5

- 12000 was tested intraday and this held

November 25, 2019

Market outlook with more charts

Daily charts:

- trend is up on daily charts

- today nifty closed 1.4% in positive at 12079

- AD was 11:7

- today was the biggest bar for NOV

- swing low around 11800

- this is the 2nd time nifty is closing above 12000

- the first time was on 1st JUN after which nifty corrected to 10700

- there has never been a weekly close above 12000

- if this happens, this will be a very strong bullish sign

- highest OI is at 12000 PE

- box indicates rally possible to 12200-12300

- trend is up on daily charts

- today nifty closed 1.4% in positive at 12079

- AD was 11:7

- today was the biggest bar for NOV

- swing low around 11800

- this is the 2nd time nifty is closing above 12000

- the first time was on 1st JUN after which nifty corrected to 10700

- there has never been a weekly close above 12000

- if this happens, this will be a very strong bullish sign

- highest OI is at 12000 PE

- box indicates rally possible to 12200-12300

November 23, 2019

November 22, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.5% in negative at 11914

- AD was flat

- highest OI at 12000 CE

- trend is up on daily charts

- today nifty closed 0.5% in negative at 11914

- AD was flat

- highest OI at 12000 CE

November 21, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.25 in negative at 11968

- AD was 4:5

- this month, nifty has closed not even once above 12000

- option writers would have made excellent money selling 12000 CE

- they were also selling 11800 PE and 11900 PE

- even today, highest OI is still at 12000 CE

- trend is up on daily charts

- today nifty closed 0.25 in negative at 11968

- AD was 4:5

- this month, nifty has closed not even once above 12000

- option writers would have made excellent money selling 12000 CE

- they were also selling 11800 PE and 11900 PE

- even today, highest OI is still at 12000 CE

Subscribe to:

Posts (Atom)