January 31, 2018

Market oulook

Daily charts

- trend is up on daily charts

- today NF closed flat at 11027

- AD was negative at 1:2

- option writing support at 10500 resistance 11500

- trend is up on daily charts

- today NF closed flat at 11027

- AD was negative at 1:2

- option writing support at 10500 resistance 11500

January 30, 2018

59 sell signals only 1 buy signal

Swing trading signals :: 30-JAN-2018

- This report is for educational purposes only and is not recommended for trading or investment.

- Liquidity filter: ||||| excellent liquidity - ||||| good liquidity - ||||| low liquidity.

| Stock name | Close | Percentage Change | Signal | Reversal Level/ SL | Last Month's | ||

|---|---|---|---|---|---|---|---|

| 1 day | 20 days | High | Low | ||||

| ||||| 8KMILES | 732.45 | -5.50% | -18.50% | SELL | 914.00 | 1011 | 852 |

| ||||| A2ZINFRA | 37.65 | -2.50% | -11.00% | SELL | 48.75 | 43 | 35 |

| ||||| ADVENZYMES | 268.85 | -3.50% | -3.00% | SELL | 323.50 | 301 | 266 |

| ||||| ANDHRABANK | 53.25 | -1.50% | -8.50% | SELL | 60.20 | 64 | 57 |

| ||||| APARINDS | 760.75 | -3.00% | -5.50% | SELL | 869.30 | 849 | 757 |

| ||||| ARCOTECH | 48.30 | -2.50% | -13.50% | SELL | 58.95 | 62 | 51 |

| ||||| ARIHANTSUP | 154.35 | -4.50% | -10.00% | SELL | 192.00 | 184 | 139 |

| ||||| ARVIND | 424.90 | -2.00% | -4.50% | SELL | 478.50 | 463 | 400 |

| ||||| ASIANPAINT | 1126.70 | -2.00% | -1.00% | SELL | 1208.20 | 1172 | 1099 |

| ||||| ASTRAL | 774.25 | -3.00% | -7.00% | SELL | 868.00 | 855 | 780 |

Market outlook

Daily charts

- trend is up on daily charts

- today, NF closed 0.7% in negative at 11050

- AD was 1:4

- 8% drop in VIX even as market went down

- option writing support 10500

- trend is up on daily charts

- today, NF closed 0.7% in negative at 11050

- AD was 1:4

- 8% drop in VIX even as market went down

- option writing support 10500

Infected with ... of all the things... chicken pox

I do not travel by trains or buses or rickshaws or go to office or crowded areas.

None of the people I know were suffering from chicken pox so I am surprised how I got it.

I am 50+ so this infection will trouble me longer than were I to get it when I was a kid.

Doc says it will take min 8-10 days to clear off.

Damn.

None of the people I know were suffering from chicken pox so I am surprised how I got it.

I am 50+ so this infection will trouble me longer than were I to get it when I was a kid.

Doc says it will take min 8-10 days to clear off.

Damn.

Functioning ‘mechanical gears’ seen in nature for the first time

The gears in the Issus hind-leg bear remarkable engineering resemblance to those found on every bicycle and inside every car gear-box. Each gear tooth has a rounded corner at the point it connects to the gear strip; a feature identical to man-made gears such as bike gears – essentially a shock-absorbing mechanism to stop teeth from shearing off.

The gear teeth on the opposing hind-legs lock together like those in a car gear-box, ensuring almost complete synchronicity in leg movement - the legs always move within 30 ‘microseconds’ of each other, with one microsecond equal to a millionth of a second.

This is critical for the powerful jumps that are this insect’s primary mode of transport, as even miniscule discrepancies in synchronisation between the velocities of its legs at the point of propulsion would result in “yaw rotation” - causing the Issus to spin hopelessly out of control.

“This precise synchronisation would be impossible to achieve through a nervous system, as neural impulses would take far too long for the extraordinarily tight coordination required,” said lead author Professor Malcolm Burrows, from Cambridge’s Department of Zoology.

“By developing mechanical gears, the Issus can just send nerve signals to its muscles to produce roughly the same amount of force - then if one leg starts to propel the jump the gears will interlock, creating absolute synchrony.

Read more at http://www.cam.ac.uk/research/news/functioning-mechanical-gears-seen-in-nature-for-the-first-time

January 29, 2018

Jack Shwager on risk management

Nithin: Talking about risk management, I have heard you say that you shouldn’t take more than one percent risk on a trade. I mean, if someone’s kind of working on a small-ish portfolio size, how does he ever get big by taking a 1% bet?

Jack Schwager: You know, the fact that the reality of limited resources doesn’t change the truth of the fact that bet size should be small. I mean, that’s a mathematical truism, and the mathematics and the markets don’t care about how much you could afford to...how much money you could afford to trade, or lose.

The reality is, if you want to be successful, your trade size should probably be 1% or infact less. As I’ve gotten older and I’ve read my original books, when I produced audios for them, and listened to the audio, I think it was New Markets Wizards, there was this chapter I was listening to, and I came across this line where somewhere I said in my conclusions in the summary of the book, that one of the things is you should limit your risks to very small levels to about, I think I might have used about 1 or 2 percent or less. And, what I thought was, after listening to the old book, in the book I would not have changed anything except 2 things. There were actually 2 things that struck me that I would have changed if I wrote the book now, which is more than 20 years later. In the whole book, there were like 2 things.

One was that line about 1 to 2 percent, now I would feel it should be one percent maximum and ideally half a percent or less.

Read complete interview at http://www.moneycontrol.com/news/business/markets/jack-schwager-interview-market-wisdom-from-the-wizard-himself-2492507.html

Jack Schwager: You know, the fact that the reality of limited resources doesn’t change the truth of the fact that bet size should be small. I mean, that’s a mathematical truism, and the mathematics and the markets don’t care about how much you could afford to...how much money you could afford to trade, or lose.

The reality is, if you want to be successful, your trade size should probably be 1% or infact less. As I’ve gotten older and I’ve read my original books, when I produced audios for them, and listened to the audio, I think it was New Markets Wizards, there was this chapter I was listening to, and I came across this line where somewhere I said in my conclusions in the summary of the book, that one of the things is you should limit your risks to very small levels to about, I think I might have used about 1 or 2 percent or less. And, what I thought was, after listening to the old book, in the book I would not have changed anything except 2 things. There were actually 2 things that struck me that I would have changed if I wrote the book now, which is more than 20 years later. In the whole book, there were like 2 things.

One was that line about 1 to 2 percent, now I would feel it should be one percent maximum and ideally half a percent or less.

Read complete interview at http://www.moneycontrol.com/news/business/markets/jack-schwager-interview-market-wisdom-from-the-wizard-himself-2492507.html

Interesting view and questions on data protection

In this internet connected always on world, we all generate a mind boggling amount of data. How is this data used by companies, what rights we have etc are important.

This article discusses some issues of data protection.

1. Who is the beneficiary of data protection?

Data is generated whenever any we undertake any transactions to further our purposes of living our lives. Since we are not hermits, our affairs cause us to engage with others as part of our lives. Together with these others, we pursue common purposes. Our activities towards these common purposes result in data.

Companies, or third parties, in the business of gathering, storing, modifying, analysing, trading or managing data leverage data from our affairs for their profits. The profits of these companies builds a data economy, usually also a digital economy. The exploitation of such data by these third parties is often viewed as innovation. Start-up businesses that exploit such use of data are often encouraged.

You, the Justice Srikrishna Committee, have to address the issue and make explicit the beneficiary of any data protection framework you propose. Is it transacting parties generating data, while pursuing their common purposes while living their lives that you will provide a protection to? Or is it third parties who choose to exploit the data of others to their profits that you are aiming to protect? Or is it the digital companies in the business of selling hardware and software to build digital empires across continents?

Your answer will decide the culture and society we will become - one that protects we, the people, or one that protects the profits of third parties exploiting data of others. One that upholds the promise and principles of the Preamble to the Constitution or one that colonises, corrupts and destroys the country as it drives its laws to help private interests to profit through exploitation of the lives of people of India.

2. Who are you protecting the beneficiary from?

Read more at http://www.moneylife.in/article/5-questions-for-the-justice-srikrishna-committee-on-data-protection/52884.html

This article discusses some issues of data protection.

1. Who is the beneficiary of data protection?

Data is generated whenever any we undertake any transactions to further our purposes of living our lives. Since we are not hermits, our affairs cause us to engage with others as part of our lives. Together with these others, we pursue common purposes. Our activities towards these common purposes result in data.

Companies, or third parties, in the business of gathering, storing, modifying, analysing, trading or managing data leverage data from our affairs for their profits. The profits of these companies builds a data economy, usually also a digital economy. The exploitation of such data by these third parties is often viewed as innovation. Start-up businesses that exploit such use of data are often encouraged.

You, the Justice Srikrishna Committee, have to address the issue and make explicit the beneficiary of any data protection framework you propose. Is it transacting parties generating data, while pursuing their common purposes while living their lives that you will provide a protection to? Or is it third parties who choose to exploit the data of others to their profits that you are aiming to protect? Or is it the digital companies in the business of selling hardware and software to build digital empires across continents?

Your answer will decide the culture and society we will become - one that protects we, the people, or one that protects the profits of third parties exploiting data of others. One that upholds the promise and principles of the Preamble to the Constitution or one that colonises, corrupts and destroys the country as it drives its laws to help private interests to profit through exploitation of the lives of people of India.

2. Who are you protecting the beneficiary from?

Read more at http://www.moneylife.in/article/5-questions-for-the-justice-srikrishna-committee-on-data-protection/52884.html

Market outlook

Daily charts

- trend is up on daily charts

- today NF closed 0.5% in positive at 11130

- AD was 1:3

- option writing support 10500... may increase to 11000

- trend is up on daily charts

- today NF closed 0.5% in positive at 11130

- AD was 1:3

- option writing support 10500... may increase to 11000

The Bankruptcy of Modern Finance Theory

Outcomes are easy to measure in financial markets: you either beat the index or you don’t. And the results could not be clearer about how few people possess any real skill.

A recent study found that 70 percent of actively managed funds have failed to beat their benchmark index and just 2.3 percent have delivered excess returns of more than 2.5 percent—and those are pre-fee numbers.1 Fees make the picture even worse.

Trying to pick in advance which funds will be among the few that beat the market has proven just as difficult. Morningstar’s famed star ratings have a poor track record of picking winning funds. Brokerage accounts advised by financial advisers achieve lower net returns and inferior risk-return tradeoffs than self-directed accounts. Even the expensive investment consultants who advise the world’s biggest money pools have shown limited ability to pick funds. The academic research now shows that the best metric for picking funds is the expense ratio: the less you pay experts to manage your money, the more you keep.

Very few of the highly paid and well-credentialed professionals that run mutual funds and advise client investments actually add value. Yet clients still flock to actively managed funds and expensive advisers. There is, in finance, a massive calibration error: a gap between claimed expertise and actual results.

At the heart of this calibration error is bad theory. The profession of finance as practiced today relies heavily on modern finance theory: the dividend discount model and the capital asset pricing model. These models are the centerpieces of most business school finance courses, and surveys suggest that they are used by over 70 percent of CFOs for capital budgeting. They are also used by almost every fundamental investor and most financial advisers.

Read more at https://americanaffairsjournal.org/2017/05/bankruptcy-modern-finance-theory/

A recent study found that 70 percent of actively managed funds have failed to beat their benchmark index and just 2.3 percent have delivered excess returns of more than 2.5 percent—and those are pre-fee numbers.1 Fees make the picture even worse.

Trying to pick in advance which funds will be among the few that beat the market has proven just as difficult. Morningstar’s famed star ratings have a poor track record of picking winning funds. Brokerage accounts advised by financial advisers achieve lower net returns and inferior risk-return tradeoffs than self-directed accounts. Even the expensive investment consultants who advise the world’s biggest money pools have shown limited ability to pick funds. The academic research now shows that the best metric for picking funds is the expense ratio: the less you pay experts to manage your money, the more you keep.

Very few of the highly paid and well-credentialed professionals that run mutual funds and advise client investments actually add value. Yet clients still flock to actively managed funds and expensive advisers. There is, in finance, a massive calibration error: a gap between claimed expertise and actual results.

At the heart of this calibration error is bad theory. The profession of finance as practiced today relies heavily on modern finance theory: the dividend discount model and the capital asset pricing model. These models are the centerpieces of most business school finance courses, and surveys suggest that they are used by over 70 percent of CFOs for capital budgeting. They are also used by almost every fundamental investor and most financial advisers.

Read more at https://americanaffairsjournal.org/2017/05/bankruptcy-modern-finance-theory/

January 28, 2018

Different position sizing strategies explained

Seth Klarman (Baupost)

- You diversify away most of the diversifiable risk by having a portfolio of 20 or 25 positions.

- You should be able to tell a great investment from a good investment, so there is no sense in having the same size position with your best idea and your 100th best idea.

- A position is defined as the total investment in a company’s securities (which could span different asset classes).

- A concentrated position is a ~10% position (every 2 years or so)

- A post here shows in the 5.5 years from Oct 95 to Apr 01, Baupost only made two 10+% investments, and five 7-10% investments.

- We would own a 10% position in a senior, distressed debt investment where there was a plan in place, where the assets were very safe – either cash or receivables or something where we could count on getting our money back, and where we saw almost no chance of principal loss over a couple of years and a chance of a very high, meaning 20% plus, type of return.

- We would not own a 10% position in a common stock that was just plain cheap unless we had a seat on the board and control, because too many bad things can happen.

- Most of the time, our most favorite ideas have 3%, 5%, 6% positions.

- Position size will increase when a cheap position becomes much, much better a bargain or when there’s a catalyst for the realization of underlying value.

- A catalyst gives you a much shorter duration on the investment and greater predictability that you will in fact make money on that investment and aren’t subject to the vagaries of the market and the economy and business over a longer period of time.

- New inexperienced managers will have some 20% positions which might even be correlated, that’s absurdly concentrated.

- 1% positions are too small to take advantage of the relatively few great mispricings that you can find.

- Source: here.

January 27, 2018

What Would You See As You Fell Into A Black Hole?

Black holes are some of the most perplexing objects in the entire Universe. Objects so dense, where gravitation is so strong, that nothing, not even light, can ever escape from it. Many physical black holes have been identified, from stellar-mass scale ones in our own galaxy to supermassive ones at the centers of the majority of galaxies, many millions or even billions of times the mass of our Sun. The key property surrounding the event horizon, that light can never escape from within it, sets up a boundary in space: once you cross it, you’re doomed to hit the central singularity. But what would you see as you fell in? Would the lights stay on, or would the Universe go dark? At last, physics has deciphered the answer, and it’s gorgeous.

Read more at https://medium.com/starts-with-a-bang/what-would-you-see-as-you-fell-into-a-black-hole-75db33fa73f4

Read more at https://medium.com/starts-with-a-bang/what-would-you-see-as-you-fell-into-a-black-hole-75db33fa73f4

January 26, 2018

Here is a really simple and powerful concept of TA

Here is a really simple and powerful concept of TA -- it is impossible for a major bull trend to occur without confirmation for a simple MA -- I use 21 days as the proxy for trend in cryptos/forex/futures -- pick your own length

11:26 PM - 25 Jan 2018

Nice read: How a Misfit Group of Computer Geeks and English Majors Transformed Wall Street

A harbinger of the techies who would storm Wall Street in a decade, this new generation of hedge-fund introverts would replace the profanity-laced trading rooms of the 1980s with quiet libraries of algorithmic research in every corner of the markets. They would also launch an early email system and look into the prospect of online retailing, leading one of Shaw’s most ambitious employees to take the idea and run with it. Yes, the seeds of Jeff Bezos’s Amazon were planted at a New York City hedge fund.

Thirty years ago, all of that was yet to come. All Shaw told Sussman at the time was, “I think I can use technology to trade securities.”

Sussman told Shaw the Goldman offer he had received was inadequate. “If you’re confident this idea is going to work, you should come work for me,” Sussman told Shaw. The offer led to three days of sailing in Long Island Sound on Sussman’s 45-foot sloop with the financier, Shaw, and his partner, Peter Laventhol. The two men —without disclosing many details — “convinced me they believed they could generate models that would identify portfolios that would be market-neutral and able to outperform others,” Sussman remembers. In lay terms, the strategy would make a lot of money without taking much risk.

Read more at http://nymag.com/selectall/2018/01/d-e-shaw-the-first-great-quant-hedge-fund.html

Thirty years ago, all of that was yet to come. All Shaw told Sussman at the time was, “I think I can use technology to trade securities.”

Sussman told Shaw the Goldman offer he had received was inadequate. “If you’re confident this idea is going to work, you should come work for me,” Sussman told Shaw. The offer led to three days of sailing in Long Island Sound on Sussman’s 45-foot sloop with the financier, Shaw, and his partner, Peter Laventhol. The two men —without disclosing many details — “convinced me they believed they could generate models that would identify portfolios that would be market-neutral and able to outperform others,” Sussman remembers. In lay terms, the strategy would make a lot of money without taking much risk.

Read more at http://nymag.com/selectall/2018/01/d-e-shaw-the-first-great-quant-hedge-fund.html

January 25, 2018

New investors entering the market... some questions being asked

Some very innocent and sweet messages from new investors..not making fun but cannot help share  :

1. At 4 PM.. my orders are not getting executed

2. I am busy during weekdays, can i trade on weekends

3. Can u maintain my portfolio

4. Do i have to buy sell 25 stocks every week

:

1. At 4 PM.. my orders are not getting executed

2. I am busy during weekdays, can i trade on weekends

3. Can u maintain my portfolio

4. Do i have to buy sell 25 stocks every week

:

1. At 4 PM.. my orders are not getting executed

2. I am busy during weekdays, can i trade on weekends

3. Can u maintain my portfolio

4. Do i have to buy sell 25 stocks every week

:

1. At 4 PM.. my orders are not getting executed

2. I am busy during weekdays, can i trade on weekends

3. Can u maintain my portfolio

4. Do i have to buy sell 25 stocks every week

1:35 PM - 25 Jan 2018

Market outlook

Daily charts

- trend is up on daily charts

- today NF closed flat at 11069

- AD was negative at 1:2

- support 10500

- trend is up on daily charts

- today NF closed flat at 11069

- AD was negative at 1:2

- support 10500

ICICI Pru’s PMS unit shuts down two small-cap schemes, to return money

Good move by ICICI ... I think a first in India

Read more at https://economictimes.indiatimes.com/markets/stocks/news/icici-prus-pms-unit-shuts-down-two-small-cap-schemes-to-return-money/articleshow/62643766.cms

Read more at https://economictimes.indiatimes.com/markets/stocks/news/icici-prus-pms-unit-shuts-down-two-small-cap-schemes-to-return-money/articleshow/62643766.cms

January 24, 2018

Market outlook

Daily charts

- trend is up on daily charts

- today NF closed flat at 11086

- AD was negative at 2:5

- support at 10500

- VIX up by 11% now at 18% ... options very expensive

- trend is up on daily charts

- today NF closed flat at 11086

- AD was negative at 2:5

- support at 10500

- VIX up by 11% now at 18% ... options very expensive

Elliott Wave Analysis Update of Nifty on All Time Frame as on 22 Jan 2018

Nifty registered new all time high 10906 on Friday, 19 Jan 2018 and bounced more than 800 points in last 8 weeks. Though, there is no change in long term wave counts but still I am preparing a fresh All Time Frame analysis report because last all time frame analysis report I prepared in Aug 2017 and many of my clients and followers are asking about further possibilities of Nifty at these higher levels.

So, today I am revising wave counts on all time frames to conclude the further possible road map of Nifty in Long, Medium and Short Term. Let’s start with a monthly chart covering life time move of Nifty.

(Friday, 10827 was immediate breakeven point on upside and I expected minimum bounce towards 10887-10917 if breaks above 10827 but with cautions at higher levels. Trading strategy was to exit Jan 10700-10800 puts (if someone holding) at 10827 but no other trade was suggested. Nifty bounced above 10887 to registered new life time high 10906 as expected.)

Read more at http://sweeglu.com/elliott-wave-analysis-update-of-nifty-on-all-time-frame-as-on-22-jan-2018/

So, today I am revising wave counts on all time frames to conclude the further possible road map of Nifty in Long, Medium and Short Term. Let’s start with a monthly chart covering life time move of Nifty.

(Friday, 10827 was immediate breakeven point on upside and I expected minimum bounce towards 10887-10917 if breaks above 10827 but with cautions at higher levels. Trading strategy was to exit Jan 10700-10800 puts (if someone holding) at 10827 but no other trade was suggested. Nifty bounced above 10887 to registered new life time high 10906 as expected.)

Read more at http://sweeglu.com/elliott-wave-analysis-update-of-nifty-on-all-time-frame-as-on-22-jan-2018/

January 23, 2018

Market outlook

Daily charts

- trend is up on daily charts

- today NF closed 1% in positive at 11084

- AD was slightly negative

- support 10500

- VIX jumped to 16% making options expensive

- trend is up on daily charts

- today NF closed 1% in positive at 11084

- AD was slightly negative

- support 10500

- VIX jumped to 16% making options expensive

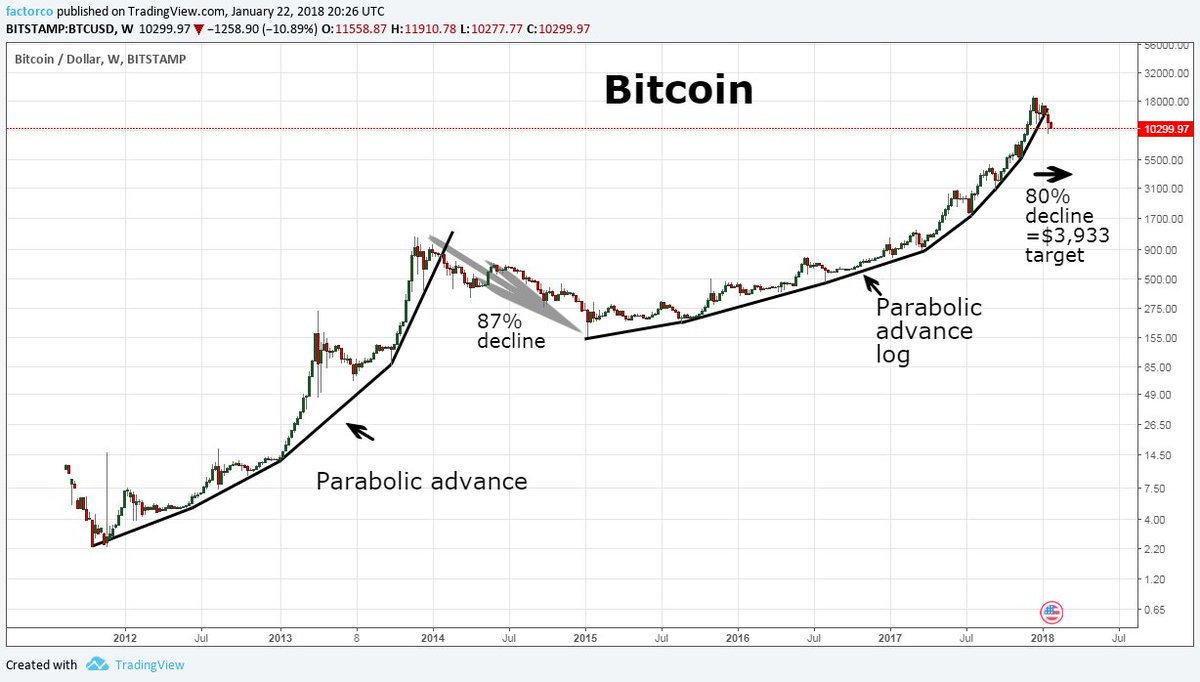

Violation of parabolic advance can lead to 80% decline

General TA rule -- violation of parabolic advance leads to 80%+ decline in value. If general rule is followed, BTC should retrace to <$4,000. Note: This Tweet does not make me a hater.

January 22, 2018

How To Tell If Someone Is Truly Smart Or Just Average

Have you ever noticed how some of the world’s most successful entrepreneurs and leaders see reality in a fundamentally different way? When they talk, it’s almost as if they’re speaking a different language.

Just look at this interview where Elon Musk describes how he understands cause and effect:

“I look at the future from the standpoint of probabilities. It’s like a branching stream of probabilities, and there are actions that we can take that affect those probabilities or that accelerate one thing or slow down another thing. I may introduce something new to the probability stream.”

Unusual, right? One writer who interviewed Musk describes his mental process like this:

“Musk sees people as computers, and he sees his brain software as the most important product he owns — and since there aren’t companies out there designing brain software, he designed his own, beta tests it every day, and makes constant updates.”

Musk’s top priority is designing the software in his brain. Have you ever heard anyone else describe their life that way?

Read more at https://medium.com/the-mission/how-to-tell-if-someone-is-truly-smart-or-just-average-a2f0bcac5db2

Just look at this interview where Elon Musk describes how he understands cause and effect:

“I look at the future from the standpoint of probabilities. It’s like a branching stream of probabilities, and there are actions that we can take that affect those probabilities or that accelerate one thing or slow down another thing. I may introduce something new to the probability stream.”

Unusual, right? One writer who interviewed Musk describes his mental process like this:

“Musk sees people as computers, and he sees his brain software as the most important product he owns — and since there aren’t companies out there designing brain software, he designed his own, beta tests it every day, and makes constant updates.”

Musk’s top priority is designing the software in his brain. Have you ever heard anyone else describe their life that way?

Read more at https://medium.com/the-mission/how-to-tell-if-someone-is-truly-smart-or-just-average-a2f0bcac5db2

Kenneth Marshall: good interview on value investing

What I’ve learned from teaching is that people with no financial background can become good investors.

Those from the hard sciences – physics, engineering, chemistry – seem to have a particular advantage. They’re already trained to chase solid answers via logic and math. They’re not satisfied with ambiguity; they want the truth. That’s a very useful mindset to have.

Read more at https://www.safalniveshak.com/interview-kenneth-jeffrey-marshall

Those from the hard sciences – physics, engineering, chemistry – seem to have a particular advantage. They’re already trained to chase solid answers via logic and math. They’re not satisfied with ambiguity; they want the truth. That’s a very useful mindset to have.

Read more at https://www.safalniveshak.com/interview-kenneth-jeffrey-marshall

January 21, 2018

January 19, 2018

Market outlook

Daily charts

- trend is up on daily charts

- today nifty closed 0.7% in positive at 10895

- AD was flat. WHY?

- option writing support 10500

- observation ... in most recent 2 red bars, AD was 1:5 (bad) and the following blue bars AD was flat.

- trend is up on daily charts

- today nifty closed 0.7% in positive at 10895

- AD was flat. WHY?

- option writing support 10500

- observation ... in most recent 2 red bars, AD was 1:5 (bad) and the following blue bars AD was flat.

January 18, 2018

Aadhaar Gives State A Switch To Cause Civil Death Of An Individual, Petitioners Argue

If the Aadhaar Act is allowed to continue, it will transform People’s Constitution into a State Constitution, argued petitioners on Day 1 of the hearing challenging the validity of the biometric ID. The constitution firmly repudiates Aadhaar, they said.

‘’The State is empowered with a ‘switch’ by which it can cause the civil death of an individual,” says the opening statements submitted in the court by the petitioners. “Where every basic facility is linked to Aadhaar and one cannot live in a society without an Aadhaar number, the switching off of Aadhaar completely destroys the individual.’’

Read more at https://www.bloombergquint.com/law-and-policy/2018/01/18/aadhaar-gives-state-a-switch-to-cause-civil-death-of-an-individual-petitioners-argue

‘’The State is empowered with a ‘switch’ by which it can cause the civil death of an individual,” says the opening statements submitted in the court by the petitioners. “Where every basic facility is linked to Aadhaar and one cannot live in a society without an Aadhaar number, the switching off of Aadhaar completely destroys the individual.’’

Read more at https://www.bloombergquint.com/law-and-policy/2018/01/18/aadhaar-gives-state-a-switch-to-cause-civil-death-of-an-individual-petitioners-argue

Index at ATH but stocks in deep red? The curse

once i hit a baba from behind while riding my bike. ages ago.

turning around...he cursed me: one day index will be all time high and all your stocks will be deep red

today was the day his words came true

Market outlook

Daily charts

- trend is up on daily charts

- today, nifty opened gapup but closed near day's low

- close was 0.3% in positive at 10817

- AD was bad at 1:6

- there is no visually obvious swing low (10000 is too far)

- immediate supports 10600-10400

- option writing support 10500

- trend is up on daily charts

- today, nifty opened gapup but closed near day's low

- close was 0.3% in positive at 10817

- AD was bad at 1:6

- there is no visually obvious swing low (10000 is too far)

- immediate supports 10600-10400

- option writing support 10500

January 17, 2018

Old post ... Greece "rockstar" FM leaving with wife after resigning as FM ... good pictures

Best quote of the year/ parting kick to the EURO folks ...

"I shall wear the creditor's loathing with pride."

One more shot... the media is ga ga over him. ... one of the best FMs and a non political one (he is a prof of eco).

One last shot... and you know why he was called a rockstar

Read more about him at his blog here

"I shall wear the creditor's loathing with pride."

One more shot... the media is ga ga over him. ... one of the best FMs and a non political one (he is a prof of eco).

One last shot... and you know why he was called a rockstar

Read more about him at his blog here

Market outlook

Daily charts

- trend is up on daily charts

- today, Nifty closed 0.8% in positive at 10788

- but AD was flat. Why?

- swing low support 10600

- option writing support 10500... may increase to 10700

- trend is up on daily charts

- today, Nifty closed 0.8% in positive at 10788

- but AD was flat. Why?

- swing low support 10600

- option writing support 10500... may increase to 10700

The truth about security: Here's why Aadhaar's greatest threat lies within

“The introduction of the VID seems to be a knee-jerk reaction of the UIDAI to the recent debate on threats to privacy in the Aadhaar database,” says she. “We’re at a loss to explain to the slum community, where we work, now totally dependent on Aadhaar to access government welfare benefits, how to go about getting this new number!”

....

In September last year, the Uttar Pradesh police busted a Lucknow-based gang which cloned the fingerprints of authorised Aadhaar enrolment operators to create ‘fake’ Aadhaar numbers.

....

“First, using biometrics as passwords is a flawed concept,” says Subhashis Banerjee of IIT Delhi. “Hackers the world over have shown how easy it is to clone biometrics — without the victim even getting to know!”

....

Today, as data has become more valuable than gold and oil, Aadhaar, the largest database of information in the world, risks becoming a sitting duck for hackers.

....

“The single biggest concern is the use of a unique ID everywhere, making it possible to build tradeable databases of individual information,” says the Internet.

....

“Aadhaar is designed to protect the state from citizen fraud. Nothing in Aadhaar’s design protects the citizen from state fraud…” The insecurity this has led to is exacerbated by the notions of the VID and “informed consent” — which suggest that the onus of protecting one’s own data lies not on the agency which has been entrusted with it, but on the individual himself…

....

Read more at http://www.business-standard.com/article/economy-policy/the-truth-about-security-here-s-why-aadhaar-s-greatest-threat-lies-within-118011700061_1.html

....

In September last year, the Uttar Pradesh police busted a Lucknow-based gang which cloned the fingerprints of authorised Aadhaar enrolment operators to create ‘fake’ Aadhaar numbers.

....

“First, using biometrics as passwords is a flawed concept,” says Subhashis Banerjee of IIT Delhi. “Hackers the world over have shown how easy it is to clone biometrics — without the victim even getting to know!”

....

Today, as data has become more valuable than gold and oil, Aadhaar, the largest database of information in the world, risks becoming a sitting duck for hackers.

....

“The single biggest concern is the use of a unique ID everywhere, making it possible to build tradeable databases of individual information,” says the Internet.

....

“Aadhaar is designed to protect the state from citizen fraud. Nothing in Aadhaar’s design protects the citizen from state fraud…” The insecurity this has led to is exacerbated by the notions of the VID and “informed consent” — which suggest that the onus of protecting one’s own data lies not on the agency which has been entrusted with it, but on the individual himself…

....

Read more at http://www.business-standard.com/article/economy-policy/the-truth-about-security-here-s-why-aadhaar-s-greatest-threat-lies-within-118011700061_1.html

January 16, 2018

UIDAI should issue new Aadhaar numbers to all card holders

Logic is simple.

Under compulsion, I have given/ parted away with copies of my Aadhaar card to banks, mobile operators etc.

Note that I am not claiming ANY benefits from the government under any scheme.

So my number with name, address etc is , for all practical purposes, available in the public domain.

The new proposed 2 tier security or virtual 16 digit code is not going to solve this problem.

Under compulsion, I have given/ parted away with copies of my Aadhaar card to banks, mobile operators etc.

Note that I am not claiming ANY benefits from the government under any scheme.

So my number with name, address etc is , for all practical purposes, available in the public domain.

The new proposed 2 tier security or virtual 16 digit code is not going to solve this problem.

Market outlook

Daily charts

- trend is up on daily charts

- today, NF closed 0.38% in negative at 10700

- AD was 1:5... quite bad

- today there was reduction in put positions and increase in call writing positions.

- however highest open interest is still at 10500 put.

- we have one hanging man, one shooting star and red bar today

- let us see if correction continues

- trend is up on daily charts

- today, NF closed 0.38% in negative at 10700

- AD was 1:5... quite bad

- today there was reduction in put positions and increase in call writing positions.

- however highest open interest is still at 10500 put.

- let us see if correction continues

New UIDAI features prove that data is unsafe: Experts

...experts have voiced concern that UIDAI's knee-jerk reaction was a last-minute attempt to cover up lack of security of humungous data stored in one place.

E-governance expert Anupam Saraph said that the decision to come up with virtual ID was admission by UIDAI that storage of Aadhaar number was "dangerous and wrong".

"If these were not so, virtual ID (VID) would be unnecessary. The introduction of VID also shows that UIDAI had failed to implement its own Aadhaar A ..

Read more at http://economictimes.indiatimes.com/articleshow/62519505.cms

E-governance expert Anupam Saraph said that the decision to come up with virtual ID was admission by UIDAI that storage of Aadhaar number was "dangerous and wrong".

"If these were not so, virtual ID (VID) would be unnecessary. The introduction of VID also shows that UIDAI had failed to implement its own Aadhaar A ..

Read more at http://economictimes.indiatimes.com/articleshow/62519505.cms

Chal Rang De Asalpha: Welcome to the 'Positano' of Mumbai | The Quint

How a slum was transformed into a colorful delight

January 15, 2018

Market outlook

Daily charts

- trend is up on daily charts

- today NF closed 0.5% in positive at 10741

- AD was flat

- option writing support 10500

- trend is up on daily charts

- today NF closed 0.5% in positive at 10741

- AD was flat

- option writing support 10500

Uday Kotak red flag over market rally, says savings going to ‘few hundred stocks’

One of India’s top bankers and Vice-Chairman of Kotak Mahindra Bank, Uday Kotak, has raised a red flag on the surge in stocks, saying that it raises questions as to whether this poses the risk of a “bubble”. He said a lot of domestic savings were flowing to “a few hundred stocks” of firms whose governance standards fuel concern.

“While we are in the right direction, I always worry about excesses. What’s the excess which worries me? Here we have got a wonderful situation where massive amounts of savings are moving to the financial savings. Within the financial savings space, (money flows) into mutual funds, unit-linked schemes of insurance companies and directly into the equity markets. Money is coming through a broad funnel and it’s going into a narrow pipe… massive amount of Indian savers’ money is now going into a few hundred stocks. And you come back to the question of how good is the governance of these companies. The amount of money that’s going into small and mid-cap stocks is something on which we have to ask tough questions. Is there a risk of a bubble?” Kotak said in an interview.

Read more at http://indianexpress.com/article/business/banking-and-finance/uday-kotak-red-flag-over-market-rally-says-savings-going-to-few-hundred-stocks-5024854/lite/?__twitter_impression=true

“While we are in the right direction, I always worry about excesses. What’s the excess which worries me? Here we have got a wonderful situation where massive amounts of savings are moving to the financial savings. Within the financial savings space, (money flows) into mutual funds, unit-linked schemes of insurance companies and directly into the equity markets. Money is coming through a broad funnel and it’s going into a narrow pipe… massive amount of Indian savers’ money is now going into a few hundred stocks. And you come back to the question of how good is the governance of these companies. The amount of money that’s going into small and mid-cap stocks is something on which we have to ask tough questions. Is there a risk of a bubble?” Kotak said in an interview.

Read more at http://indianexpress.com/article/business/banking-and-finance/uday-kotak-red-flag-over-market-rally-says-savings-going-to-few-hundred-stocks-5024854/lite/?__twitter_impression=true

How PremjiInvest became the top investment co from a quiet family office

PremjiInvest, which according to three independent and conservative estimates, manages at least $3 billion of assets — predominantly in the public markets — is by far the largest family office in the country. The firm has a runway to increase assets under management to $6 billion, according to one of these sources.

"There are only five mutual funds larger than PremjiInvest when you look at their public markets corpus," said an investment banker, on the condition of anonymity.

Read more at http://economictimes.indiatimes.com/articleshow/62500500.cms

"There are only five mutual funds larger than PremjiInvest when you look at their public markets corpus," said an investment banker, on the condition of anonymity.

Read more at http://economictimes.indiatimes.com/articleshow/62500500.cms

How a school dropout compounded 50% returns for 13 years to outgrow the market

Working in a BPO (Business Process Outsourcing) at night and trading during the day, Nikhil Kamath managed to identify the method in the madness. To have an elder brother, who was also a trader, helped. But as Nikhil says, trading is a solo sport no one can play it on your behalf. With nearly 15 years of trading and an enviable track record, Nikhil now has an institution-sized trading book.

His lack of education did not stop his learning process. Nikhil is a voracious reader, reading up on a vast range of subjects, but prefers books on mass psychology.

In an interview with Moneycontrol’s Shishir Asthana, Nikhil Kamath speaks about his journey in the market and what it takes to succeed.

Q. Nikhil you started trading when you were 16. What inspired you to take up trading that early?

I quit school around the ninth standard to play chess full time. I used to play for India that time. Around the same time, I started trading. I got interested as my brother was into trading. But after two years I quit chess. I did not go back to school. During this time I managed to get a part-time job in a BPO and continued trading full-time.

Q. So you learned to trade with your brother and what were your initial lessons?

Read more at http://www.moneycontrol.com/news/business/markets/how-a-school-dropout-compounded-50-returns-for-13-years-to-outgrow-the-market-2482879.html

His lack of education did not stop his learning process. Nikhil is a voracious reader, reading up on a vast range of subjects, but prefers books on mass psychology.

In an interview with Moneycontrol’s Shishir Asthana, Nikhil Kamath speaks about his journey in the market and what it takes to succeed.

Q. Nikhil you started trading when you were 16. What inspired you to take up trading that early?

I quit school around the ninth standard to play chess full time. I used to play for India that time. Around the same time, I started trading. I got interested as my brother was into trading. But after two years I quit chess. I did not go back to school. During this time I managed to get a part-time job in a BPO and continued trading full-time.

Q. So you learned to trade with your brother and what were your initial lessons?

Read more at http://www.moneycontrol.com/news/business/markets/how-a-school-dropout-compounded-50-returns-for-13-years-to-outgrow-the-market-2482879.html

January 14, 2018

January 13, 2018

Sebi crackdown puts WhatsApp groups on silent mode

I stopped using Whatsapp 2-3 years ago... complete waste of time.

Read more at https://economictimes.indiatimes.com/markets/stocks/news/sebi-crackdown-puts-whatsapp-groups-on-silent-mode/articleshow/62467490.cms

Read more at https://economictimes.indiatimes.com/markets/stocks/news/sebi-crackdown-puts-whatsapp-groups-on-silent-mode/articleshow/62467490.cms

Why Mutual Fund Investors Must Care About This New Benchmark

What’s TRI? It’s something a mutual fund investor should know.

TRI, or Total Return Index, tracks both the capital gains of a scheme and assumes that any cash distribution, such as dividends, are reinvested back into the index. Markets regulator SEBI released a circular on Jan. 4 asking fund houses to benchmark a scheme’s performance against the TRI.

The objective, as highlighted by SEBI, is to help investors compare the performance of a scheme with the benchmark in a fairer manner.

A quick look at the difference between Nifty returns over the last 17 years, compared to the total returns (as per TRI), will suggest that it will become harder for a mutual fund to show significant outperformance versus the benchmark.

“TRI is a good move as it will get fund managers to become more active, and will align us with global market practices,” Leo Puri, managing director at UTI Asset Management, said on this week’s BQMutualFundShow. The total return gives a true and fair picture of the performance of an entity, he said.

Here are edited excerpts from the conversation.

Read more at https://www.bloombergquint.com/mutual-funds/2018/01/13/why-mutual-fund-investors-must-care-about-this-new-benchmark

TRI, or Total Return Index, tracks both the capital gains of a scheme and assumes that any cash distribution, such as dividends, are reinvested back into the index. Markets regulator SEBI released a circular on Jan. 4 asking fund houses to benchmark a scheme’s performance against the TRI.

The objective, as highlighted by SEBI, is to help investors compare the performance of a scheme with the benchmark in a fairer manner.

A quick look at the difference between Nifty returns over the last 17 years, compared to the total returns (as per TRI), will suggest that it will become harder for a mutual fund to show significant outperformance versus the benchmark.

“TRI is a good move as it will get fund managers to become more active, and will align us with global market practices,” Leo Puri, managing director at UTI Asset Management, said on this week’s BQMutualFundShow. The total return gives a true and fair picture of the performance of an entity, he said.

Here are edited excerpts from the conversation.

Read more at https://www.bloombergquint.com/mutual-funds/2018/01/13/why-mutual-fund-investors-must-care-about-this-new-benchmark

Will oppose FDI till our last breath: BJP

Complete U turn on FDI... same with Aadhaar and GST.

Why did I vote for BJP?

Read more at https://www.ndtv.com/india-news/will-oppose-fdi-till-our-last-breath-bjp-515464

Why did I vote for BJP?

Read more at https://www.ndtv.com/india-news/will-oppose-fdi-till-our-last-breath-bjp-515464

Will 2018 Be As Good as 2017?

What’s for 2018?

For one, I don’t think making money will be as easy in 2018. This has been a brilliant year for everything, even random portfolios. It’s been a year of excesses, in terms of returns, as capital ran towards equities in a strong way. It’s seen returns come more from more buying, than from earning increases that would have raised valuations. The P/Es of all indexes are at near term, or all-time highs, meaning that we are paying more for stocks than ever before. This situation doesn’t tend to last, and while it may still go up a lot more before it reverses, it won’t end very well.

Does that mean we exit stocks? No. We keep a healthy debt and equity allocation, and continue to ride through. And then, as some under-covered stocks are found, they will be useful additions to portfolios.

What’s bothering is the government’s borrowing situation. Yields are up to 7.34% from about 6.4% in the early part of October. And this, after a rate cut from the RBI. There’s a distinct feeling that the government will have to borrow hard to finance the bank bailouts, and indeed, other expenses. Borrowing in the last quarter has gone up marginally, but the budget may spring more surprises.

And yes, there’s the budget. Which will come in Feb. Which will be the last budget of this government, before the 2019 elections. This was supposed to be a strong budget that cut taxes. Because that was what was promised. And more expenses, like infra spending and others. But in the light of higher yields, can the government afford to earn less revenue and spend more? And without this, would this even be the kind of blockbuster budget people are looking for?

Read more at https://capitalmind.in/2018/01/happy-new-year-2018-nifty-28-run-will-2018-good/

For one, I don’t think making money will be as easy in 2018. This has been a brilliant year for everything, even random portfolios. It’s been a year of excesses, in terms of returns, as capital ran towards equities in a strong way. It’s seen returns come more from more buying, than from earning increases that would have raised valuations. The P/Es of all indexes are at near term, or all-time highs, meaning that we are paying more for stocks than ever before. This situation doesn’t tend to last, and while it may still go up a lot more before it reverses, it won’t end very well.

Does that mean we exit stocks? No. We keep a healthy debt and equity allocation, and continue to ride through. And then, as some under-covered stocks are found, they will be useful additions to portfolios.

What’s bothering is the government’s borrowing situation. Yields are up to 7.34% from about 6.4% in the early part of October. And this, after a rate cut from the RBI. There’s a distinct feeling that the government will have to borrow hard to finance the bank bailouts, and indeed, other expenses. Borrowing in the last quarter has gone up marginally, but the budget may spring more surprises.

And yes, there’s the budget. Which will come in Feb. Which will be the last budget of this government, before the 2019 elections. This was supposed to be a strong budget that cut taxes. Because that was what was promised. And more expenses, like infra spending and others. But in the light of higher yields, can the government afford to earn less revenue and spend more? And without this, would this even be the kind of blockbuster budget people are looking for?

Read more at https://capitalmind.in/2018/01/happy-new-year-2018-nifty-28-run-will-2018-good/

Brace for negative returns in 2018

Predicting stock markets is a futile exercise. You only need to compare historical predictions versus actual market movements to come to this conclusion. When bulge bracket investment banks and powerhouse economists with their multi-factor models of staggering complexity get them wrong more often than right, should the rest of us even bother trying to predict markets?

No, we shouldn’t. At least not to time entries and exits.

The exercise:

To use three readily available NIFTY valuation metrics (Price-Earnings, Price-Book, Dividend Yield) to “predict” 2018 NIFTY returns

Read more at https://thecalminvestor.com/nifty-prediction-2018/

No, we shouldn’t. At least not to time entries and exits.

The exercise:

To use three readily available NIFTY valuation metrics (Price-Earnings, Price-Book, Dividend Yield) to “predict” 2018 NIFTY returns

Read more at https://thecalminvestor.com/nifty-prediction-2018/

January 12, 2018

Realtime datafeed customers please note

Received this email from GDFL.... Note that brokers will not be affected.

Hello,

The Exchange (NSE) will be conducting Live trading sessions on 15th and 16th January, 2018, from their BCP site, in Capital Market, Futures & Options, Currency Derivatives, Debt and SLBM segments.

Since we do not have a connectivity at their BCP site, so Exchange will be providing the data from their Primary site (BKC) on a best effort basis with expected delays. It means our data users may experience delayed data and / or data disruption. Users are requested to please take a note and make suitable arrangements.

Thank You,

Regards,

Swapnil Bhavsar

Support Team

www.globaldatafeeds.in

Swapnil Bhavsar

Support Team

www.globaldatafeeds.in

Market outlook

Daily charts

- trend is up on daily charts

- today NF closed 0.3% in positive

- AD was negative

- trading range was large resulting in formation of "hanging man"

- this can have bearish implications if markets trade below 10600 next week

- option writing support 10500

- trend is up on daily charts

- today NF closed 0.3% in positive

- AD was negative

- trading range was large resulting in formation of "hanging man"

- this can have bearish implications if markets trade below 10600 next week

- option writing support 10500

I thought the BJP was against FDI... now why this big U turn?

And to think they accused UPA of selling the country when a milder version of FDI was initiated

Also, what happens to the Make in India initiative? The UPA condition of min 30% local manufacturing is being done away with.

Read more at https://economictimes.indiatimes.com/news/economy/policy/cabinet-approves-100-fdi-in-single-brand-retail-via-automatic-route/articleshow/62441547.cms

Subscribe to:

Posts (Atom)