February 29, 2020

BANKNIFTY technicals

Daily charts:

- trend is down

- support zone 28500-29000

- resistance 30500-31000

- trend is down

- support zone 28500-29000

- resistance 30500-31000

February 28, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 3.6% in negative at 11219

- AD was 1:5

- today 350 stocks made new 52 week lows

- good support around 11000-11200 range

- no swing formed below 12200

- I expect 11600 to provide resistance

- VIX up 29% today... options have become very expensive

- nifty has reached lower trendline of rising wedge (will post chart tomorrow)

- trend is down on daily charts

- today nifty closed 3.6% in negative at 11219

- AD was 1:5

- today 350 stocks made new 52 week lows

- good support around 11000-11200 range

- no swing formed below 12200

- I expect 11600 to provide resistance

- VIX up 29% today... options have become very expensive

- nifty has reached lower trendline of rising wedge (will post chart tomorrow)

February 27, 2020

Coronavirus impact...

If true, the 2% at risk = 150 million people on the planet.— Nassim Nicholas Taleb (@nntaleb) February 27, 2020

This (very very) dangerous virushead doesn't get that the medical system will be overloaded, hence 0000000 more casualties from unrelated conditions & diseases owing to disruptions. https://t.co/AlIXblCiS8

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.4% in negative at 11633

- AD was 1:2 (not bad)

- but stocks at 52 week low to 52 week high were 10 times

- note double bottom / swing low around 11500

- this was also SEP high and FEB low

- today was also the 5th consecutive day of decline

- RSI(5) less than 20... oversold

- hammer formed.... sustaining above today's high will be bullish tomorrow

- trend is down on daily charts

- today nifty closed 0.4% in negative at 11633

- AD was 1:2 (not bad)

- but stocks at 52 week low to 52 week high were 10 times

- note double bottom / swing low around 11500

- this was also SEP high and FEB low

- today was also the 5th consecutive day of decline

- RSI(5) less than 20... oversold

- hammer formed.... sustaining above today's high will be bullish tomorrow

February 26, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 1.2% in negative at 11678

- AD was 1:2

- double bottom near 11600

- stocks at 52 week lows > 7 times stocks at 52 week highs

February is the new May

February is the new May. #DowJones pic.twitter.com/keL4hL1K8v— George DSouza (@geoneld) February 26, 2020

February 25, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed flat at 11813

- AD was 7:11

- since NOV, markets doing timepass around 12000 levels

- net change is zero

- trend is down on daily charts

- today nifty closed flat at 11813

- AD was 7:11

- since NOV, markets doing timepass around 12000 levels

- net change is zero

2008 once more? The world may be headed for another global economic crisis

...For some years now, many analysts have believed that the next major global crisis would start in China, because it was suspected to be hugely overleveraged; equally, if not more important, nobody knew what was really going on. However, with central banks keeping the money feed so easy, markets all over the world kept rising.

Judging from the way equity markets are behaving today, could that time have come?

It is, perhaps, significant that the long rally in US equities since the taper tantrum in 2015 was interrupted only when Trump began braying about a trade war with China in 2018. The Dow fell 15% in a couple of weeks, highlighting the fact that the health of the US economy—and certainly US equity markets—is very tightly linked to the China relationship

Read more at https://www.financialexpress.com/opinion/2008-once-more-the-world-may-be-headed-for-another-global-economic-crisis/1877962/

Judging from the way equity markets are behaving today, could that time have come?

It is, perhaps, significant that the long rally in US equities since the taper tantrum in 2015 was interrupted only when Trump began braying about a trade war with China in 2018. The Dow fell 15% in a couple of weeks, highlighting the fact that the health of the US economy—and certainly US equity markets—is very tightly linked to the China relationship

Read more at https://www.financialexpress.com/opinion/2008-once-more-the-world-may-be-headed-for-another-global-economic-crisis/1877962/

February 24, 2020

Hedged options margins to come down by 70%

Original SEBI document is at https://www.sebi.gov.in/legal/circulars/feb-2020/review-of-margin-framework-for-cash-and-derivatives-segments-except-for-commodity-derivatives-segment-_46058.html

Detailed but simple explanation at https://tradingqna.com/t/new-margin-framework-is-here-to-benefit-hedged-positions/70652

This will benefit traders of covered calls and puts massively.

Detailed but simple explanation at https://tradingqna.com/t/new-margin-framework-is-here-to-benefit-hedged-positions/70652

This will benefit traders of covered calls and puts massively.

Stocks at 52 week low

ABB - ACC - ANDPAPER - APARINDS - APCOTEXIND - APOLSINHOT - ARSHIYA -

ASAL - BANDHANBNK - BASF - BHARATGEAR - CANBK - CENTUM - CLEDUCATE -

CSBBANK - DBCORP - DCBBANK - DEEPIND - DELTAMAGNT - DVL - ELGIEQUIP -

ENIL - EXCELINDUS - FCONSUMER - FLFL - GAYAPROJ - GET&D - GICHSGFIN -

HEROMOTOCO - HINDPETRO - HINDZINC - IFBIND - INDSWFTLAB - ISFT -

JAYAGROGN - JHS - KAMDHENU - KDDL - KIRLOSENG - LICHSGFIN -

LOKESHMACH - LT - MADRASFERT - MANUGRAPH - MASKINVEST - MENONBE -

MODIRUBBER - MUNJALSHOW - NATIONALUM - NBCC - NKIND - OLECTRA -

ONMOBILE - ORIENTHOT - RANEHOLDIN - SARLAPOLY - SATIN - SHARDACROP -

SHEMAROO - SOBHA - SOTL - SPAL - SWSOLAR - SYNDIBANK - TEJASNET -

TEXRAIL - VARDHACRLC - WHEELS - WIPL -

ASAL - BANDHANBNK - BASF - BHARATGEAR - CANBK - CENTUM - CLEDUCATE -

CSBBANK - DBCORP - DCBBANK - DEEPIND - DELTAMAGNT - DVL - ELGIEQUIP -

ENIL - EXCELINDUS - FCONSUMER - FLFL - GAYAPROJ - GET&D - GICHSGFIN -

HEROMOTOCO - HINDPETRO - HINDZINC - IFBIND - INDSWFTLAB - ISFT -

JAYAGROGN - JHS - KAMDHENU - KDDL - KIRLOSENG - LICHSGFIN -

LOKESHMACH - LT - MADRASFERT - MANUGRAPH - MASKINVEST - MENONBE -

MODIRUBBER - MUNJALSHOW - NATIONALUM - NBCC - NKIND - OLECTRA -

ONMOBILE - ORIENTHOT - RANEHOLDIN - SARLAPOLY - SATIN - SHARDACROP -

SHEMAROO - SOBHA - SOTL - SPAL - SWSOLAR - SYNDIBANK - TEJASNET -

TEXRAIL - VARDHACRLC - WHEELS - WIPL -

Some one is super bullish CBOE VIX will spike up

The "50 Cent" $VIX options trading continues as a trader buys 50,000 Mar 23 $VIX calls for 47 cents. Plus, the S&P 500 Index sells-off midday on reports of new coronavirus cases. Host Michael Palmer pic.twitter.com/p6Tt5nJxde— Cboe (@CBOE) February 20, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 2% in negative at 11838

- AD was 5:13

- VIX jumped 26%

- highest OI was at 12000 PE now it has shifted to 12000 CE

- next support 11600

- resistance at 12200... significant top?

- note trend is down on intraday charts from Friday

- trend is down on daily charts

- today nifty closed 2% in negative at 11838

- AD was 5:13

- VIX jumped 26%

- highest OI was at 12000 PE now it has shifted to 12000 CE

- next support 11600

- resistance at 12200... significant top?

- note trend is down on intraday charts from Friday

What is your Uncle Point?

The uncle point is a place where a trader has had enough pain or draw-down and decides that the trade is no longer working and throws in the towel. ... The uncle point is usually the point where you know something is truly going wrong with your system and you take action and get out.

February 21, 2020

Impact of coronavirus on supply chains (and busness)

The biggest factor that's not understood is the non linearity of supply chains. A 2 week total shut down *does not* mean a two week delay in products to consumer. This is very different from the tariff impacts, where pricing was adjusted.— Dan McMurtrie (@SuperMugatu) February 20, 2020

Full thread at https://twitter.com/SuperMugatu/status/1230562561201819650

February 20, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.4% in negative at 12080

- AD was flat

- option writing support 12000 resistance 12200

- trend is down on daily charts

- today nifty closed 0.4% in negative at 12080

- AD was flat

- option writing support 12000 resistance 12200

This is the best description of what Aadhaar is

This is the best description of #Aadhaar I have ever heard -— V. Anand | வெ. ஆனந்த் (@iam_anandv) February 20, 2020

This number belongs to this fingerprint [with a probability threshold]. https://t.co/5epyhr6e5N

BTW.. it is not a proof of citizenship... the UIDAI website makes this abundantly clear. In fact, foreigners can also apply if they are resident in India for more than 6 months.

February 19, 2020

How can one submit false biometrics?

Sometimes it becomes necessary to cancel the Aadhaar number when it is found that a resident has obtained it by submitting false biometrics or documents. It is a routine quality improvement process that UIDAI takes up regularly. 11/n— Aadhaar (@UIDAI) February 19, 2020

This is the best garbage UIDAi can come up with.... this also means it is possible to cancel one's Aadhar number.

Note that there is no provision for cancelling a deceased person's Aadhar number.

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 1.1% in positive at 12130

- AD was 2:1

- timepass around 12000 continues

- it has been more than 3 months with nifty sometimes closing above 12000 and sometimes below

- the markets have clearly been directionless though trading in a big range

- trend is down on daily charts

- today nifty closed 1.1% in positive at 12130

- AD was 2:1

- timepass around 12000 continues

- it has been more than 3 months with nifty sometimes closing above 12000 and sometimes below

- the markets have clearly been directionless though trading in a big range

February 18, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.4% in negative at 12992

- AD was 1:2

- hammer pattern formed

- bullish implications if nifty opens above 12030 spot tomorrow

- trend is down on daily charts

- today nifty closed 0.4% in negative at 12992

- AD was 1:2

- hammer pattern formed

- bullish implications if nifty opens above 12030 spot tomorrow

February 17, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.6% in negative at 12045

- AD was 1:2

- VIX jumped 7%

- stocks at 52 week low thrice that of stocks at 52 week highs

- will 12000 hold?

- this level has been broken and reversed several times in the past

- trend is down on daily charts

- today nifty closed 0.6% in negative at 12045

- AD was 1:2

- VIX jumped 7%

- stocks at 52 week low thrice that of stocks at 52 week highs

- will 12000 hold?

- this level has been broken and reversed several times in the past

February 15, 2020

Calling the top

The drumbeat of U.S. equity perma-bears has been a constant in my 45 years as a trader— Peter Brandt (@PeterLBrandt) February 14, 2020

Those that bet against U.S. capitalism keep losing their money, their reputation, or both

It guess it must be a thrill to proclaim a top at every new ATH. Someday they will be right. Maybe! pic.twitter.com/RISjeC0jIa

February 14, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.5% in negative at 12113

- AD was 1:2 (not bad)

- nifty is having difficult sustaining above 12200

- third attempt failed

- trend is down on daily charts

- today nifty closed 0.5% in negative at 12113

- AD was 1:2 (not bad)

- nifty is having difficult sustaining above 12200

- third attempt failed

Only 2,200 professionals declared income above Rs 1 crore in FY19, says CBDT

Out of these,1.03 crore individuals have shown income below Rs 2.5 lakh & 3.29 crore individuals disclosed taxable income between Rs.2.5 lakh to Rs.5 lakh.— Income Tax India (@IncomeTaxIndia) February 13, 2020

Out of 5.78 crore returns filed during this financial year,4.32 crore individuals have disclosed income upto Rs 5 lakh..2/6

Hence, only around 1.46 crore individual tax payers are liable to pay income-tax.— Income Tax India (@IncomeTaxIndia) February 13, 2020

Further, around 1 crore individuals disclosed income between Rs. 5-10 lakh and only 46 lakh individual tax payers have disclosed income above Rs.10 lakh...4/6

In the ITRs filed by individuals in current financial year,only about 2200 Doctors,Chartered Accountants, Lawyers &such other professionals have disclosed annual income of more than Rs.1crore from their profession(excluding other incomes like rental,interest,capital gains etc)6/6— Income Tax India (@IncomeTaxIndia) February 13, 2020

February 13, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today markets closed 0.2% n negative at 12175

- AD was flat

- past few days, no of stocks at 52 week lows is exceeding stocks at 52 week highs

- option writers see good support around 12000 this series

- trend is down on daily charts

- today markets closed 0.2% n negative at 12175

- AD was flat

- past few days, no of stocks at 52 week lows is exceeding stocks at 52 week highs

- option writers see good support around 12000 this series

Real importance of charts

I have made my living since 1975 trading futures markets using charts— Peter Brandt (@PeterLBrandt) February 12, 2020

My conclusion on chart trading:

1. Charts do NOT predict prices

2. Most chart patterns fail

3. Charts simply tell us where a market

has been

4. The only value in charts is for trade/risk management

February 12, 2020

February 11, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.6% in positive at 12108

- incidentally there was a gap up opening, a short rally and a close near open

- AD was 4:5

- option writing support 12000

- we now also have strong resistance around 12200

- this defines the trading range for next few days

- monthly option series indicates range from 12000 to 12500

- incidentally 12100 is roughly the 61.8% retracement to the prev correction

- and the 61.8% retracement of this 4 day rally is 11800

- trend is down on daily charts

- today nifty closed 0.6% in positive at 12108

- incidentally there was a gap up opening, a short rally and a close near open

- AD was 4:5

- option writing support 12000

- we now also have strong resistance around 12200

- this defines the trading range for next few days

- monthly option series indicates range from 12000 to 12500

- incidentally 12100 is roughly the 61.8% retracement to the prev correction

- and the 61.8% retracement of this 4 day rally is 11800

So easy to fool the human mind

The beliefs you carry, many of them unconscious, shape the judgments you make & stop you from seeing reality.— EAGLE EYE (@BrainandMoney) February 10, 2020

This image is a perfect example. Your familiarity with a chess board & shadows, fools your brain into thinking Squares A & B are different shades of grey. pic.twitter.com/shkAQnp5dY

February 10, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.6% in negative at 12031.5

- AD was 7:11

- index is holding 12000

- weekly expiry indicated limited upside while

- monthly options indicate strong support around 12000

- trend is down on daily charts

- today nifty closed 0.6% in negative at 12031.5

- AD was 7:11

- index is holding 12000

- weekly expiry indicated limited upside while

- monthly options indicate strong support around 12000

Powerful concepts of understanding the world by @G_S_Bhogal

Causal Reductionism: Things rarely happen for just 1 reason. Usually, outcomes result from many causes conspiring together. But our minds cannot process such a complex arrangement, so we tend to ascribe outcomes to single causes, reducing the web of causality to a mere thread.

Emergence: When many simple objects interact with each other, they can form a system that has qualities that the objects themselves don’t. Examples: neurons creating consciousness, traders creating the stock-market, simple mathematical rules creating “living” patterns.

Cultural Parasitism: An ideology parasitizes the mind, changing the host’s behavior so they spread it to other people. Therefore, a successful ideology (the only kind we hear about) is not configured to be true; it is configured only to be easily transmitted and easily believed.

Cumulative Error: Mistakes grow. Beliefs are built on beliefs, so one wrong thought can snowball into a delusional worldview. Likewise, as an inaccuracy is reposted on the web, more is added to it, creating fake news. In our networked age, cumulative errors are the norm.

Simpson’s Paradox: A trend can appear in groups of data but disappear when these groups are combined. This effect can easily be exploited by limiting a dataset so that it shows exactly what one wants it to show. Thus: beware of even the strongest correlations.

Woozle Effect: An article makes a claim without evidence, is then cited by another, which is cited by another, and so on, until the range of citations creates the impression that the claim has evidence, when really all articles are citing the same uncorroborated source.

Emergence: When many simple objects interact with each other, they can form a system that has qualities that the objects themselves don’t. Examples: neurons creating consciousness, traders creating the stock-market, simple mathematical rules creating “living” patterns.

Cultural Parasitism: An ideology parasitizes the mind, changing the host’s behavior so they spread it to other people. Therefore, a successful ideology (the only kind we hear about) is not configured to be true; it is configured only to be easily transmitted and easily believed.

Cumulative Error: Mistakes grow. Beliefs are built on beliefs, so one wrong thought can snowball into a delusional worldview. Likewise, as an inaccuracy is reposted on the web, more is added to it, creating fake news. In our networked age, cumulative errors are the norm.

Survivorship Bias: We overemphasize the examples that pass a visibility threshold e.g. our understanding of serial killers is based on the ones who got caught. Equally, news is only news if it’s an exception rather than the rule, but since it’s what we see we treat it as the rule

Simpson’s Paradox: A trend can appear in groups of data but disappear when these groups are combined. This effect can easily be exploited by limiting a dataset so that it shows exactly what one wants it to show. Thus: beware of even the strongest correlations.

Focusing Illusion: Nothing is ever as important as what you’re thinking about while you’re thinking about it. E.g. worrying about a thing makes the thing being worried about seem worse than it is. As Marcus Aurelius observed, “We suffer more often in imagination that in reality.”

Belief Bias: Arguments we'd normally reject for being idiotic suddenly seem perfectly logical if they lead to conclusions we approve of. In other words, we judge an argument’s strength not by how strongly it supports the conclusion but by how strongly *we* support the conclusion.

Woozle Effect: An article makes a claim without evidence, is then cited by another, which is cited by another, and so on, until the range of citations creates the impression that the claim has evidence, when really all articles are citing the same uncorroborated source.

Tocqueville Paradox: As the living standards in a society rise, the people’s expectations of the society rise with it. The rise in expectations eventually surpasses the rise in living standards, inevitably resulting in disaffection (and sometimes populist uprisings).

Read more at https://twitter.com/G_S_Bhogal/status/1225561131122597896

Read more at https://twitter.com/G_S_Bhogal/status/1225561131122597896

February 9, 2020

In pictures: A historical perspective on the Great Depression, the market rally and the crash of 1929...must read for all investors

When we look at events in the past, we assume whatever happened was inevitable and we get surprised how others could not see the obvious. But if you see the notes and articles written at "that" time, one can imagine the joy and sorrows, the frustrations alternating with boundless optimism.

Here is a nice write up with screenshots of newspapers from the US showing the historical perspective from the 1920s to the rally of the lifetime followed by the crash in 1929.

Always remember

All above explained with newspaper screenshots and captions

Read more at https://www.collaborativefund.com/blog/history-is-only-interesting-because-nothing-is-inevitable/

Here is a nice write up with screenshots of newspapers from the US showing the historical perspective from the 1920s to the rally of the lifetime followed by the crash in 1929.

Always remember

Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria

All above explained with newspaper screenshots and captions

Read more at https://www.collaborativefund.com/blog/history-is-only-interesting-because-nothing-is-inevitable/

Magnified close AFL

Edit: this code was first posted in 03/2015 and is now modified to change color depending on whether the bar close is in positive or negative.

Green vertical line is currently selected bar.

Modified code is highlighted.

Close in positive:

Close in negative:

Code is pretty simple - use low level graphics functions. The AFL is:

Green vertical line is currently selected bar.

Modified code is highlighted.

Close in positive:

Close in negative:

Code is pretty simple - use low level graphics functions. The AFL is:

February 7, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.3% in negative at 12098

- AD was flat

- important swing low formed around 11600

- trend is down on daily charts

- today nifty closed 0.3% in negative at 12098

- AD was flat

- important swing low formed around 11600

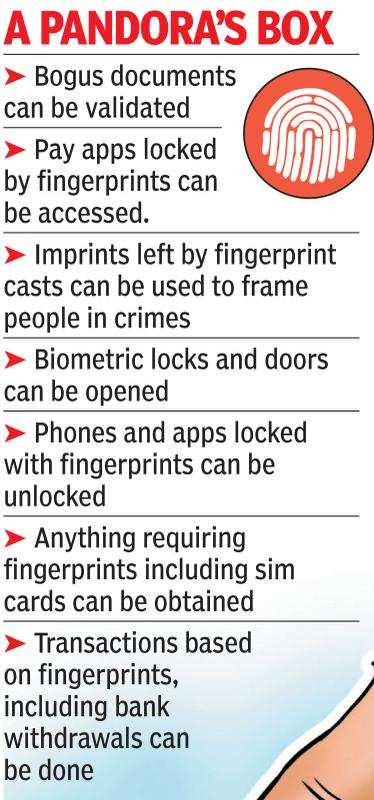

Biometrics are easily hackable and there is nothing you can do about it

Ration racket: 1,100 fingerprint casts found

Your fingerprint is the worst password and you leave traces of it everywhere. Worse, you cannot change it but this is something which are babus failed to realise when they implemented Aadhar

Read more at https://timesofindia.indiatimes.com/city/ahmedabad/ration-racket-1100-fingerprint-casts-found/articleshow/73969626.cms

February 6, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.4% in positive at 12134

- AD was 5:4

- option open interest suggests limited upside

- put writing support is at 12000 and increasing to 12100

- call writing resistance is at 12200

- above is weekly expiry series

- on monthly expiry bias will bullish with

- support at 12000 and resistance at 12500

- trend is down on daily charts

- today nifty closed 0.4% in positive at 12134

- AD was 5:4

- option open interest suggests limited upside

- put writing support is at 12000 and increasing to 12100

- call writing resistance is at 12200

- above is weekly expiry series

- on monthly expiry bias will bullish with

- support at 12000 and resistance at 12500

February 5, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.9% in positive at 12090

- AD was 5:4

- with today's move, all budget day losses are recovered

- note current all has been from 12400 to 11600

- 50% of this is around 12000 and this level is crossed today

- if you are following 50% retracement, then you should be stopped out

- I will wait for 12200 as SL

- in above case, note this is for analysis only

- all positional F&O trades should ideally be on 15 or 30 min charts

- in this lower timeframe, trend is up from yesterday

- trend is down on daily charts

- today nifty closed 0.9% in positive at 12090

- AD was 5:4

- with today's move, all budget day losses are recovered

- note current all has been from 12400 to 11600

- 50% of this is around 12000 and this level is crossed today

- if you are following 50% retracement, then you should be stopped out

- I will wait for 12200 as SL

- in above case, note this is for analysis only

- all positional F&O trades should ideally be on 15 or 30 min charts

- in this lower timeframe, trend is up from yesterday

February 4, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 2.2% in positive at 11980

- AD was 12:5

- VIX dropped 9%

- very high additions seen in 11800 and 11900 PE

- budget day fall erased completely

- now resistance around 12000-12100 zone

- the latter is 61.8% retracementt of current fall

- on lower degree timeframe, trend has already turned up

- this 11000-12000 zone has become a treacherous trading zone

- more than a year has been spent here with false signals occurring

- this is normal when markets are directionless/ rangebound

- trend is down on daily charts

- today nifty closed 2.2% in positive at 11980

- AD was 12:5

- VIX dropped 9%

- very high additions seen in 11800 and 11900 PE

- budget day fall erased completely

- now resistance around 12000-12100 zone

- the latter is 61.8% retracementt of current fall

- on lower degree timeframe, trend has already turned up

- this 11000-12000 zone has become a treacherous trading zone

- more than a year has been spent here with false signals occurring

- this is normal when markets are directionless/ rangebound

February 3, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.5% in positive at 11724

- AD was 7:11

- immediate resistance 11800

- next support 11200

- trend is down on daily charts

- today nifty closed 0.5% in positive at 11724

- AD was 7:11

- immediate resistance 11800

- next support 11200

February 2, 2020

What happens after BNF falls 25 in a day?

What happens after BNF falls > 2% in a day ? what happens after a WR ( Wide Range) day ? what happens when there is a distribution before the fall ?— Subhadip Nandy (@SubhadipNandy) January 6, 2020

Here is the history. Make you plan, plan your trade pic.twitter.com/oqeyAuCpIG

February 1, 2020

Market outlook

Daily charts:

- trend is down on daily charts (wef today)

- today nifty closed 2.5% in negative at 11662

- AD was 2:7

Expecting lot of comments why I did not warn earlier

- note trend was down on hourly charts from 12224 (https://www.vfmdirect.in/2020/01/market-outlook_20.html)

- above post also mentioned of huge bearish engulfing bar

- weekly charts show rising wedge/ nifty at stiff resistance

- yesterday made a 3rd part post about possible 10% correction

- PE ratio above 28 has been a problem for a long time

- indicated close below 12000 will be a problem/ trend reversal

Looking forward

- retest of 11800 and maybe 12000 possible

- but this damage to structure, volatility will be there for some time

- this is because new people will like to short and people who could not exit earlier will attempt to exit on any bounce

- next support 11200

Intraday chart for reference only

On a different note: this is what FM said on the market crash

- trend is down on daily charts (wef today)

- today nifty closed 2.5% in negative at 11662

- AD was 2:7

Expecting lot of comments why I did not warn earlier

- note trend was down on hourly charts from 12224 (https://www.vfmdirect.in/2020/01/market-outlook_20.html)

- above post also mentioned of huge bearish engulfing bar

- weekly charts show rising wedge/ nifty at stiff resistance

- yesterday made a 3rd part post about possible 10% correction

- PE ratio above 28 has been a problem for a long time

- indicated close below 12000 will be a problem/ trend reversal

Looking forward

- retest of 11800 and maybe 12000 possible

- but this damage to structure, volatility will be there for some time

- this is because new people will like to short and people who could not exit earlier will attempt to exit on any bounce

- next support 11200

Intraday chart for reference only

On a different note: this is what FM said on the market crash

Curse of the big bull

Curse of the big bull... I remember when it was first installed, it was actually considered some panvati by the local brokers— KPL (@vfmdirect) January 31, 2020

Similarity between S&P500 and NIFTY charts

- both had a breakout in SEP 2019

- this was followed by a retest of support in OCT

- and then a breakout

- the S&P 500 has since then blasted, nifty struggled upwards

- and then in JAN 2020, both indices traded in a range

- and yesterday, both closed near JAN lows (first week)

Charts:

- this was followed by a retest of support in OCT

- and then a breakout

- the S&P 500 has since then blasted, nifty struggled upwards

- and then in JAN 2020, both indices traded in a range

- and yesterday, both closed near JAN lows (first week)

Charts:

Subscribe to:

Posts (Atom)