December 31, 2020

NIFTY monthly, quarterly and yearly charts

December 30, 2020

NIFTY EOD charts

How the Nifty will change in the coming decade?

December 29, 2020

NIFTY EOD charts

December 28, 2020

NIFTY EOD charts

The anatomy of a stock market bubble staring India in the face

On 18 December, the price to earnings (PE) ratio of the Nifty 50 stock market index reached an all-time high of 37.84. This was around 87% higher than the average PE ratio of 20.26 since 1 January 1999.

The PE ratios of the Nifty 50 and other broader indices continue to remain at extremely high levels. This ratio is essentially the number of rupees that investors are ready to pay for every rupee of earnings over the last 12 months of the stocks that make up any index.

The average yearly PE ratio of the Nifty 50 has been largely rising since 2013. This basically means that share prices have risen much faster than company earnings. This is true for other indices as well. Interestingly, the overall net profit of listed companies in India hasn’t grown in many years. Their overall net profit in 2019-20 was lower than in 2007-08. Of course, 2019-20 profits would have been slightly hit by the covid pandemic, but even the overall net profit for 2018-19 was lower than that in 2010-11.

December 27, 2020

BANKNIFTY (futures) top down analysis on multiple timeframes

How to get rich without being lucky - by Naval Ravikant

Naval Ravikant is an Indian-American entrepreneur and investor. He is the co-founder, chairman and former CEO of AngelList. He has invested early-stage in over 200 companies including Uber, FourSquare, Twitter, Wish.com, Poshmark, Postmates, Thumbtack, Notion, SnapLogic, Opendoor, Stack Overflow, OpenDNS, Yammer, and Clearview AI, with over 70 total exits and more than 10 Unicorn companies.

Ravikant is is also a podcaster who shares advice on pursuing wealth and happiness.

Seek wealth, not money or status. Wealth is having assets that earn while you sleep. Money is how we transfer time and wealth. Status is your place in the social hierarchy.

↓

Understand ethical wealth creation is possible. If you secretly despise wealth, it will elude you.

↓

Ignore people playing status games. They gain status by attacking people playing wealth creation games.

↓

You’re not going to get rich renting out your time. You must own equity—a piece of a business—to gain your financial freedom.

↓

You will get rich by giving society what it wants but does not yet know how to get. At scale.

↓

Pick an industry where you can play long-term games with long-term people.

↓

The internet has massively broadened the possible space of careers. Most people haven’t figured this out yet.

↓

Play iterated games. All the returns in life, whether in wealth, relationships, or knowledge, come from compound interest.

↓

Pick business partners with high intelligence, energy, and, above all, integrity.

↓

Don’t partner with cynics and pessimists. Their beliefs are self-fulfilling.

↓

Learn to sell. Learn to build. If you can do both, you will be unstoppable.

↓

Arm yourself with specific knowledge, accountability, and leverage.

↓

Specific knowledge is knowledge you cannot be trained for. If society can train you, it can train someone else and replace you.

↓

Specific knowledge is found by pursuing your genuine curiosity and passion rather than whatever is hot right now.

↓

Building specific knowledge will feel like play to you but will look like work to others.

↓

When specific knowledge is taught, it’s through apprenticeships, not schools.

↓

Specific knowledge is often highly technical or creative. It cannot be outsourced or automated.

↓

Embrace accountability, and take business risks under your own name. Society will reward you with responsibility, equity, and leverage.

↓

“Give me a lever long enough and a place to stand, and I will move the earth.”

—Archimedes

↓

Fortunes require leverage. Business leverage comes from capital, people, and products with no marginal cost of replication (code and media).

↓

Capital means money. To raise money, apply your specific knowledge with accountability and show resulting good judgment.

↓

Labor means people working for you. It’s the oldest and most fought-over form of leverage. Labor leverage will impress your parents, but don’t waste your life chasing it.

↓

Capital and labor are permissioned leverage. Everyone is chasing capital, but someone has to give it to you. Everyone is trying to lead, but someone has to follow you.

↓

Code and media are permissionless leverage. They’re the leverage behind the newly rich. You can create software and media that works for you while you sleep.

↓

An army of robots is freely available—it’s just packed in data centers for heat and space efficiency. Use it.

↓

If you can’t code, write books and blogs, record videos and podcasts.

↓

Leverage is a force multiplier for your judgment.

↓

Judgment requires experience but can be built faster by learning foundational skills.

↓

There is no skill called “business.” Avoid business magazines and business classes.

↓

Study microeconomics, game theory, psychology, persuasion, ethics, mathematics, and computers.

↓

Reading is faster than listening. Doing is faster than watching.

↓

You should be too busy to “do coffee” while still keeping an uncluttered calendar.

↓

Set and enforce an aspirational personal hourly rate. If fixing a problem will save less than your hourly rate, ignore it. If outsourcing a task will cost less than your hourly rate, outsource it.

↓

Work as hard as you can. Even though who you work with and what you work on are more important than how hard you work.

↓

Become the best in the world at what you do. Keep redefining what you do until this is true.

↓

There are no get-rich-quick schemes. Those are just someone else getting rich off you.

↓

Apply specific knowledge, with leverage, and eventually you will get what you deserve.

↓

When you’re finally wealthy, you’ll realize it wasn’t what you were seeking in the first place. But that is for another day. [11]

Summary: Productize Yourself

Source: https://www.navalmanack.com/almanack-of-naval-ravikant/understanding-how-wealth-is-created

December 26, 2020

December 24, 2020

NIFTY EOD charts

December 23, 2020

NSE Clearing suffered a tech glitch before Nifty fell by 3% on Monday

NSE Clearing, the trade-clearing and settlement arm of the National Stock Exchange (NSE), was hit by a ‘technical glitch’ on Monday that affected several stock brokers, sources in the know told BusinessLine.

Before the Nifty index witnessed its worst single day fall of over 3 per cent, or 432 points, in nearly seven months , many brokers saw their trade orders being automatically deleted and some even had their terminals disabled, brokers said.

“At around 11.38 AM, all our pending orders were cancelled by the exchange. Market regulator SEBI should look into this as to how it happens on the day volatility is high,” a dealer at a south-Mumbai brokerage house said.

At around 11.30 AM, the Nifty index was trading at 13,722 levels. But in less than three hours around 2.45 PM, the index crashed to 13,212. According to brokers, the orders pending in the system at lower levels often act as a cushion for the markets during severe price fall. However, since pending orders of several brokers were ‘automatically’ deleted the selling seemed intense, brokers said.

Long term investing beautifully explained

Find one company you can hold for 10+ years

— D.Muthukrishnan (@dmuthuk) December 23, 2020

Use your savings in the year to buy that one stock

Find next company in the second year

Repeat the process

Do it year after year

Over a period, you would have built a great portfolio.

December 22, 2020

NIFTY EOD charts

December 21, 2020

US Dollar monthly chart

NIFTY EOD charts

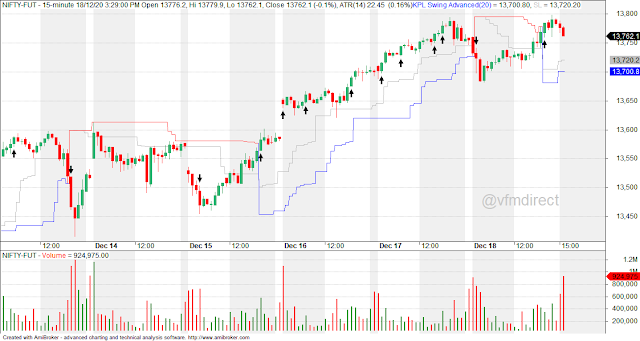

December 18, 2020

December 16, 2020

NIFTY EOD charts

December 15, 2020

Financial Freedom

Money gives you the power to buy others time & energy. Also, gives you power to buy your own time which is pledged against salary in fulfilling someone’s dream

— Adam Umesh (@adamumesh18) December 15, 2020

Everyone is working hard thinking that the day will come

Some see it

Rest fade thinking about it https://t.co/17zNzJsMUe

NIFTY EOD charts

December 14, 2020

NIFTY EOD charts

December 12, 2020

NIFTY weekly charts

On believing "experts"

The problem with “believing the experts” is that for every expert, there’s another expert with equal credentials saying the opposite.

— 🥶 (@bp2username) December 11, 2020

The media chooses which side to report, thus becoming the “expert” you are believing.

December 11, 2020

NIFTY intraday charts

NIFTY EOD charts

December 10, 2020

NIFTY EOD charts

NASDAQ bar reversal

December 9, 2020

NIFTY EOD charts

December 8, 2020

NIFTY EOD charts

December 7, 2020

How long will these valuations sustain?

NIFTY intraday charts

NIFTY EOD charts

December 6, 2020

NIFTY weekly charts

BANKNIFTY EOD and hourly charts

December 4, 2020

INDIAVIX daily and weekly charts

NIFTY intraday charts

NIFTY EOD charts

December 3, 2020

Bill Ackman - Massive pent up demand - 2021 will be 'very, very good year'

Bill Ackman estimated that consumers are sitting on a colossal sum of up to $US3 trillion of savings.

“People aren’t eating out, they’re not going on vacation, they’re not driving“, he pointed out.

It is elementary that when the restrictions are eased, consumers will go on a rampage and spending binge.

“When you keep someone locked down, their next move when they can actually feel safe is going to be to go on a vacation, to go drinking, to go to dinner, to go to a show,” he stated.

“It’s probably the single greatest time in history to open a restaurant,” he added.

It is obvious that the forthcoming quarterly results of companies as well as the GDP growth of Countries will be very strong due to the surge in spending by consumers.

Read more at https://www.sohnheartsandminds.com.au/media/bill-ackman-says-go-long-2021-will-be-very-very-good-year