Nassim Nicholas Taleb is a Lebanese–American scholar, statistician, former trader, and risk analyst. He is known for his books - the Black Swan, Fooled by Randomness, Antifragile and the recent one Skin in the Game... all best sellers.

I owe a significant part of my trading success to his book "Fooled by Randomness". This has helped me realise that no matter how much study or analysis you do, you have no control over the outcome of a trade and the outcome of any trade is at best random.

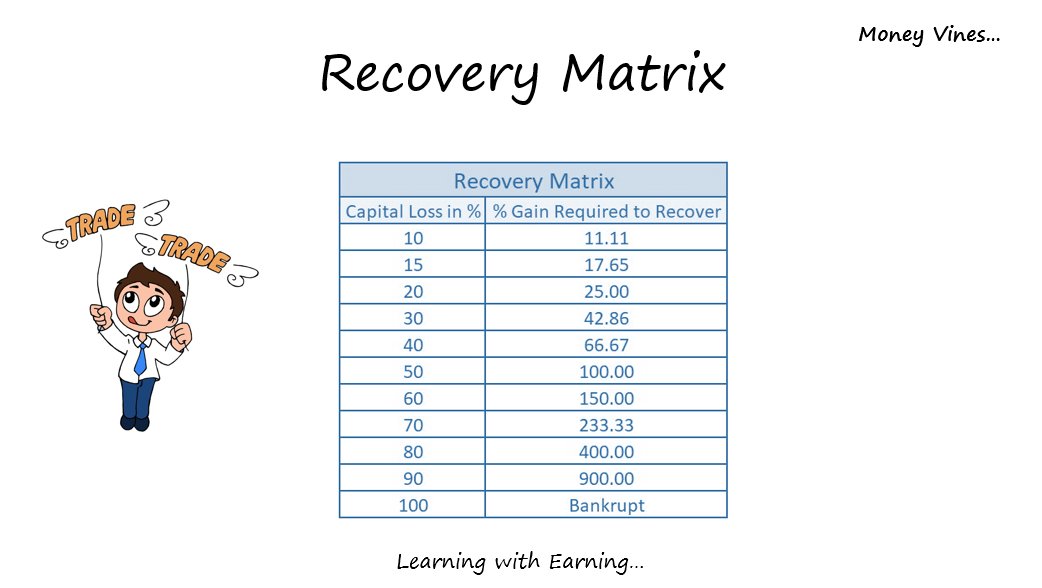

Risk management is all that matters. This also means there is no correlation between intelligence and trading success.

The Intellectual Yet Idiot

What we have been seeing worldwide, from India to the UK to the US, is the rebellion against the inner circle of no-skin-in-the-game policymaking “clerks” and journalists-insiders, that class of paternalistic semi-intellectual experts with some Ivy league, Oxford-Cambridge, or similar label-driven education who are telling the rest of us 1) what to do, 2) what to eat, 3) how to speak, 4) how to think… and 5) who to vote for.

But the problem is the one-eyed following the blind: these self-described members of the “intelligentsia” can’t find a coconut in Coconut Island, meaning they aren’t intelligent enough to define intelligence hence fall into circularities — but their main skill is capacity to pass exams written by people like them. With psychology papers replicating less than 40%, dietary advice reversing after 30 years of fatphobia, macroeconomic analysis working worse than astrology, the appointment of Bernanke who was less than clueless of the risks, and pharmaceutical trials replicating at best only 1/3 of the time, people are perfectly entitled to rely on their own ancestral instinct and listen to their grandmothers (or Montaigne and such filtered classical knowledge) with a better track record than these policymaking goons.