March 31, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 4% in positive at 8598

- AD was 13:5

- VIX down 10% now at 64

- resistance 9000

- above this, shorts may become nervous

- 14 day ATR is 500+

- trend is down on daily charts

- today nifty closed 4% in positive at 8598

- AD was 13:5

- VIX down 10% now at 64

- resistance 9000

- above this, shorts may become nervous

- 14 day ATR is 500+

Major bear move has started?

Hourly charts again with today's data. #Nifty_fut— Subhadip Nandy (@SubhadipNandy) March 30, 2020

Major bear move has started. The yellow highlight at the bottom signifies a major move about to take place#quantitative #proprietary pic.twitter.com/35PkbC3o1X

March 30, 2020

NIFTY fell 380 points overnight... yet positional put option buyers hardly made money

- despite a 380 point fall in the nifty, put prices did not appreciate

- was this because of theta? there was no change in VIX

- note I am writing about weekly expiry options

- someone who bought 8700 PE on Friday close has earned 77 points after a 380 point fall

- and a 8300 PE has actually lost money

- let us see what happens tomorrow

Summary: do not trade options unless you know the greeks

Newbies: visit http://zerodha.com/varsity/module/option-theory/

- was this because of theta? there was no change in VIX

- note I am writing about weekly expiry options

- someone who bought 8700 PE on Friday close has earned 77 points after a 380 point fall

- and a 8300 PE has actually lost money

- let us see what happens tomorrow

Summary: do not trade options unless you know the greeks

Newbies: visit http://zerodha.com/varsity/module/option-theory/

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 45 in negative at 8281

- AD was 7:11

- 3 days pattern of higher high higher low got disrupted today

- there was a warning on Friday anyway

- nice swing high formed around 9000

- support 7500

- trend is down on daily charts

- today nifty closed 45 in negative at 8281

- AD was 7:11

- 3 days pattern of higher high higher low got disrupted today

- there was a warning on Friday anyway

- nice swing high formed around 9000

- support 7500

March 29, 2020

Bob Farrell's 10 Rules

Bob Farrell is a Wall Street veteran who draws on some 50 years of experience in crafting his investing rules. After finishing a masters program at Columbia Business School, he launched his career as a technical analyst with Merrill Lynch in 1957. Even though Mr. Farrell studied fundamental analysis, he turned to technical analysis after realizing there was more to stock prices than balance sheets and income statements. He became a pioneer in sentiment studies and market psychology. His 10 rules on investing stem from personal decades of experience with dull markets, bull markets, bear markets, crashes, and bubbles. In short, Bob Farrell has seen it all and lived to tell about it.

Like all rules on Wall Street, Bob Farrell's 10 rules are not intended to be considered hard and fast or set in stone. There are exceptions to every rule. Nevertheless, these rules will benefit you as a trader or as an investor by helping you to look beyond the latest news headlines or your gut emotions. Being aware of sentiment can prevent traders from selling near the bottom and buying near the top, which often goes against our natural instincts. Human nature causes individual investors and traders to often feel most confident at the top of a market. At the same time, they often feel most pessimistic or cautious at market bottoms. Awareness of these emotions and their potential consequences is the first step towards conquering their adverse effects.

Read more at https://school.stockcharts.com/doku.php?id=overview:bob_farrell_10_rules

Like all rules on Wall Street, Bob Farrell's 10 rules are not intended to be considered hard and fast or set in stone. There are exceptions to every rule. Nevertheless, these rules will benefit you as a trader or as an investor by helping you to look beyond the latest news headlines or your gut emotions. Being aware of sentiment can prevent traders from selling near the bottom and buying near the top, which often goes against our natural instincts. Human nature causes individual investors and traders to often feel most confident at the top of a market. At the same time, they often feel most pessimistic or cautious at market bottoms. Awareness of these emotions and their potential consequences is the first step towards conquering their adverse effects.

Read more at https://school.stockcharts.com/doku.php?id=overview:bob_farrell_10_rules

March 28, 2020

Hypothetical question

If you see a 200-foot high tsunami heading toward you on the beach, would you conclude that it is a hoax because you are still dry?

Discuss. By Scott Adams

Discuss. By Scott Adams

If you are alive 60 days from now, you will regret losing the equity opportunity of March 2020, says Basant Maheshwari

“The game right now is to wait for clarity, but as we have seen in the past, if you are waiting for clarity, then you will have to pay the price of clarity. People who stayed in cash in 2008 didn’t buy till the Sensex had doubled itself in 2009,” he said.

That bull run saw the emergence of multibaggers like Page Industries and Pantaloon, which surged up to 40 times in the next few years.

“In 60 days from now if we are alive, then we will regret the opportunity of March 2020. If ..

Read more at:

https://economictimes.indiatimes.com/markets/stocks/news/if-you-are-alive-60-days-from-now-we-will-regret-losing-the-equity-opportunity-of-march-2020-says-basant-maheshwari/articleshow/74824500.cms

That bull run saw the emergence of multibaggers like Page Industries and Pantaloon, which surged up to 40 times in the next few years.

“In 60 days from now if we are alive, then we will regret the opportunity of March 2020. If ..

Read more at:

https://economictimes.indiatimes.com/markets/stocks/news/if-you-are-alive-60-days-from-now-we-will-regret-losing-the-equity-opportunity-of-march-2020-says-basant-maheshwari/articleshow/74824500.cms

March 27, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed flat at 8660

- AD was 5:4

- this was 3rd consecutive day of higher high higher low

- nifty opened gap up but could not sustain at highs

- now we have various possibilities

- retest of recent lows and then breakout above 9000

- break of recent lows

- rangebound market

- trend is down on daily charts

- today nifty closed flat at 8660

- AD was 5:4

- this was 3rd consecutive day of higher high higher low

- nifty opened gap up but could not sustain at highs

- now we have various possibilities

- retest of recent lows and then breakout above 9000

- break of recent lows

- rangebound market

March 26, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 4% at 8641

- AD was 13:5

- VIX dropped 8% to 71

- I think we are seeing bear market rally or technical pullback

- this will not be a time to start investing (except SIP in mutual funds)

- resistance 10000

- trend is down on daily charts

- today nifty closed 4% at 8641

- AD was 13:5

- VIX dropped 8% to 71

- I think we are seeing bear market rally or technical pullback

- this will not be a time to start investing (except SIP in mutual funds)

- resistance 10000

March 25, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 7% in positive at 8318

- AD was 11:7

- VIX down 8%

- 14 day ATR is 535

- swing highs (very approx) is at 9000, 10000

- no technical pullback/ relief rally seen in this correction so far

- the first buy signal will fail.

- trend is down on daily charts

- today nifty closed 7% in positive at 8318

- AD was 11:7

- VIX down 8%

- 14 day ATR is 535

- swing highs (very approx) is at 9000, 10000

- no technical pullback/ relief rally seen in this correction so far

- the first buy signal will fail.

March 24, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 2.5% in positive at 7801

- AD was 4:5

- VIX jumps 14% to 82

- intraday high was 86

- evidence of bottoming out would be huge drop in VIX

- as of now this is not happening

- trend is down on daily charts

- today nifty closed 2.5% in positive at 7801

- AD was 4:5

- VIX jumps 14% to 82

- intraday high was 86

- evidence of bottoming out would be huge drop in VIX

- as of now this is not happening

March 23, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 13% in negative at 7610

- AD was 1:17

- nifty is month to date down by 32%

- this is clearly a record

- swing high dropped from 11500 to 10000 to 9000

- dotted lines are plotted

- ATR is 525 points or 7%

- anyone following ATR based SL has to keep min SL 1050 points

- trend is down on daily charts

- today nifty closed 13% in negative at 7610

- AD was 1:17

- nifty is month to date down by 32%

- this is clearly a record

- swing high dropped from 11500 to 10000 to 9000

- dotted lines are plotted

- ATR is 525 points or 7%

- anyone following ATR based SL has to keep min SL 1050 points

March 22, 2020

The Gambler by Kenny Rogers - must listen for all stock market traders

Kenny Roger, best known for his song "The Gambler" passed away recently... here is the song with lyrics and a must listen for stock market traders

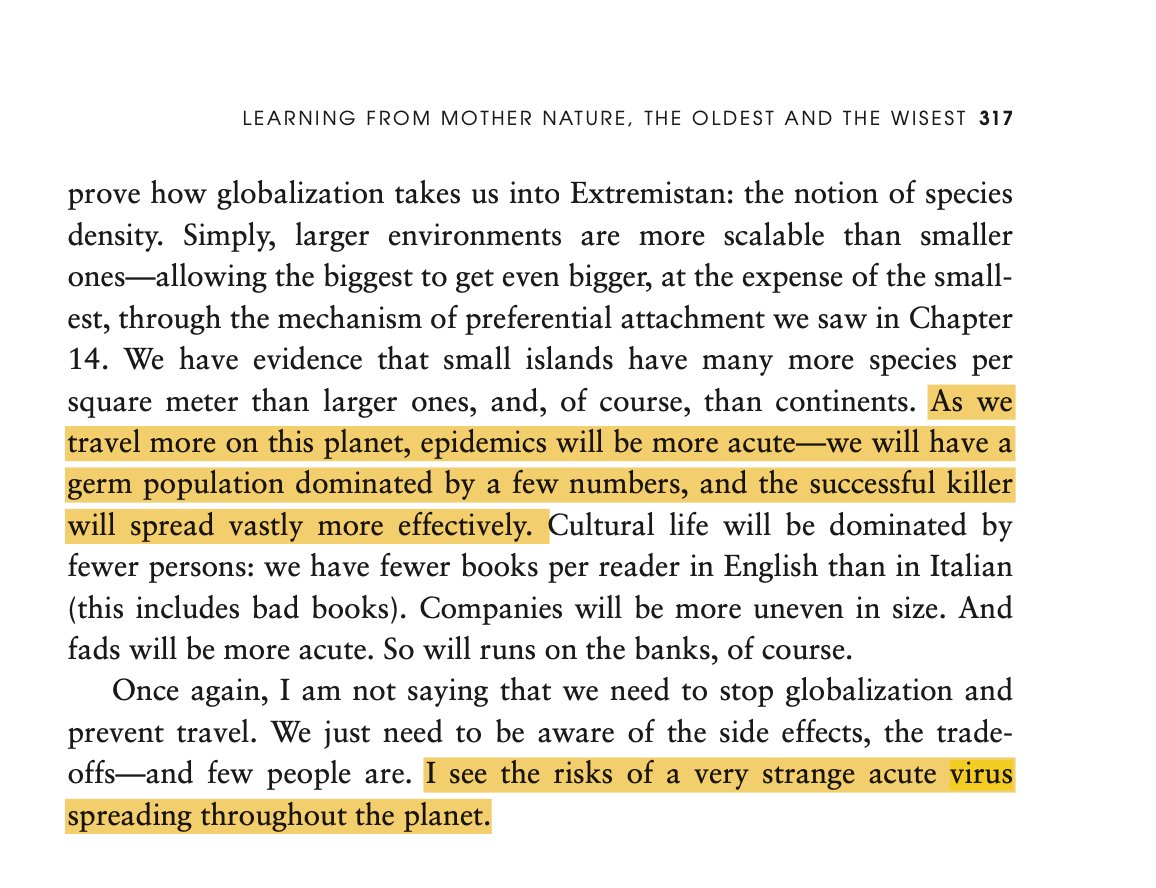

Why this ongoing crash is unique and unlike the 2008 crash

In the empirical sciences the so-called three-sigma rule of thumb expresses a conventional heuristic that nearly all values are taken to lie within three standard deviations of the mean, and thus it is empirically useful to treat 99.7% probability as near certainty.— Subhadip Nandy (@SubhadipNandy) March 21, 2020

March 21, 2020

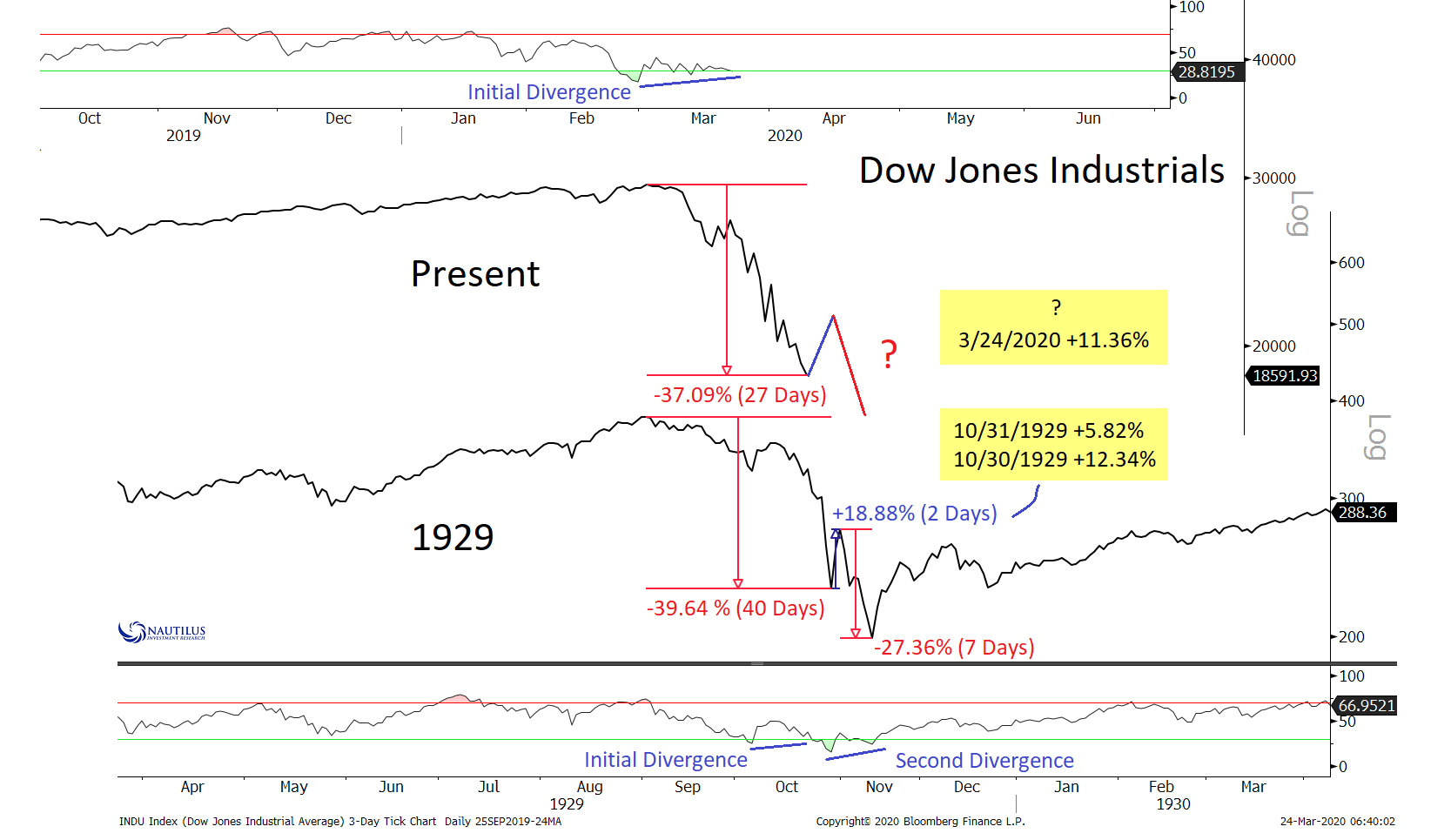

Every DOW drawdown greater than 30%

as I said the other day, Every bear market is unhappy in its own way -- and they recover in such a way as to make fools out of the maximum number of forecasters. https://t.co/M67HApqDeJ— Jason Zweig (@jasonzweigwsj) March 19, 2020

March 20, 2020

Market outllook

Daily charts:

- trend is down on daily charts

- today nifty closed 5.5% in positive at 8745

- AD was 2:1

- today was first day in 18-20 days where nifty closed above prev day high

- VIX dropped 7%

- too early to call a bottom

- some swing high needs to form for this and nifty should cross this

- nearest high is around 10000 level and this is a rough one

- trend is down on daily charts

- today nifty closed 5.5% in positive at 8745

- AD was 2:1

- today was first day in 18-20 days where nifty closed above prev day high

- VIX dropped 7%

- too early to call a bottom

- some swing high needs to form for this and nifty should cross this

- nearest high is around 10000 level and this is a rough one

Investor Bill Miller calls this market one of the best buying opportunities of his lifetime

- "I think this is an exceptional buying opportunity," Miller said on CNBC's "The Exchange" on Wednesday.

- As Miller was speaking, the stock market had halted trading, because the S&P 500 fell more than 7% triggering the level one "circuit breaker."

- "There have been four great buying opportunities in my adult lifetime. The first was in 1973 and '74, the second was in 1982, the third was in 1987 and the fourth was in 2008 and 2009. And this is the fifth one," Miller added.

Index ETFs fail to track indices as market makers stay away

As the Nifty crumbled by 7.61% on 16th March, Exchange Traded Funds (ETFs) tracking it failed to keep up. Nippon India ETF Nifty BEES, one of the largest and oldest ETFs tracking the Index fell by just 2.23%. SBI ETF Nifty 50, which has assets under management of ₹64,464 crore, and is India’s largest equity mutual fund scheme, closed up instead of down. It closed with a gain of 1.16%. The tracking failure was not just limited to the Nifty. SBI Sensex ETF was down 3.61% even as the Sensex itself fell by 7.96%. Intra-day moves in the ETFs tracking India’s benchmark indices were also wildly out of sync with the underlying indices. This may have hurt retail investors trying to take advantage of the market correction.

An ETF is a passive mutual fund. Its aim is to simply give the same returns as the index it is tracking such as

Read more at https://www.livemint.com/market/stock-market-news/index-etfs-fail-to-track-indices-as-market-makers-stay-away-11584382453748.html

An ETF is a passive mutual fund. Its aim is to simply give the same returns as the index it is tracking such as

Read more at https://www.livemint.com/market/stock-market-news/index-etfs-fail-to-track-indices-as-market-makers-stay-away-11584382453748.html

Bill Gates: Countries that shut down for coronavirus could bounce back in weeks

Microsoft co-founder Bill Gates on Wednesday urged people to remain calm in the face of the coronavirus pandemic.

In an Ask Me Anything session on the discussion forum Reddit, Gates was asked about how long “this” will last.

“If a country does a good job with testing and ‘shut down’ then within 6-10 weeks they should see very few cases and be able to open back up,” he responded.

Gates has been focused on health for many years as part of his work at the nonprofit Bill and Melinda Gates Foundation. The comments come days after Gates said he was leaving the boards of Microsoft, which he co-founded in 1975, and Berkshire Hathaway. He said he wanted to focus more on philanthropy.

On Reddit, Gates elaborated on what shutting down means.

“The current phase has a lot of the cases in rich countries. With the right actions including the testing and social distancing (which I call ‘shut down’) within 2-3 months the rich countries should have avoided high levels of infection,” Gates wrote. “I worry about all the economic damage but even worse will be how this will affect the developing countries who cannot do the social distancing the same way as rich countries and whose hospital capacity is much lower.”

Read more at https://www.cnbc.com/2020/03/18/bill-gates-places-that-close-for-coronavirus-could-open-in-6-10-weeks.html

In an Ask Me Anything session on the discussion forum Reddit, Gates was asked about how long “this” will last.

“If a country does a good job with testing and ‘shut down’ then within 6-10 weeks they should see very few cases and be able to open back up,” he responded.

Gates has been focused on health for many years as part of his work at the nonprofit Bill and Melinda Gates Foundation. The comments come days after Gates said he was leaving the boards of Microsoft, which he co-founded in 1975, and Berkshire Hathaway. He said he wanted to focus more on philanthropy.

On Reddit, Gates elaborated on what shutting down means.

“The current phase has a lot of the cases in rich countries. With the right actions including the testing and social distancing (which I call ‘shut down’) within 2-3 months the rich countries should have avoided high levels of infection,” Gates wrote. “I worry about all the economic damage but even worse will be how this will affect the developing countries who cannot do the social distancing the same way as rich countries and whose hospital capacity is much lower.”

Read more at https://www.cnbc.com/2020/03/18/bill-gates-places-that-close-for-coronavirus-could-open-in-6-10-weeks.html

March 19, 2020

Biggest ECONOMIC DISLOCATON of Independent India?

2/n However, if the above doesn’t happen - here are some things to think about:— Haresh Chawla (@hchawlah) March 19, 2020

We are possibly facing the biggest ECONOMIC DISLOCATON of Independent India.

There is no playbook, no living memory of such an event.

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 2.4% in negative at 8263

- AD was 2:7

- markets opened gap down, tested 7800, then rallied to 8500 before closing at 8263

- ATR(14) at 460 (eod), 47 (3 min) and 130 (15 min) charts

- morning star formed

- confirmation will be a gap up tomorrow

- VIX is now at 72

- still no signs of coming down

- this means more downside still possible?

3 min charts:

- i did not trade today

- arrows shown for educational purposes only

- trend is down on daily charts

- today nifty closed 2.4% in negative at 8263

- AD was 2:7

- markets opened gap down, tested 7800, then rallied to 8500 before closing at 8263

- ATR(14) at 460 (eod), 47 (3 min) and 130 (15 min) charts

- morning star formed

- confirmation will be a gap up tomorrow

- VIX is now at 72

- still no signs of coming down

- this means more downside still possible?

3 min charts:

- i did not trade today

- arrows shown for educational purposes only

March 18, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 6% in negative at 8470

- AD was 1:5

- VIX at 65

- few days ago, nifty formed a huge with low at 8555 and high around 10000

- I said this range can persist for few weeks at least

- markets broke this level in just 3 days

- fall this month is 24.5%

- this is second highest fall in last 20 years

- highest fall was 26.5% in OCT 2008 (closing basis)

3 min charts:

- took a long trade in deep OTM puts

- difficult trade as the put hardly moved even after 100 points fall

- will stay away from options

- with IVs at 80% plus, very difficult to trade

- trend is down on daily charts

- today nifty closed 6% in negative at 8470

- AD was 1:5

- VIX at 65

- few days ago, nifty formed a huge with low at 8555 and high around 10000

- I said this range can persist for few weeks at least

- markets broke this level in just 3 days

- fall this month is 24.5%

- this is second highest fall in last 20 years

- highest fall was 26.5% in OCT 2008 (closing basis)

3 min charts:

- took a long trade in deep OTM puts

- difficult trade as the put hardly moved even after 100 points fall

- will stay away from options

- with IVs at 80% plus, very difficult to trade

March 17, 2020

NIFTY targets by @PeterLBrandt

I will again present a chart interpretation I have shown in the past to the rude and harsh criticism of traders in India who know better— Peter Brandt (@PeterLBrandt) March 13, 2020

Nifty #nifty50 has violated a parabolic advance

and completed a RABT

Target of 9000 met. Next target 6400, then 4,500 pic.twitter.com/4zlfEXExDy

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 2.5% in negative at 8967

- AD was 1:2

- VIX now at 62

- swing high 10000

- support 8000-6400

- trend is down on daily charts

- today nifty closed 2.5% in negative at 8967

- AD was 1:2

- VIX now at 62

- swing high 10000

- support 8000-6400

Correction history so far

#nifty— FUSION_CHARTS (@FUSION_Charts) March 16, 2020

correction history

interesting thing to see

this is not a new or unexpected thing in correction

imagine the 2008 fall -- 6300 to 2300 (64%) fall

what you r expecting this time ?? pic.twitter.com/pKojr2Av11

March 16, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty opened gap own and closed 8% in negative at 9197

- AD was 1:5

- new swing high formed around 10000

- VIX jumps 16% to 60

- this makes options extremely expensive

- ATR(14) at 410...

- I expect markets to trade within 8500 and 10000

- trend is down on daily charts

- today nifty opened gap own and closed 8% in negative at 9197

- AD was 1:5

- new swing high formed around 10000

- VIX jumps 16% to 60

- this makes options extremely expensive

- ATR(14) at 410...

- I expect markets to trade within 8500 and 10000

March 15, 2020

NIFTY weekly charts

- trend is down

- rising wedge pattern gave excellent warning

- unfortunately moves were too fast

- target 10000 done

- nifty formed biggest weekly bar in 8-10 years

- height was 2200 points

- break of 10000 saw lower circuit on Friday followed by fast rally

- looking forward, markets likely to trade within 10750 and 8500

- the correction is not over and new lows are possible

- rising wedge pattern gave excellent warning

- unfortunately moves were too fast

- target 10000 done

- nifty formed biggest weekly bar in 8-10 years

- height was 2200 points

- break of 10000 saw lower circuit on Friday followed by fast rally

- looking forward, markets likely to trade within 10750 and 8500

- the correction is not over and new lows are possible

Covid_19: Open letter from Italy to the international scientific community

As you surely know, Italy is suffering a dramatic spreading of the coronavirus.

In just 3 weeks from the beginning of the outbreak, the virus has reached more than 10.000 infected people.

From our data, about 10% of patients require ICU (Intensive Care Unit) or sub ICU assistance and about 5% of patients die.

We are now in the tragic situation that the most efficient health system of the richest area of the country (Lombardy) is almost at its full capacity and will soon be difficult to assist more people with Covid-19.

This is the reason why an almost complete lockdown of the country has been ordered: to slow down and hopefully stop the contagion as soon as possible.

The virus is spreading at maximum speed, doubling the number of infected people in just 2,4 days[1].

Read more at https://left.it/2020/03/13/covid_19-open-letter-from-italy-to-the-international-scientific-community/

In just 3 weeks from the beginning of the outbreak, the virus has reached more than 10.000 infected people.

From our data, about 10% of patients require ICU (Intensive Care Unit) or sub ICU assistance and about 5% of patients die.

We are now in the tragic situation that the most efficient health system of the richest area of the country (Lombardy) is almost at its full capacity and will soon be difficult to assist more people with Covid-19.

This is the reason why an almost complete lockdown of the country has been ordered: to slow down and hopefully stop the contagion as soon as possible.

The virus is spreading at maximum speed, doubling the number of infected people in just 2,4 days[1].

Read more at https://left.it/2020/03/13/covid_19-open-letter-from-italy-to-the-international-scientific-community/

March 13, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 4.5% in positive at 9952

- AD was 5:4

- today was a volatile day

- gap down opening at 9100, lower circuit at 8555 and then a fast rally

- this is probably the biggest trading ranges in a 10-15 years

- ATR has shot up to 380 points

- this will make a mockery of any SL.

- the only to trade is wait patiently for the volatility to come down

- in my experience this will take couple of weeks atleast

- VIX shot up 46% to a record high of 59

- high VIX makes options extremely expensive

- these levels are seen once in 8-10 years

- we exited 50% delivery calls on 20th JAN and last on 28th FEB

- highest loss was 10% in a stock and last exits were all in profits

- max portfolio drawdown was 0.4%

- nifty since then has cracked by 2000 points

- retails investors have lost heavily in past few months

- and most never had any risk management in place

- we are now waiting for markets to stabilise before initiating new delivery trades

- trend is down on daily charts

- today nifty closed 4.5% in positive at 9952

- AD was 5:4

- today was a volatile day

- gap down opening at 9100, lower circuit at 8555 and then a fast rally

- this is probably the biggest trading ranges in a 10-15 years

- ATR has shot up to 380 points

- this will make a mockery of any SL.

- the only to trade is wait patiently for the volatility to come down

- in my experience this will take couple of weeks atleast

- VIX shot up 46% to a record high of 59

- high VIX makes options extremely expensive

- these levels are seen once in 8-10 years

- we exited 50% delivery calls on 20th JAN and last on 28th FEB

- highest loss was 10% in a stock and last exits were all in profits

- max portfolio drawdown was 0.4%

- nifty since then has cracked by 2000 points

- retails investors have lost heavily in past few months

- and most never had any risk management in place

- we are now waiting for markets to stabilise before initiating new delivery trades

March 12, 2020

So how much money did I make in this correction?

NIFTY has corrected from 12400 to 9700 in a few weeks so how much did I make?

Mutual funds:

I invested around 10000 and exited all investments around 12200 and started SIP yesterday (nifty 10500)... I plan to do this for another 1-2 years.

Reason for exit was very simple... PE around 28+ and markets near upper end of rising wedge on weekly charts. I also had a target of 10000 on nifty (rising wedge).

This has been mentioned in my bog posts for many weeks/ months.

NIFTY options:

I profited very well till 11500 and then the volatility kicked me out of trades. Since then I am sitting on sidelines and not trading at all.

Before you jump in say - what's the use of a system if you cannot make money... here is my answer:

- I am mostly an intraday trader and rarely take positional trades

- my systems have been giving signals every now and then in every market and every timeframe

- I take positions depending on the risk in every trade and depending on the location of the signal

- but now the very risk management rules are forcing me to do nothing

- my strategies work well when volatility is low/ medium

- the whipsaws and losses can run very high if nifty swings 50-100 points in few minutes

- today VIX jumped 30% and is now at 40+

- my min SL in any option would be 50-80 points... cannot and will not trade in this environment

- earning money is no big deal... protecting what you have earned is more important

- above takes years to understand

- see anyone who has earned a lottery or got VRS...few years and the money is gone

- eg..many traders see whole europe, asia deep in red and they jump and trade 4-6X times their regular qtty.

- when these traders get stopped out, the losses exceed what they have earned in prev sessions

- in volatile markets, you should be trading 1/4 your regular qtty or not trading at all

- this volatility will eventually drop (mean reversion)

- and opportunities will come again

- I am happy with 30-40 points (or even lower)

Mutual funds:

I invested around 10000 and exited all investments around 12200 and started SIP yesterday (nifty 10500)... I plan to do this for another 1-2 years.

Reason for exit was very simple... PE around 28+ and markets near upper end of rising wedge on weekly charts. I also had a target of 10000 on nifty (rising wedge).

This has been mentioned in my bog posts for many weeks/ months.

NIFTY options:

I profited very well till 11500 and then the volatility kicked me out of trades. Since then I am sitting on sidelines and not trading at all.

Before you jump in say - what's the use of a system if you cannot make money... here is my answer:

- I am mostly an intraday trader and rarely take positional trades

- my systems have been giving signals every now and then in every market and every timeframe

- I take positions depending on the risk in every trade and depending on the location of the signal

- but now the very risk management rules are forcing me to do nothing

- my strategies work well when volatility is low/ medium

- the whipsaws and losses can run very high if nifty swings 50-100 points in few minutes

- today VIX jumped 30% and is now at 40+

- my min SL in any option would be 50-80 points... cannot and will not trade in this environment

- earning money is no big deal... protecting what you have earned is more important

- above takes years to understand

- see anyone who has earned a lottery or got VRS...few years and the money is gone

- eg..many traders see whole europe, asia deep in red and they jump and trade 4-6X times their regular qtty.

- when these traders get stopped out, the losses exceed what they have earned in prev sessions

- in volatile markets, you should be trading 1/4 your regular qtty or not trading at all

- this volatility will eventually drop (mean reversion)

- and opportunities will come again

- I am happy with 30-40 points (or even lower)

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 8.3% in negative at 10590

- AD was 1:7

- VIX up 30%... this is huge

- rising wedge target met/ exceeded

- above pattern has been discussed every week for past few months

- correction has been brutal

- nifty broke 3 levels 12000, 11000 and 10000 in 3 weeks

- next support 9000

- already people are talking of 6000

- nifty has corrected 22% from all time high

- good time for long investors to start SIP in index based mutual funds

- good names are ICICI, KOTAK, HDFC, SBIN

- deal with AMC / bypass broker and save on brokerage

- choose direct option, growth (not dividend)

- invest 5% of your capital per month for 20 months

- and forget about it

- trend is down on daily charts

- today nifty closed 8.3% in negative at 10590

- AD was 1:7

- VIX up 30%... this is huge

- rising wedge target met/ exceeded

- above pattern has been discussed every week for past few months

- correction has been brutal

- nifty broke 3 levels 12000, 11000 and 10000 in 3 weeks

- next support 9000

- already people are talking of 6000

- nifty has corrected 22% from all time high

- good time for long investors to start SIP in index based mutual funds

- good names are ICICI, KOTAK, HDFC, SBIN

- deal with AMC / bypass broker and save on brokerage

- choose direct option, growth (not dividend)

- invest 5% of your capital per month for 20 months

- and forget about it

March 11, 2020

NIFTY 9000 - 6000?

As part of a major congestion zone, the Nifty $Nifty #Nifty50 has violated a parabolic advance. If this congestion zone proves to be a top, the targets become 9,000, then 6,000, then lower. pic.twitter.com/H3iVZmumEn— Peter Brandt (@PeterLBrandt) March 9, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed flat at 10450

- AD was 1:2

- VIX up to another 52 week high

- monthly expiry shows support at 10000

- trend is down on daily charts

- today nifty closed flat at 10450

- AD was 1:2

- VIX up to another 52 week high

- monthly expiry shows support at 10000

March 10, 2020

March 9, 2020

NIFTY made a 52 week low today... so what?

- these are monthly charts

- in trending markets, 52 weeks lows are buying opportunities the once in a year types

- nifty made 52 week lows once in 2011 and 2016 and then recovered

- by this logic, markets present a good opportunity for long term investors/ SIP

- disclaimer:

- I have no data for prolonged bear markets

- 52 week lows can last for longish periods with new lows forming

- this can happen till markets bottom out

- I exited my funds around 12200.... I am reinvesting from current levels

- you can invest in ICICI, HDFC, KOTAK, SBI nifty index fund (direct, growth option)

- in trending markets, 52 weeks lows are buying opportunities the once in a year types

- nifty made 52 week lows once in 2011 and 2016 and then recovered

- by this logic, markets present a good opportunity for long term investors/ SIP

- disclaimer:

- I have no data for prolonged bear markets

- 52 week lows can last for longish periods with new lows forming

- this can happen till markets bottom out

- I exited my funds around 12200.... I am reinvesting from current levels

- you can invest in ICICI, HDFC, KOTAK, SBI nifty index fund (direct, growth option)

Market outlook and some gyan

- trend is down

- today nifty closed 5% in negative at 10451

- AD was 1:5

- VIX up 21% at 31

- nifty closes at 52 week low ... first time since 2016

- immediate support 10000

- will this break as easily as 11000 did?

- many traders are cursing themselves for missed the short of a lifetime

- or regretting an early exit

- this is normal as it is not easy to catch every move

- on the other hand, the "fear of missing out" can cause massive losses

- loss protection is more important than profit maximization (takes years to understand)

- so let volatility come down to acceptable levels

- I am out of the market as the stops are way too deep

- there will be ample trading opportunities

- don't wait for the trade of the decade.

- it can lead to loss of the decade with profit just remaining on paper

- today nifty closed 5% in negative at 10451

- AD was 1:5

- VIX up 21% at 31

- nifty closes at 52 week low ... first time since 2016

- immediate support 10000

- will this break as easily as 11000 did?

- many traders are cursing themselves for missed the short of a lifetime

- or regretting an early exit

- this is normal as it is not easy to catch every move

- on the other hand, the "fear of missing out" can cause massive losses

- loss protection is more important than profit maximization (takes years to understand)

- so let volatility come down to acceptable levels

- I am out of the market as the stops are way too deep

- there will be ample trading opportunities

- don't wait for the trade of the decade.

- it can lead to loss of the decade with profit just remaining on paper

CRUDE down 30% this year but no benefit to Indian end customers

Will indian govt. Slash petrol/diesel prices by 30% with CRUDEOIL move??— Pathik (@Pathik_Trader) March 9, 2020

Or we have to just work hard to add value in govt. Pocket??

Have seen crude at 80$ odd 2 years back, petrol were trading at 80 INR. Now crude at 30$ odd and petrol still at 70 INR.#RamBharoseIndia

March 7, 2020

BANNIFTY technicals

- trend is down on daily charts

- this week, banknifty closed 5% in negative

- support zone 26500-27000

- on Friday, there was a big gap down opening but the first bar low never broke in the day

- close was near the highs of the day

- gap up opening above 28000 can lead to technical pullback

- this week, banknifty closed 5% in negative

- support zone 26500-27000

- on Friday, there was a big gap down opening but the first bar low never broke in the day

- close was near the highs of the day

- gap up opening above 28000 can lead to technical pullback

March 6, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty opened gap down and closed 2.5% in negative at 10990

- AD was 2:7

- ATR jumps to 200 points... average SL 400 points for nifty

- support 10500 resistance 11400

- VIX up 26%.. option writers paradise?

- did not trade today... no point

- trend is down on daily charts

- today nifty opened gap down and closed 2.5% in negative at 10990

- AD was 2:7

- ATR jumps to 200 points... average SL 400 points for nifty

- support 10500 resistance 11400

- VIX up 26%.. option writers paradise?

- did not trade today... no point

YESBANK - losing the API

2. Until today, I did not know that I had a Yes bank account b/c I used @Razorpay to generate a virtual account and linked it w/ POS vendors like PayTm, ezeTap etc.— V. Anand | வெ. ஆனந்த் (@iam_anandv) March 6, 2020

3. Now all settlements from POS vendors are locked, till I move it to other bank accounts.

Smooth seas do not make skillful sailors

Don't shun the market turbulence.— Wayne Himelsein (@WayneHimelsein) March 5, 2020

Times like these are akin to attending a world class university. They will better teach and prepare you for a wider range of future markets. Embrace the opportunity!

“Smooth seas do not make skillful sailors.”

-African proverb

March 5, 2020

More downsides possible?

This is happening too frequently . These movements do not suggest a bottom, markets are uncomfortable here . Despite the high VIX , 10 day HV was greater than VIX today morning . We are probably looking at further downsides https://t.co/kXXOzw8Dlo— Subhadip Nandy (@SubhadipNandy) March 5, 2020

Market outlook

Daily charts:

- trend is down

- today nifty closed flat at 11269

- AD was flat

- option writers expect 11000 to hold

- they are also expecting a big trading range

- surprised to see call writing at 12000 levels also

Note:

- because of high IVs, I have shifted to option writing positional

- last week, we sold 11300 CE and 11300 PE for Rs.300 and closed it today at 80

- today we repeated the same trade in weekly options

- the positions are always hedged.

- trend is down

- today nifty closed flat at 11269

- AD was flat

- option writers expect 11000 to hold

- they are also expecting a big trading range

- surprised to see call writing at 12000 levels also

Note:

- because of high IVs, I have shifted to option writing positional

- last week, we sold 11300 CE and 11300 PE for Rs.300 and closed it today at 80

- today we repeated the same trade in weekly options

- the positions are always hedged.

March 4, 2020

NIFTY intraday spot charts... multiple timeframes

Hourly charts:

- resistance around 11400

- all activity is within master candle formed on 2nd MAR

- trend remains down

30 min charts:

- triangle seen

- choppy environment

15 min charts:

- directionless markets

- my indicator is giving all whipsaws

5 min charts:

- 2 big moves

- one 200 points down and one 150 points up

- very difficult to trade as your SL is min 50-60 points

- huge changes in underlying alongwith theta (tom is expiry) means difficult trading in options

- for eg. I bought 11200 PE at 78, got stopped out and after nifty broke day's low by 20 points, my PE did not increase and was still around 72.

- later on, I did not trade as SL was too deep

- resistance around 11400

- all activity is within master candle formed on 2nd MAR

- trend remains down

30 min charts:

- triangle seen

- choppy environment

15 min charts:

- directionless markets

- my indicator is giving all whipsaws

5 min charts:

- 2 big moves

- one 200 points down and one 150 points up

- very difficult to trade as your SL is min 50-60 points

- huge changes in underlying alongwith theta (tom is expiry) means difficult trading in options

- for eg. I bought 11200 PE at 78, got stopped out and after nifty broke day's low by 20 points, my PE did not increase and was still around 72.

- later on, I did not trade as SL was too deep

March 3, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 1.5% in positive at 11303

- AD was 10:7

- ATR (average true range) has increased to 180 points

- this means min SL should be at least 360 points for a positional trade

- on 17th JAN, the ATR was 100 points

- on intraday charts, this volatility is reflected via a 100 point in less than 10 minutes

- stopped trading now due to huge SL required

- trend is down on daily charts

- today nifty closed 1.5% in positive at 11303

- AD was 10:7

- ATR (average true range) has increased to 180 points

- this means min SL should be at least 360 points for a positional trade

- on 17th JAN, the ATR was 100 points

- on intraday charts, this volatility is reflected via a 100 point in less than 10 minutes

- stopped trading now due to huge SL required

March 2, 2020

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.8% in negative at 11133

- AD was 7:11

- VIX up 8% at 25

- it was down 7% in morning

- inspite of a strong gapup, markets could not sustain above 11400

- huge "outside bar" formed

- is a bottom being formed?

- trend is down on daily charts

- today nifty closed 0.8% in negative at 11133

- AD was 7:11

- VIX up 8% at 25

- it was down 7% in morning

- inspite of a strong gapup, markets could not sustain above 11400

- huge "outside bar" formed

- is a bottom being formed?

GST collection crosses Rs 1-trn mark for the fourth month in a row in Feb

Some good news after a long time

Goods and Services Tax (GST) collection crossed the Rs 1-trillion-mark for the fourth month in a row in February at Rs 1.05 trillion. The GST collection, which grew 8.3 per cent year-on-year (y-o-y) in the month, was a tad lower than Rs 1.10 trillion mopped up in the previous month.

GST collection had grown 8.1 per cent y-o-y in January. The mop-up could have been much higher, but tax on imports fell 2 per cent y-o-y. However, experts ruled out the impact of the coronavirus outbreak in China on imports since these are contracted three months in advance.

Read more at https://www.business-standard.com/article/economy-policy/gst-collection-crosses-rs-1-trn-mark-for-the-fourth-month-in-a-row-in-feb-120030200034_1.html

Goods and Services Tax (GST) collection crossed the Rs 1-trillion-mark for the fourth month in a row in February at Rs 1.05 trillion. The GST collection, which grew 8.3 per cent year-on-year (y-o-y) in the month, was a tad lower than Rs 1.10 trillion mopped up in the previous month.

GST collection had grown 8.1 per cent y-o-y in January. The mop-up could have been much higher, but tax on imports fell 2 per cent y-o-y. However, experts ruled out the impact of the coronavirus outbreak in China on imports since these are contracted three months in advance.

Read more at https://www.business-standard.com/article/economy-policy/gst-collection-crosses-rs-1-trn-mark-for-the-fourth-month-in-a-row-in-feb-120030200034_1.html

March 1, 2020

Subscribe to:

Posts (Atom)