October 31, 2020

NIFTY monthly charts

NIFTY weekly charts

October 30, 2020

NIFTY EOD charts

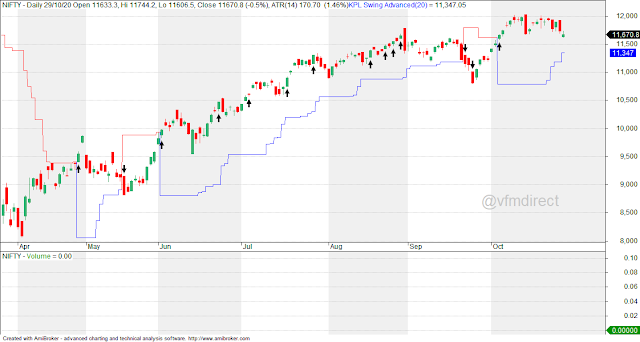

October 29, 2020

NIFTY 15 min charts

NIFTY EOD charts

Stupid "formatting error" leads to 10% intraday swing in BHARTIARTL

Read more at https://twitter.com/rajivmehta19/status/1321492982575427584They copy paste lines from excel to pdf and by mistake the row width was reduced leading to only the middle line being visible so it LOOKED like limit is up to 100%.

— Rajiv Mehta (@rajivmehta19) October 28, 2020

The three lines were:

‘Automatic Route upto 49%; Government Route beyond 49%.

October 28, 2020

NIFTY EOD charts

October 27, 2020

NIFTY EOD charts

October 26, 2020

NIFTY EOD charts

October 23, 2020

NIFTY EOD charts

October 22, 2020

NIFTY EOD charts

October 21, 2020

NIFTY EOD charts

October 20, 2020

NIFTY EOD charts

October 19, 2020

NIFTY EOD charts

October 18, 2020

5 Key Rules For Heikin Ashi Trade

Rule Number 1 – Green candles with no lower “shadows” indicate a strong uptrend: When you spot these on charts, be in the trade and don’t think about profit booking. You might want to add to your long position and exit short positions.

How crucial is risk management in protecting the capital and for healthy return as well : A case study

hw crucial is risk management in protecting the capital and for healthy return as well : A case study@PAVLeader @sanstocktrader @RajarshitaS

— Aneesh Philomina Antony (@ProdigalTrader) July 31, 2019

courtesy : https://t.co/Jx7mbp2Y3p pic.twitter.com/SmakhUAQF7

October 17, 2020

Video: Trading in the BSE in the good old days

BSE : Old ring before the present jeejibhoi tower ring pic.twitter.com/BTa1LqPijO

— Rajiv Mehta (@rajivmehta19) October 16, 2020

October 16, 2020

The decline of the US...remember the decline of the British "Empire"?

Excited to share a new piece in FP!

— Rush Doshi (@RushDoshi) October 12, 2020

I argue ODNI's claim that China prefers Trump "not win reelection" tells only half the story.

Party texts show China believes Trump is accelerating US decline.

This has triggered a new phase in PRC grand strategy.

1/https://t.co/qTdFBKclYW

NIFTY EOD charts

October 15, 2020

NIFTY EOD charts

October 14, 2020

NIFTY intraday charts

NIFTY EOD charts

October 13, 2020

October 12, 2020

NIFTY EOD charts

Harvard: Why beating the stock markets (or index funds) is incredibly difficult

• Performance persistence is rare: Harvard’s endowment hasn’t always lagged the market. In fact, it produced a remarkable string of successes in the late 1990s and early aughts. Cumulatively over the 15 years through mid-2008, for example, it beat the S&P 500 by more than five annualized percentage points, better than almost every actively managed mutual fund and Wall Street institutional investor. While the odds of producing that 15-year market-beating return were very low, they were even lower that the endowment’s managers would be able to repeat that success. Rather than reacting smugly, we should take to heart that even the best and the brightest are unable to consistently beat the market.

• Overconfidence is an obstacle: One of the reasons that performance persistence is rare is that success breeds overconfidence. I have no inside knowledge about the managers running the Harvard endowment, but it would be difficult not to let a 15-year annualized alpha of over five percentages points go to their heads.

Markets care a damn about your qualification, title or CV

First day on my job my PM told me "at our firm we eat what we kill... no one cares about your title or CV. If you don't make your target

Fast-forward 6-months - still in the business (after remarkable trading and decent p&l through lehman aftermath)... Went on a business trip with my PM to meet our counterparties at the banks

most of the traders/VPs/head-of are no longer trading for these banks (some are even out of the market completely)... very few (very bright people) buy-side still in the game..

That throws me back to boxing... I often see guys coming to the gym with high

These expensive gloves and super light shoes don't make

My point? the market couldn't care less about our titles and resume.. if one wants to survive he/she needs good fundamental and to constantly grow and evolve

October 11, 2020

Charts do not predict prices

Charts do NOT predict prices. No form of TA predicts prices.

— Peter Brandt (@PeterLBrandt) October 10, 2020

Charts suggest the path of least resistance

Charts provide a means to determine the risk of a trade

Charts offer help in timing

Charts offer POSSIBILITIES, not probabilities and certainly not certainties

October 10, 2020

Sheer randomness or luck?

What about the other children who studied in the same school/ similar school in same/ similar village?

— KPL (@vfmdirect) October 10, 2020

Any info how they are doing?

Or does randomness have a huge role tp play.

October 9, 2020

NIFTY EOD Charts

October 8, 2020

Historic move

Nifty fell from 11800 to 10800 in September, all the bears came with usual arguments, "Corona, Lockdown, High PE, Bad Economy, GDP, etc, etc"

— P R Sundar (@PRSundar64) October 8, 2020

But last 9 trading sessions, 1100 points higher is Historic, never happened in India markets before. (Exception: 2009 event based gap up)