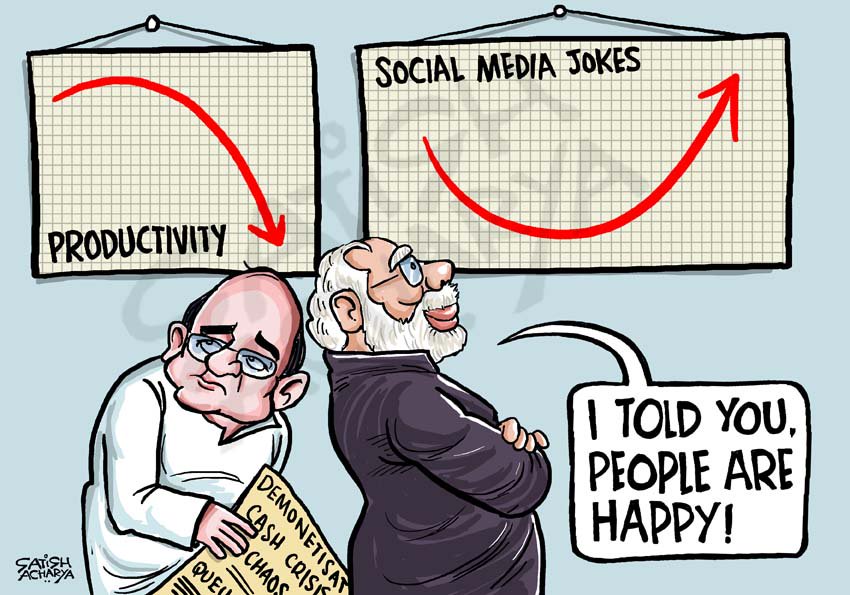

ON DAY 21, surging deposits of over Rs 9 lakh crore in banks — more than 60 per cent of the total value of 500 and 1,000 rupee notes in circulation — have stirred a debate in the government about the stated objective of the demonetisation scheme, which is to break the grip of corruption and black money. Bankers and analysts estimate almost 90-95 per cent of the money will return to the system, with more than a month to go for the deadline to deposit the scrapped notes.

The Income-Tax department, meanwhile, is grappling with a possible situation of people depositing significant amounts of undisclosed money and taking it out soon after the restrictions on withdrawal are lifted on December 30.

Indeed, the government and the BJP’s narrative over the last one week has taken a subtle turn from the original buoyant estimates of reaping a Rs 3 lakh crore windfall — the quantum of black money that will not return to the system — which can be used to invest in public infrastructure.

Read more at http://indianexpress.com/article/business/banking-and-finance/demonetisation-month-to-go-bankers-say-90-95-per-cent-money-will-return-to-system-4402467/

The Income-Tax department, meanwhile, is grappling with a possible situation of people depositing significant amounts of undisclosed money and taking it out soon after the restrictions on withdrawal are lifted on December 30.

Indeed, the government and the BJP’s narrative over the last one week has taken a subtle turn from the original buoyant estimates of reaping a Rs 3 lakh crore windfall — the quantum of black money that will not return to the system — which can be used to invest in public infrastructure.

Read more at http://indianexpress.com/article/business/banking-and-finance/demonetisation-month-to-go-bankers-say-90-95-per-cent-money-will-return-to-system-4402467/