June 29, 2019

June 28, 2019

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.45% in negative at 11789

- AD was flat

- note that weekly close was below 11800

- I was hopeful of a nice close above prev week's high

- option writing support 11500 resistance 12000

- testing new intraday strategy in SBIN (cash).. will post results after a month

- trend is down on daily charts

- today nifty closed 0.45% in negative at 11789

- AD was flat

- note that weekly close was below 11800

- I was hopeful of a nice close above prev week's high

- option writing support 11500 resistance 12000

- testing new intraday strategy in SBIN (cash).. will post results after a month

Cox & Kings defaults on payments of Rs.150 crore

Source: https://www.livemint.com/companies/news/cox-kings-defaults-on-payments-of-rs-150-crore-1561654567340.html

But the charts showed there was a problem long time ago... from JAN 2018 to be precise.

Till last year every other middle class Indian was going abroad for foreign vacation as Indian GPD has to become 2 nd in world and discretionary expenditure was rising.— Zafar (@Maaachaaa69) June 14, 2019

Research house was advising their client to buy stock on that theme.

Share of #CoxandKings tells otherwise.

June 27, 2019

Almanac of a 100% options buyer

Almanac of a 100% options buyer :— Subhadip Nandy (@SubhadipNandy) June 1, 2018

As many of you know, I am an options buyer. I never sell naked options. Nothing wrong with naked selling, it's simply that I do not have that level of knowledge or is comfortable doing so (1/n)

On reading chart patterns... nice thread by @SubhadipNandy

I see a lot of traders following classical chart patterns . Being a pattern follower myself for some years , here is my advice to them as I feel some pointers will improve their accuracy . Again , this is not the only correct way but what I have learnt from my experiences

1. Volume confirmation is a must. Without the volume rules being fulfilled , there is no importance to the pattern

2. Understand where the pattern is taking place within the major price structure of the index/stock. An inverse head and shoulders bottom reversal occurs at market bottoms , not at market tops

3. If a pattern is valid, it will leap out at you from the computer screen

Read more at https://threadreaderapp.com/thread/996619500840632320.html

1. Volume confirmation is a must. Without the volume rules being fulfilled , there is no importance to the pattern

2. Understand where the pattern is taking place within the major price structure of the index/stock. An inverse head and shoulders bottom reversal occurs at market bottoms , not at market tops

3. If a pattern is valid, it will leap out at you from the computer screen

Read more at https://threadreaderapp.com/thread/996619500840632320.html

Market outlook

Daily charts:

- trend is down on daily charts

- today markets closed flat at 11841

- AD was 10:7

- there was no follow thru buying to Wed close

- on the other hand we had selling at higher levels

- on the plus side, today was 2nd consecutive close above 11800

- tomorrow is last day of week and month

- trend is down on daily charts

- today markets closed flat at 11841

- AD was 10:7

- there was no follow thru buying to Wed close

- on the other hand we had selling at higher levels

- on the plus side, today was 2nd consecutive close above 11800

- tomorrow is last day of week and month

June 26, 2019

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.4% in positive at 11847

- AD was 10:7

- trend is down on daily charts

- today nifty closed 0.4% in positive at 11847

- AD was 10:7

How banking and economics works - DRINK now pay LATER

Mary is the proprietor of a bar. She realizes that virtually all of her customers are unemployed alcoholics and, as such, can no longer afford to patronise her bar.

To solve this problem, she comes up with a new marketing plan that allows her customers to drink now, but pay later. She keeps track of the drinks consumed on a ledger (thereby granting the customers loans)

Word gets around about Mary's "drink now, pay later" marketing strategy and, as a result, increasing numbers of customers flood into Mary's bar. Soon she has the largest sales volume for any bar in the area. By providing her customers' freedom from immediate payment demands, Mary gets no resistance when, at regular intervals, she substantially increases her prices for wine and beer, the most consumed beverages. Consequently, Mary's gross sales volume increases massively

To solve this problem, she comes up with a new marketing plan that allows her customers to drink now, but pay later. She keeps track of the drinks consumed on a ledger (thereby granting the customers loans)

Word gets around about Mary's "drink now, pay later" marketing strategy and, as a result, increasing numbers of customers flood into Mary's bar. Soon she has the largest sales volume for any bar in the area. By providing her customers' freedom from immediate payment demands, Mary gets no resistance when, at regular intervals, she substantially increases her prices for wine and beer, the most consumed beverages. Consequently, Mary's gross sales volume increases massively

The world is full of obvious things which nobody ever observes

Uninfluential people whose aggregate actions are enormously influential.

If you manage a $50 billion hedge fund you will be called a market maven and your investment actions will be viewed with rapt attention when analyzed on CNBC. If you are unassuming Steve from Boeing’s accounts receivable department who invests in a $401(k) plan, no one will pay any attention to you, because poor Steve has no investing influence. But Boeing’s 401(k) plan manages $51 billion, made up almost entirely of people like Steve from accounts receivable. They self-direct their investments, both the allocation and the timing of that allocation. That gives them more trading influence than the $50 billion hedge fund manager, whose supposed influence stems from the ease of focusing on one well-dressed person rather than 85,000 Steves.

It is obvious that an army of Steves has more direct investing influence than any single fund manager. But they escape your attention because Steve by himself makes no difference.

The same is true in elections, consumer spending, and cultural trends: It is easy to underestimate the collective influence of tons of otherwise uninfluential people.

This is partly why the market has performed so well while so many macro investors predicted doom.

Read more at https://www.collaborativefund.com/blog/obvious-things-that-easily-escape-attention/

If you manage a $50 billion hedge fund you will be called a market maven and your investment actions will be viewed with rapt attention when analyzed on CNBC. If you are unassuming Steve from Boeing’s accounts receivable department who invests in a $401(k) plan, no one will pay any attention to you, because poor Steve has no investing influence. But Boeing’s 401(k) plan manages $51 billion, made up almost entirely of people like Steve from accounts receivable. They self-direct their investments, both the allocation and the timing of that allocation. That gives them more trading influence than the $50 billion hedge fund manager, whose supposed influence stems from the ease of focusing on one well-dressed person rather than 85,000 Steves.

It is obvious that an army of Steves has more direct investing influence than any single fund manager. But they escape your attention because Steve by himself makes no difference.

The same is true in elections, consumer spending, and cultural trends: It is easy to underestimate the collective influence of tons of otherwise uninfluential people.

This is partly why the market has performed so well while so many macro investors predicted doom.

Read more at https://www.collaborativefund.com/blog/obvious-things-that-easily-escape-attention/

June 25, 2019

Price action trading... nice by @ForNifty

Trade 1: +22— Nifty For Living (@ForNifty) June 25, 2019

Trade 2: +4

Trade 3: +22

Trade 4: +19

Trade 5: -6

Trade 6: +15#DayTrading #Nifty #OptionsTrading #PriceActionTrading #NakedTrading pic.twitter.com/7tF1exdagC

June 24, 2019

Unemployment problem solved by McDonalds?

Every new McDonald outlet creates at least 50 jobs -— Vijay Pahwa (@Wealth_Park) June 23, 2019

10 Cardiologists, 10 Dentists, 10 weight loss experts apart from people working in McDonald outlet.

How much should you spend on your wedding? Interesting thread

Seeking experts here.— Niraj (@Niraj_dugar) June 24, 2019

How much money should be spent as a % of your net worth on your own wedding?

Pls respond on the comments and share your views in the thread.@dmuthuk @position_trader @RichifyMeClub @FI_InvestIndia @Sanjay__Bakshi @morganhousel @paraschopra @Gautam__Baid

NIFTY expiry view

This chart will give a hint on whats Nifty upto till expiry— AP (@ap_pune) June 24, 2019

11700 CE and PE OI

Their crossover will be bearish; if they go further apart..bullish pic.twitter.com/UuIzXDgGIs

Visit the thread for more details/ explanations.

Who are hawks?

Hawks are low-intellect, low-experience, low-skills people; if laid off, unusable in real-life, not even to wash you car.— Nassim Nicholas Taleb (@nntaleb) June 24, 2019

The absence of the #skininthegame filtering degrades decision-making. https://t.co/YyFgKFzrNc

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.2% in negative at 11699

- AD was 7:10

- trades today: short intraday 11800 CE and 11700 PE; close by 3.15 ... approx profit 12-13 points.

- trend is down on daily charts

- today nifty closed 0.2% in negative at 11699

- AD was 7:10

- trades today: short intraday 11800 CE and 11700 PE; close by 3.15 ... approx profit 12-13 points.

You don't need complicated indicators to make money

Many new Traders look for many indicators, assumption is more exotic indicators more money can be made.— Trendmyfriend (@Trendmyfriends) June 6, 2019

for various reason trader not able to accept simple indicators or price action. e.g for crude i follow below last 2 years, let me know if you disagree or anything better ? pic.twitter.com/h9rcrTYrBz

June 23, 2019

Can this analysis get hilarious? Follow the thread on twitter

I wanna smoke whatever this guy is smoking, potent stuff ! 🤣 https://t.co/y1cF5c4cQT— Subhadip Nandy (@SubhadipNandy) June 22, 2019

Anti fragile?

Then someone decided to build government-subsidized steel plants on their land, in order to “create jobs”. Instead, they lost their antifragility 2/2— Marco Liera (@LieraMarco) June 22, 2019

Forget demonetisation... we have now dewaterisation

Move aside Demonetization. We have De-waterization.— V. Anand | வெ. ஆனந்த் (@iam_anandv) June 23, 2019

"The scarcity has brought the rich as well as the poor on par. You may have money but that doesn't mean you have water," said Dr Raghavan.https://t.co/OkP71b859e

June 22, 2019

June 21, 2019

Market outlook

Daily charts:

- trend is down on daily charts

- today markets closed 0.9 in negative at 11724

- no follow up buying to yesterday's rally

- AD was flat

- VIX up 4%

- trend is down on daily charts

- today markets closed 0.9 in negative at 11724

- no follow up buying to yesterday's rally

- AD was flat

- VIX up 4%

SEBI sets up panel to review margins on derivatives

“In India, initial margin in equity F&O segment consists of SPAN margin, exposure margin and other additional margins... Across global exchanges considered under review, only SPAN margin is collected as the initial margin. Intermittent periods of higher volatility are covered by applying event-based margins,” stated the report while adding that between January 2014 and March 2019, total initial margin applied was about 20% and 14.65% on options and futures contracts respectively.

Read more at https://www.thehindu.com/business/Industry/sebi-sets-up-panel-to-review-margins-on-derivatives/article28089359.ece

Read more at https://www.thehindu.com/business/Industry/sebi-sets-up-panel-to-review-margins-on-derivatives/article28089359.ece

June 20, 2019

Your Professional Decline Is Coming (Much) Sooner Than You Think

..Again, the woman: “Oh, stop saying that.”

I didn’t mean to eavesdrop, but couldn’t help it. I listened with morbid fascination, forming an image of the man in my head as they talked. I imagined someone who had worked hard all his life in relative obscurity, someone with unfulfilled dreams—perhaps of the degree he never attained, the career he never pursued, the company he never started.

At the end of the flight, as the lights switched on, I finally got a look at the desolate man. I was shocked. I recognized him—he was, and still is, world-famous. Then in his mid‑80s, he was beloved as a hero for his courage, patriotism, and accomplishments many decades ago.

....For selfish reasons, I couldn’t get the cognitive dissonance of that scene out of my mind. It was the summer of 2015, shortly after my 51st birthday. I was not world-famous like the man on the plane, but my professional life was going very well. I was the president of a flourishing Washington think tank, the American Enterprise Institute. I had written some best-selling books. People came to my speeches. My columns were published in The New York Times.

But I had started to wonder: Can I really keep this going? I work like a maniac. But even if I stayed at it 12 hours a day, seven days a week, at some point my career would slow and stop. And when it did, what then? Would I one day be looking back wistfully and wishing I were dead? Was there anything I could do, starting now, to give myself a shot at avoiding misery—and maybe even achieve happiness—when the music inevitably stops?

Though these questions were personal, I decided to approach them as the social scientist I am, treating them as a research project. It felt un..

Read more at https://www.theatlantic.com/magazine/archive/2019/07/work-peak-professional-decline/590650/

I didn’t mean to eavesdrop, but couldn’t help it. I listened with morbid fascination, forming an image of the man in my head as they talked. I imagined someone who had worked hard all his life in relative obscurity, someone with unfulfilled dreams—perhaps of the degree he never attained, the career he never pursued, the company he never started.

At the end of the flight, as the lights switched on, I finally got a look at the desolate man. I was shocked. I recognized him—he was, and still is, world-famous. Then in his mid‑80s, he was beloved as a hero for his courage, patriotism, and accomplishments many decades ago.

....For selfish reasons, I couldn’t get the cognitive dissonance of that scene out of my mind. It was the summer of 2015, shortly after my 51st birthday. I was not world-famous like the man on the plane, but my professional life was going very well. I was the president of a flourishing Washington think tank, the American Enterprise Institute. I had written some best-selling books. People came to my speeches. My columns were published in The New York Times.

But I had started to wonder: Can I really keep this going? I work like a maniac. But even if I stayed at it 12 hours a day, seven days a week, at some point my career would slow and stop. And when it did, what then? Would I one day be looking back wistfully and wishing I were dead? Was there anything I could do, starting now, to give myself a shot at avoiding misery—and maybe even achieve happiness—when the music inevitably stops?

Though these questions were personal, I decided to approach them as the social scientist I am, treating them as a research project. It felt un..

Read more at https://www.theatlantic.com/magazine/archive/2019/07/work-peak-professional-decline/590650/

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 1.2% in positive at 11832

- AD was 11:7

- last 3 days we are having large moves

- this happens at tops and bottoms

- so are the markets bottoming out? quite likely

- very good support 11600 (swing low)

- we already have a buy on hourly charts

- this is because markets crossed yesterday's swing high

- sustaining above 11800 next few weeks can lead to new highs

- break of 11600 can lead to more downsides (looks unlikely right now)

- trend is down on daily charts

- today nifty closed 1.2% in positive at 11832

- AD was 11:7

- last 3 days we are having large moves

- this happens at tops and bottoms

- so are the markets bottoming out? quite likely

- very good support 11600 (swing low)

- we already have a buy on hourly charts

- this is because markets crossed yesterday's swing high

- sustaining above 11800 next few weeks can lead to new highs

- break of 11600 can lead to more downsides (looks unlikely right now)

Big Move on the cards?

All 3 MAs are almost at the same level on Nifty spot 0.1% eod chart (till yesterday).— AP (@ap_pune) June 19, 2019

Happens very rarely;

and A BIG MOVE FOLLOWS. pic.twitter.com/bOE8VC1SOc

June 19, 2019

Swing trading signals :: 19-JUN-2019

- This report is for your personal use only and is valid for next trading day.

- Signals are generated using the kplswing indicator.

- Algorithm: BUY signal is generated if a stock closes above 20 days high and vice versa.

- Ignore signal if stock is rangebound for extended periods of time.

- Hint: give preference to stocks making 52 week highs or all time highs or breaking out from a range.

- Stock name is highlighted in case of first signal of the trend.

- Exits: There are no targets and exits are based on a trailing stoploss. Returns are whatever the market gives - 20%, 100%, etc.

- Trailing SL: For long positions, use last week's low or 10 days low.

- Click on stock name link for charts, more info etc

- Risk Management: Limit investment per stock to 3% of trading capital.

- Important: Trade in cash only and never in futures.

This information is for your study only and is not a recommendation to buy or sell

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed flat at 11691

- today we had a nice gap up opening

- but this was sold off into

- note how 11800 is offering resistance

- big intraday fall from 11800 to 11625

- gap support 11400-11600

- will this gap be filled?

- trend is down on daily charts

- today nifty closed flat at 11691

- the flat closing does NOT disclose what happened intraday

- AD was 5:13- today we had a nice gap up opening

- but this was sold off into

- note how 11800 is offering resistance

- big intraday fall from 11800 to 11625

- giving a trading range of 175 points

- will this gap be filled?

Why credit analysts must keep an eye on the market

In December last year, the media reported that the market regulator was probing how the country’s credit rating agencies failed to spot stress in IL&FS and maintained high ratings till the default on its debt instruments occurred.

The fact that the rating tumbled from AAA to junk in a matter of weeks was a wake-up call for all players in the debt market. After all, should not a rating agency raise timely red flags ahead of a default?

In an attempt to restore faith in the agencies and ensure that they are not caught napping, SEBI implemented some measures. One of them being...

Read more at https://morningstar.in/posts/53243/bond-analysts-must-keep-eye-stock-market.aspx

The fact that the rating tumbled from AAA to junk in a matter of weeks was a wake-up call for all players in the debt market. After all, should not a rating agency raise timely red flags ahead of a default?

In an attempt to restore faith in the agencies and ensure that they are not caught napping, SEBI implemented some measures. One of them being...

Read more at https://morningstar.in/posts/53243/bond-analysts-must-keep-eye-stock-market.aspx

No end to auto blues as lenders reduce exposure

Mounting bad debt in the auto sector has resulted in leading retail banks seeking a high collateral for inventory funding—at times, 100% of the loan—making a dire situation worse for a large number of dealers, four people aware of the development from the automobile and banking industries said on the condition of anonymity.

Lenders are being extremely cautious about extending fresh credit to dealers because the outlook for several automobile manufacturers is bleak, said a senior banker. “The situation is particularly bad for a few manufacturers

Read more at https://www.livemint.com/auto-news/no-end-to-automobile-sector-s-blues-as-lenders-reduce-exposure-1560881102353.html

Lenders are being extremely cautious about extending fresh credit to dealers because the outlook for several automobile manufacturers is bleak, said a senior banker. “The situation is particularly bad for a few manufacturers

Read more at https://www.livemint.com/auto-news/no-end-to-automobile-sector-s-blues-as-lenders-reduce-exposure-1560881102353.html

June 18, 2019

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.2% in positive at 11691

- AD was 7:11

- option writing support 11500

- trend is down on daily charts

- today nifty closed 0.2% in positive at 11691

- AD was 7:11

- option writing support 11500

June 17, 2019

Mahindra to observe no production days for up to 13 days this quarter

Mahindra & Mahindra (M&M) on Saturday said it will shut production across plants for up to 13 days in the ongoing quarter to adjust to market demand.

The company would be observing no production days during the first quarter ranging between 5-13 days across its automotive and farm equipment sector plants, M&M said in a regulatory filing. “The management does not envisage any adverse impact on availability of vehicles in the market due to adequacy of vehicle stocks to serve the market requirements,” it added.

Read more at https://www.thehindubusinessline.com/companies/mahindra-to-observe-no-production-days-for-up-to-13-days-this-quarter/article27696678.ece

The company would be observing no production days during the first quarter ranging between 5-13 days across its automotive and farm equipment sector plants, M&M said in a regulatory filing. “The management does not envisage any adverse impact on availability of vehicles in the market due to adequacy of vehicle stocks to serve the market requirements,” it added.

Read more at https://www.thehindubusinessline.com/companies/mahindra-to-observe-no-production-days-for-up-to-13-days-this-quarter/article27696678.ece

Market outlook

Daily charts:

- trend is down on daily charts (wef today)

- today nifty closed 1.35 in negative at 11672

- close was below support of 11800

- AD was 2:7

- next support is gap around 11500-11600

- option writing support 11500-11000

- trend is down on daily charts (wef today)

- today nifty closed 1.35 in negative at 11672

- close was below support of 11800

- AD was 2:7

- next support is gap around 11500-11600

- option writing support 11500-11000

Different perspective: India has wage problem, not job problem: Mohandas Pai

...."India is not producing good jobs, but creating a lot of Rs 10,000-Rs 15,000 low-paid jobs which are not fancied by degree holders. India has a wage problem, not a job problem," he told PTI.

Also, India has regional and geographical problems, Pai said.

Pai suggested that India adopt the Chinese model of opening up labour-intensive industries and building infrastructure near coasts, besides investing heavily in hitech R&D to meet the aspirations of job-seekers.

Read more at: http://economictimes.indiatimes.com/articleshow/69812223.cms

Also, India has regional and geographical problems, Pai said.

Pai suggested that India adopt the Chinese model of opening up labour-intensive industries and building infrastructure near coasts, besides investing heavily in hitech R&D to meet the aspirations of job-seekers.

Read more at: http://economictimes.indiatimes.com/articleshow/69812223.cms

June 16, 2019

June 15, 2019

The Subramaniam Factor / Sab Golmaal Hai

Subramaniam factor = 2.5%,— V. Anand | வெ. ஆனந்த் (@iam_anandv) June 14, 2019

Actual GDP = Govt GDP - Subramaniam Factor. @andymukherjee70 has now made the most important contribution to our economic discourse by coining this word. "Subramaniam Factor"https://t.co/a9dRmwL6Eq

June 14, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.8% in negative at 11823

- AD was 5:12

- this week also, nifty could not close above 12000

- option writing support 11500 resistance 12000

- trend is up on daily charts

- today nifty closed 0.8% in negative at 11823

- AD was 5:12

- this week also, nifty could not close above 12000

- option writing support 11500 resistance 12000

From a maths teacher to India's leading option seller: The inspiring journey of PR Sundar

From a person who managed to lay hands on his first pair of slippers when he reached the 10th grade to be one of the largest individual option sellers in the country is an inspiring journey. The fact that the person was a teacher for the most part of his life makes one wonder about the hidden potential of this individual.

PR Sundar, a math teacher, learned about options from the most basic source - the stock exchange booklet - that every dealer working in a broker’s office reads. He still maintains that the book is his primary source of knowledge. While the source of information was the same, the knowledge that Sundar could extract from that source was much higher than what most are capable of.

Born in a poor family, Sundar, a post graduate in mathematics, took to teaching as there were few job opportunities back then. A teaching assignment in Singapore helped him save capital to think about returning back to India and starting a business. A strange happenstance brought Sundar to the market and he has never looked back.

A successful trader who earned his spurs in the options market, Sundar continues to teach, only this time the subject has changed to options. But like every good teacher he is more interested in clearing the cobwebs and imparting knowledge, which can remain lifelong, than spoon-feeding strategies.

Read more at https://www.moneycontrol.com/news/business/moneycontrol-research/from-a-maths-teacher-to-indias-biggest-option-seller-the-inspiring-journey-of-pr-sundar-2832331.html

PR Sundar, a math teacher, learned about options from the most basic source - the stock exchange booklet - that every dealer working in a broker’s office reads. He still maintains that the book is his primary source of knowledge. While the source of information was the same, the knowledge that Sundar could extract from that source was much higher than what most are capable of.

Born in a poor family, Sundar, a post graduate in mathematics, took to teaching as there were few job opportunities back then. A teaching assignment in Singapore helped him save capital to think about returning back to India and starting a business. A strange happenstance brought Sundar to the market and he has never looked back.

A successful trader who earned his spurs in the options market, Sundar continues to teach, only this time the subject has changed to options. But like every good teacher he is more interested in clearing the cobwebs and imparting knowledge, which can remain lifelong, than spoon-feeding strategies.

Read more at https://www.moneycontrol.com/news/business/moneycontrol-research/from-a-maths-teacher-to-indias-biggest-option-seller-the-inspiring-journey-of-pr-sundar-2832331.html

Nice discussion between father and son on investing in MF/ real estate

A nice discussion between father & son-— Varaprasad Daitha (@daitha12) June 13, 2019

Son (To dad): I want to invest Rs 10,000 every month in Mutual Funds through two SIPs of Rs 5000 each.

Dad: Why two funds?

Son: As Warren Buffet says ‘Never put all your eggs in one basket.’

June 13, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed flat at 11914

- AD was 1:2

- see how beautifully nifty is trading within range of the recent big red bar.

- VIX down 3%

- trend is up on daily charts

- today nifty closed flat at 11914

- AD was 1:2

- see how beautifully nifty is trading within range of the recent big red bar.

- VIX down 3%

What is retirement?

Note: I "retired" at 32

We destroy the best years of our life to make use of the worst years. And we call ourselves rational.— Thibaut (@Kpaxs) June 12, 2019

NSE to remove Jet Airways shares from daily trading

Jet's securities will now be moved to the trade for trade segment with effect from June 28 as a "preventive surveillance measure", from the current rolling segment, which allows daily trading, the stock exchange said in a circular.

"There are concerns with regard to continuity of flow of information about the company which is very vital for the appropriate price discovery in the scrip," NSE said, adding that trading in the stock may not reflect the actual status of the company.

NSE also cited the company's failure to submit its financial results for the year ended March 31 as well as observations made by the airline's auditor as reasons for the move.

"There are concerns with regard to continuity of flow of information about the company which is very vital for the appropriate price discovery in the scrip," NSE said, adding that trading in the stock may not reflect the actual status of the company.

NSE also cited the company's failure to submit its financial results for the year ended March 31 as well as observations made by the airline's auditor as reasons for the move.

June 12, 2019

Sorry boss, we have stopped redemptions due to a liquidity crisis

..........So typically I will be needing this debt money desperately to buy equities when there is a crisis and equity markets have crashed (now whether I am able to pull it off in reality is a different issue).

The last thing I want is for my debt fund to say that “Sorry boss, we have stopped redemptions due to a liquidity crisis”. Credit funds given their inherent structure have a high probability of getting scr****d up in these scenarios.

So my simple laymanistic reasoning being – why take so much tension for debt returns. As it is equities give me enough of it, but at least the long term payoff is worth the pain

5. From an overall portfolio perspective, the incremental returns mostly go unnoticed

Also if you really think about it, most of us have credit funds as a small portion of overall portfolio. Say Debt is 50% and Equity is 50%. You may have 30% of debt portfolio as credit funds. Now this means it is 15% of overall portfolio.

So assuming you get 1.5% excess returns over short term funds, for the overall portfolio it works to 0.23% excess returns. The effort to reward for this category from an overall portfolio level is too less.

Instead you can focus on reducing the expense ratio of the overall portfolio, which is intellectually boring but easier and more effective.

So make sure you think about the credit fund contribution from an overall portfolio perspective before you make the decision.

So broadly my thesis remains and I will continue to avoid credit funds.

Still want to evaluate Credit funds?

Read more at https://eightytwentyinvestor.com/2019/06/12/debt-funds-revisiting-the-framework/

The last thing I want is for my debt fund to say that “Sorry boss, we have stopped redemptions due to a liquidity crisis”. Credit funds given their inherent structure have a high probability of getting scr****d up in these scenarios.

So my simple laymanistic reasoning being – why take so much tension for debt returns. As it is equities give me enough of it, but at least the long term payoff is worth the pain

5. From an overall portfolio perspective, the incremental returns mostly go unnoticed

Also if you really think about it, most of us have credit funds as a small portion of overall portfolio. Say Debt is 50% and Equity is 50%. You may have 30% of debt portfolio as credit funds. Now this means it is 15% of overall portfolio.

So assuming you get 1.5% excess returns over short term funds, for the overall portfolio it works to 0.23% excess returns. The effort to reward for this category from an overall portfolio level is too less.

Instead you can focus on reducing the expense ratio of the overall portfolio, which is intellectually boring but easier and more effective.

So make sure you think about the credit fund contribution from an overall portfolio perspective before you make the decision.

So broadly my thesis remains and I will continue to avoid credit funds.

Still want to evaluate Credit funds?

Read more at https://eightytwentyinvestor.com/2019/06/12/debt-funds-revisiting-the-framework/

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.6% in negative at 11906

- AD was 7:10 (not bad)

- VIX is falling in this correction (good for bulls)

- support 11500-11800 resistance 12200

- trend is up on daily charts

- today nifty closed 0.6% in negative at 11906

- AD was 7:10 (not bad)

- VIX is falling in this correction (good for bulls)

- support 11500-11800 resistance 12200

Classic case of "Trump Derangement Syndrome"

This is when you start getting hysterical or hallucinating of terrible events in the future.

Note that the guy making the comment has nothing to lose if he is wrong... be very careful of such people who give this kind of advice.

Note that the guy making the comment has nothing to lose if he is wrong... be very careful of such people who give this kind of advice.

"If he loses... he won't go. I've been saying that since before he got elected."— Cuomo Prime Time (@CuomoPrimeTime) June 12, 2019

"Real Time" host Bill Maher warns @ChrisCuomo that President Trump may not leave the White House is he loses the presidential election in 2020, saying it's something we have to worry about. pic.twitter.com/znTRm3yyO7

On creating fake companies with fake electricity bills

I finally understood why the MCA database used for calculating the new GDP series had a lot of missing companies. The answers in two simple words is - Electricity Bills.— V. Anand | வெ. ஆனந்த் (@iam_anandv) June 12, 2019

Teach a man how to fish and....

Old saying:

Give a man a fish and he will feed himself for a day

Teach a man how to fish and he will feed himself for life

New saying:

Give a man a fish and he will feed himself for a day

Teach a man how to fish but he will probably be too lazy to fish so he will definitely resell the method

Give a man a fish and he will feed himself for a day

Teach a man how to fish and he will feed himself for life

New saying:

Give a man a fish and he will feed himself for a day

Teach a man how to fish but he will probably be too lazy to fish so he will definitely resell the method

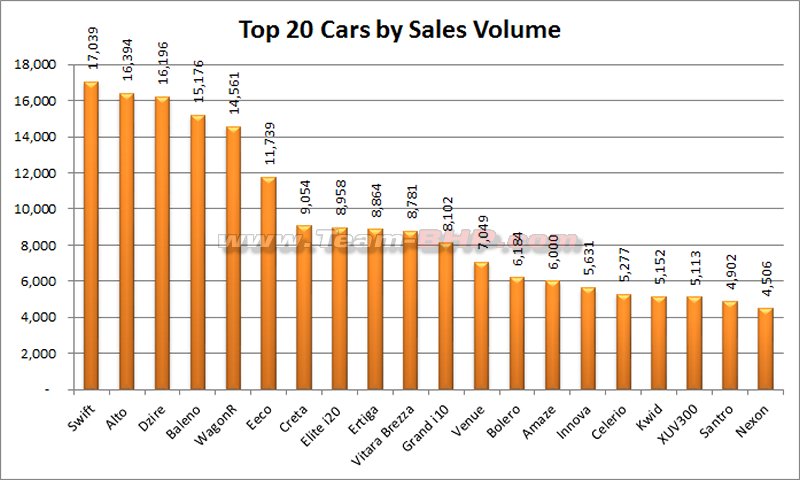

Auto sales go from bad to worse, fall 21% in May

Passenger vehicle sales in India posted the steepest drop in nearly 18 years in May amid weak demand and a liquidity crunch faced by non-bank vehicle financiers, prompting major auto makers to cut production.

Sales fell 20.6% in May to 239,347 vehicles from a year earlier, according to data released on Tuesday by the Society of Indian Automobile Manufacturers (Siam). It was the biggest fall since a 22% decline in September 2001 and the seventh consecutive drop in monthly domestic passenger vehicle sales. Vehicle sales in India are counted as factory dispatches and not retail sales.

With retail demand staying weak for several months, some of the top carmakers such as Maruti Suzuki India Ltd and Mahindra and Mahindra Ltd have announced temporary factory closures to trim mounting stocks at their dealerships as well as factories.

Source: https://www.livemint.com/auto-news/auto-sales-go-from-bad-to-worse-fall-21-in-may-1560277126102.html

Some more stats from https://www.team-bhp.com/forum/indian-car-scene/210043-may-2019-indian-car-sales-figures-analysis.html

Sales fell 20.6% in May to 239,347 vehicles from a year earlier, according to data released on Tuesday by the Society of Indian Automobile Manufacturers (Siam). It was the biggest fall since a 22% decline in September 2001 and the seventh consecutive drop in monthly domestic passenger vehicle sales. Vehicle sales in India are counted as factory dispatches and not retail sales.

With retail demand staying weak for several months, some of the top carmakers such as Maruti Suzuki India Ltd and Mahindra and Mahindra Ltd have announced temporary factory closures to trim mounting stocks at their dealerships as well as factories.

Source: https://www.livemint.com/auto-news/auto-sales-go-from-bad-to-worse-fall-21-in-may-1560277126102.html

Some more stats from https://www.team-bhp.com/forum/indian-car-scene/210043-may-2019-indian-car-sales-figures-analysis.html

June 11, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.4% in positive at 11966

- AD was 4:5

- incidentally nifty is forming a doji for past 3 days

- support 11800 (next 11500) resistance 12200

- trend is up on daily charts

- today nifty closed 0.4% in positive at 11966

- AD was 4:5

- incidentally nifty is forming a doji for past 3 days

- support 11800 (next 11500) resistance 12200

Very scary thread on water shortage/ drought in India

"Over-usage of existing resources leading to 91 major reservoirs across India left with a mere 21 percent of the total storage capacity."— meghnad (@Memeghnad) June 10, 2019

😳https://t.co/KSom3Hlyba

June 10, 2019

Fire the mutual fund managers

Summary: you are better off investing in an index fund than any actively managed fund.

Source: https://us.spindices.com/spiva/#/reports

Source: https://us.spindices.com/spiva/#/reports

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.4% in positive at 11923

- pattern was a doji showing indecision between bulls and bears

- AD was 7:11

- support 11800-11500

- trend is up on daily charts

- today nifty closed 0.4% in positive at 11923

- pattern was a doji showing indecision between bulls and bears

- AD was 7:11

- support 11800-11500

June 8, 2019

The DHFL and mutual funds mess explained in simple words

..Okay so if I give you a loan, I can say that you pay me back interest every year. For five years. But I can add a clause saying if you default on your loans to anyone else, then please pay me immediately. Because I am afraid that if you default on someone else he will come and take your sofa and TV and you’ll have nothing left to pay me later.

So when you do that, you create a covenant that triggers when you default somewhere else. This is a cross default covenant.

Because DHFL has cross default covenants on some other loans, some other fellow will come and say dude, my loan is immediately due.

Read more at https://www.capitalmind.in/2019/06/abeyaar-what-is-this-dhfl-default-and-debt-mutual-funds-crashing/

So when you do that, you create a covenant that triggers when you default somewhere else. This is a cross default covenant.

Because DHFL has cross default covenants on some other loans, some other fellow will come and say dude, my loan is immediately due.

Read more at https://www.capitalmind.in/2019/06/abeyaar-what-is-this-dhfl-default-and-debt-mutual-funds-crashing/

June 7, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.2% in positive at 11870

- AD was 7:11

- VIX down 5%

- option writing support 11500

- trend is up on daily charts

- today nifty closed 0.2% in positive at 11870

- AD was 7:11

- VIX down 5%

- option writing support 11500

Derivative traders in India pay up to 500 times more margin, says study by SEBI sub-committee

India is the only country in the world where initial margin charged in the F&O (futures and options) segment consists of three margins -- SPAN (Standardised Portfolio Analysis for Risk) margin, exposure margin and other additional margins. All other countries charge only SPAN margin.

The study also found out that if India followed only the SPAN margin system it would have been good enough to cover the risk for 99.44 percent instances of At-the-Money (ATM) and Out-of-the-Money (OTM) stock option contract. Simply put, there is no need to burden traders with extra margins.

Higher margins result in a lower return on investment (RoI) for a trader. Ironically, an FII who has an option of trading both in India as well as in Singapore Stock Exchange (SGX) has to pay the complete margin in India but only the SPAN margin if he trades the Nifty derivatives in SGX.

Read more at https://www.moneycontrol.com/news/business/derivative-traders-in-india-pay-up-to-500-times-more-margin-says-study-by-sebi-sub-committee-4072141.html

The study also found out that if India followed only the SPAN margin system it would have been good enough to cover the risk for 99.44 percent instances of At-the-Money (ATM) and Out-of-the-Money (OTM) stock option contract. Simply put, there is no need to burden traders with extra margins.

Higher margins result in a lower return on investment (RoI) for a trader. Ironically, an FII who has an option of trading both in India as well as in Singapore Stock Exchange (SGX) has to pay the complete margin in India but only the SPAN margin if he trades the Nifty derivatives in SGX.

Read more at https://www.moneycontrol.com/news/business/derivative-traders-in-india-pay-up-to-500-times-more-margin-says-study-by-sebi-sub-committee-4072141.html

Market analysis based on options data

Analysis of yesterday's market:— P R Sundar (@PRSundar64) June 7, 2019

Nifty fell nearly 200 points from intraday high. The big question is whether the downtrend will continue or markets will stabilise?

First from fundamental point of view.

Why markets fell?

It was DHFL news.

But it was not a surprising news.

(1/n)

Read complete thread at https://twitter.com/PRSundar64/status/1136794401399721984

June 6, 2019

Market outlook + multiple timeframe charts

Daily charts:

- trend is up on daily charts

- today nifty closed 1.5% in negative at 11843

- AD was 5:13 (not bad)

- selling was across the board/ all indices/ sectors

- VIX down 1.5% .. no fear?

- now we have multiple supports around 11500 and then nearest at 11800 spot

- since I need to keep SOME sl, I am keeping this at 11800

- note there is no conviction in bulls above 12000

- though index has closed twice above this, fresh buying is not coming in

- PE around 30 is very negative for long term investors

- I am talking about high for PE for several weeks (if not months)

- trend is up on daily charts

- today nifty closed 1.5% in negative at 11843

- AD was 5:13 (not bad)

- selling was across the board/ all indices/ sectors

- VIX down 1.5% .. no fear?

- now we have multiple supports around 11500 and then nearest at 11800 spot

- since I need to keep SOME sl, I am keeping this at 11800

- note there is no conviction in bulls above 12000

- though index has closed twice above this, fresh buying is not coming in

- PE around 30 is very negative for long term investors

- I am talking about high for PE for several weeks (if not months)

How Tasneem Mithaiwala, a single mother, fought all odds to become a full-time trader

.......As far as my intraday trades are concerned I trade on the 1-minute chart as well as on the 15-minute chart. I basically am a price action trader and trade mainly around my support and resistance.

.......As far as my intraday trades are concerned I trade on the 1-minute chart as well as on the 15-minute chart. I basically am a price action trader and trade mainly around my support and resistance.In case of a side market, I trade the 1-min chart but when it is a trending market I move to the higher timeframe and give the trade room to workout.

I always do my homework the previous day and have my support and resistances in place. I wait for the market to come to these zones before taking a trade. But I do not buy at the first instance, I wait for a retest to get in the trade.

There are days when I get an opportunity to take 5-6 trades, but in case of trending days, I sit throughout the day with one single trade. I look for a trade which gives a risk-reward of 1:3 but these trades are rare and have to mostly settle for a 1:2 trade.

Here I take trades with a 1:3 risk reward opportunity. I rarely carry my trades home unless it is a very strong trend and the closing is strong. I have averaged around six winners for every four losses in my intraday trades.

But my biggest gainers come from trading on the expiry days. Sometimes I think why to bother trading on other days when most money can be made on expiry day trading.

Here too the strategy more or less remains the same. Since I am always an option buyer I pick up a slightly out-of-the-money (OTM) option which is closer to a support or resistance which is where I feel the market can go. These trades are always taken in the post-lunch session when the market gives a sharp burst.

Read more at https://www.moneycontrol.com/news/business/markets/how-tasneem-mithaiwala-a-single-mother-fought-all-odds-to-become-a-full-time-trader-4065261.html

Labels:

education,

options,

technical analysis

Financial Advice For My New Daughter by @morganhousel

I have not become a father but one highly respected person @morganhousel I follow on Twitter has just become one.

Here is his blog post.... awesome read like all his previous posts and worth reading several times over.

My wife and I welcomed a daughter into the world yesterday.

Her only job now is eating and sleeping. But, one day, when she needs financial advice, here’s what I’ll tell her.

It is easy to assume that wealth and poverty are caused by the choices we make, but it’s even easier to underestimate the role of chance in life.

Everyone’s life is a reflection of the experiences they’ve had and the people they’ve met, a lot of which are out of your control and driven by chance. Being born to different families, with different values, in different countries, in different generations, and the luck of who you happen to meet along the way plays a bigger role in outcomes than most people want to admit.

I want you to believe in the values and rewards of hard work. But realize that not all success is due to hard work, and not all poverty is due to laziness. Keep this in mind when judging people, including yourself.

This is my daughter, born today. She’s great, her Mom’s a champion, and nothing else matters. pic.twitter.com/g1nDT5Zpfu— Morgan Housel (@morganhousel) June 4, 2019

Here is his blog post.... awesome read like all his previous posts and worth reading several times over.

My wife and I welcomed a daughter into the world yesterday.

Her only job now is eating and sleeping. But, one day, when she needs financial advice, here’s what I’ll tell her.

It is easy to assume that wealth and poverty are caused by the choices we make, but it’s even easier to underestimate the role of chance in life.

Everyone’s life is a reflection of the experiences they’ve had and the people they’ve met, a lot of which are out of your control and driven by chance. Being born to different families, with different values, in different countries, in different generations, and the luck of who you happen to meet along the way plays a bigger role in outcomes than most people want to admit.

I want you to believe in the values and rewards of hard work. But realize that not all success is due to hard work, and not all poverty is due to laziness. Keep this in mind when judging people, including yourself.

PAGEIND: is it a buy at current levels? fundamental view

Weekly chart, self explanatory

Read more at https://www.outlookbusiness.com/markets/trend/is-this-a-good-time-to-buy-page-industries-5156

Read more at https://www.outlookbusiness.com/markets/trend/is-this-a-good-time-to-buy-page-industries-5156

DHFL: the problem with fundamental analysis

>>>

Knowing when one is wrong using fundamentals, though, is a very grey area. Depending on the style of analysis employed, the lower a share price goes below its valuation may mean the better value the stock becomes. On the other hand, it may mean the valuation was incorrect to begin with. It's a hard ask for any analyst to amend his or her analysis and valuation in the face of a plunging share price – they are usually only forced do so after the fact and after the monetary damage is done.

However, the main benefit of technical analysis over fundamental analysis is that the charts provide a very specific right or wrong point where protective stops can be placed and monetary losses can be limited.

<<<

From Successful stock trading by Nick Radge

DHFL chart... it is only now that rating agencies have "woken up" to the problem

Knowing when one is wrong using fundamentals, though, is a very grey area. Depending on the style of analysis employed, the lower a share price goes below its valuation may mean the better value the stock becomes. On the other hand, it may mean the valuation was incorrect to begin with. It's a hard ask for any analyst to amend his or her analysis and valuation in the face of a plunging share price – they are usually only forced do so after the fact and after the monetary damage is done.

However, the main benefit of technical analysis over fundamental analysis is that the charts provide a very specific right or wrong point where protective stops can be placed and monetary losses can be limited.

<<<

From Successful stock trading by Nick Radge

DHFL chart... it is only now that rating agencies have "woken up" to the problem

June 5, 2019

Where is the bull market?

Just did a scan of all NSE stocks for Year to Date (YTD) performance.

Filter: 20 day average price * volume > Rs. 5 crores per day

No of stocks: 360 out of 1500

YTD < 0% = 160 stocks

YTD 0-20% = 121 stocks

YTD 20-50% = 62 stocks

Filter: 20 day average price * volume > Rs. 5 crores per day

No of stocks: 360 out of 1500

YTD < 0% = 160 stocks

YTD 0-20% = 121 stocks

YTD 20-50% = 62 stocks

YTD > 50% = 10 stocks

This means that even as nifty is near all time highs the vast majority of stocks have not moved or still are in the red.

If I exclude the filter, it still means close to 900 stocks from a universe of 1500 are still in the red. Only 4 stocks have doubled this year, total of 28 stocks have given YTD gains of more than 50%.

So where is the bull market?

This means that even as nifty is near all time highs the vast majority of stocks have not moved or still are in the red.

If I exclude the filter, it still means close to 900 stocks from a universe of 1500 are still in the red. Only 4 stocks have doubled this year, total of 28 stocks have given YTD gains of more than 50%.

So where is the bull market?

Develop your own strategy / unfollow others / social priming

This is a very serious topic because of the repercussions social priming has on your trading outcome. I recently un-followed hundreds of people from whom I have been subtly getting market direction. (1/n) https://t.co/b94da8Mtfq— Sidhu Ram (@sidhuram) June 5, 2019

Confessions of an option buyer ... read full thread

One instrument I have consistently lost money since inception is Nifty weekly options , trying to daytrade those . After the first few losses , drastically cut volume to 2 lots . Still the losses continued . Remember , my approach was/is to buy options .— Subhadip Nandy (@SubhadipNandy) June 5, 2019

S&P 500 index: new rally or technical pullback?

- index recovered sharply from recent lows

- gain was 2%

- many people would look at this as double bottom buy

- support 2720

- now expecting strong resistance around 2820

- if the index cannot sustain above 2820, then new lows possible

- this will also create H&S pattern IF neckline breaks (2720)

Other factors:

- index lost 6.6% last month

- current bounce is from RSI 30 levels

- gain was 2%

- many people would look at this as double bottom buy

- support 2720

- now expecting strong resistance around 2820

- if the index cannot sustain above 2820, then new lows possible

- this will also create H&S pattern IF neckline breaks (2720)

Other factors:

- index lost 6.6% last month

- current bounce is from RSI 30 levels

June 4, 2019

NIFTY PE at 30

Not much is there for long term investors

Source: https://nseindia.com/products/content/equities/indices/historical_pepb.htm

Source: https://nseindia.com/products/content/equities/indices/historical_pepb.htm

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.6% in negative at 12022

- AD was 4:5

- support 11800-11500

- trend is up on daily charts

- today nifty closed 0.6% in negative at 12022

- AD was 4:5

- support 11800-11500

June 3, 2019

Swing trading signals :: 03-JUN-2019

- This report is for your personal use only and is valid for next trading day.

- Signals are generated using the kplswing indicator.

- Algorithm: BUY signal is generated if a stock closes above 20 days high and vice versa.

- Ignore signal if stock is rangebound for extended periods of time.

- Hint: give preference to stocks making 52 week highs or all time highs or breaking out from a range.

- Stock name is highlighted in case of first signal of the trend.

- Exits: There are no targets and exits are based on a trailing stoploss. Returns are whatever the market gives - 20%, 100%, etc.

- Trailing SL: For long positions, use last week's low or 10 days low.

- Click on stock name link for charts, more info etc

- Risk Management: Limit investment per stock to 3% of trading capital.

- Important: Trade in cash only and never in futures.

This information is for your study only and is not a recommendation to buy or sell

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 1.4% in positive at 12088

- this was first ever close above 12000

- AD was flat ... why?

- 36 stocks made 52 week high and 76 stocks made 52 week lows... why?

- trend is up on daily charts

- today nifty closed 1.4% in positive at 12088

- this was first ever close above 12000

- AD was flat ... why?

- 36 stocks made 52 week high and 76 stocks made 52 week lows... why?

Why only a few are successful in trading?

.......What the market will do next or what a stock will do next (next being after you have bought it/ or in some cases sold if going short) has no bearing on being a successful trader.

Shocked?! (If I buy and stock goes down, I am into a loss and how is it that it doesn’t matter?)

Trading is essentially taking a probabilistic bet. Whatever be your basis of arriving at the probability, the probability can never be 1 or 0. It falls between this range and that is the risk a trader takes. If his view is correct, he makes money else he loses money. What a good trader doesn’t do is argue with the market – if he is proven wrong, he takes the loss.

Thinking about trading this way takes away the whole pressure to be right about the bet all the time. While taking the bet (or the trade) itself, you know that there is a probability that you could be wrong and if that happens it is not disturbing. What kills most of the traders is the expectation and pressure to be right ALL THE TIME – which leads to fatalities ranging from hoping that it works, going crazy on risk management to losing it mentally etc. (On a side note, twitter is full of people with views on stocks and markets but no skin in the game. If they were to put money behind their views, we may only have one-tenth the traffic on Fintwit.)

Just having the background that the stock or the market can do anything after you have bought – makes it much easier to not let ego or emotion get attached to the trade.

Read more at https://altaisadvisors.com/why-only-a-few-are-successful-in-trading

Shocked?! (If I buy and stock goes down, I am into a loss and how is it that it doesn’t matter?)

Trading is essentially taking a probabilistic bet. Whatever be your basis of arriving at the probability, the probability can never be 1 or 0. It falls between this range and that is the risk a trader takes. If his view is correct, he makes money else he loses money. What a good trader doesn’t do is argue with the market – if he is proven wrong, he takes the loss.

Thinking about trading this way takes away the whole pressure to be right about the bet all the time. While taking the bet (or the trade) itself, you know that there is a probability that you could be wrong and if that happens it is not disturbing. What kills most of the traders is the expectation and pressure to be right ALL THE TIME – which leads to fatalities ranging from hoping that it works, going crazy on risk management to losing it mentally etc. (On a side note, twitter is full of people with views on stocks and markets but no skin in the game. If they were to put money behind their views, we may only have one-tenth the traffic on Fintwit.)

Just having the background that the stock or the market can do anything after you have bought – makes it much easier to not let ego or emotion get attached to the trade.

Read more at https://altaisadvisors.com/why-only-a-few-are-successful-in-trading

June 2, 2019

Big contraction in automobile sales... why?

Maruti Suzuki India reports 22% decline in May sales at 1,34,641 units

Tata Motors Sales Fall 26%, M&M Tractor Sales Decline 16%

Royal Enfield sales down 16.5 per cent at 62,371 units in May

Eicher Motors' Commercial Vehicles Unit Sales Fall 20%

Tata Motors Sales Fall 26%, M&M Tractor Sales Decline 16%

Royal Enfield sales down 16.5 per cent at 62,371 units in May

Eicher Motors' Commercial Vehicles Unit Sales Fall 20%

Honda Cars sales dip 28 per cent to 11,442 units in May

NIFTY monthly charts

- trend is up

- support 11000-10000

- this month's candle had a long lower wick

- after a rally, this is indicative of selling at higher levels (hanging man?)

- note if the same long wick happens AFTER a correction, it indicates buying at lower levels

- so the same candle can have different interpretation depending on the location of the candlestick in relation to the bigger trend

- support 11000-10000

- this month's candle had a long lower wick

- after a rally, this is indicative of selling at higher levels (hanging man?)

- note if the same long wick happens AFTER a correction, it indicates buying at lower levels

- so the same candle can have different interpretation depending on the location of the candlestick in relation to the bigger trend

June 1, 2019

Will 11800 hold this month... interesting perspective from @ap_pune

#oldjunglesaying— AP (@ap_pune) June 30, 2017

A selloff on day 1 of a new settlement... is most probably the low for many days--sometimes for entire settlement

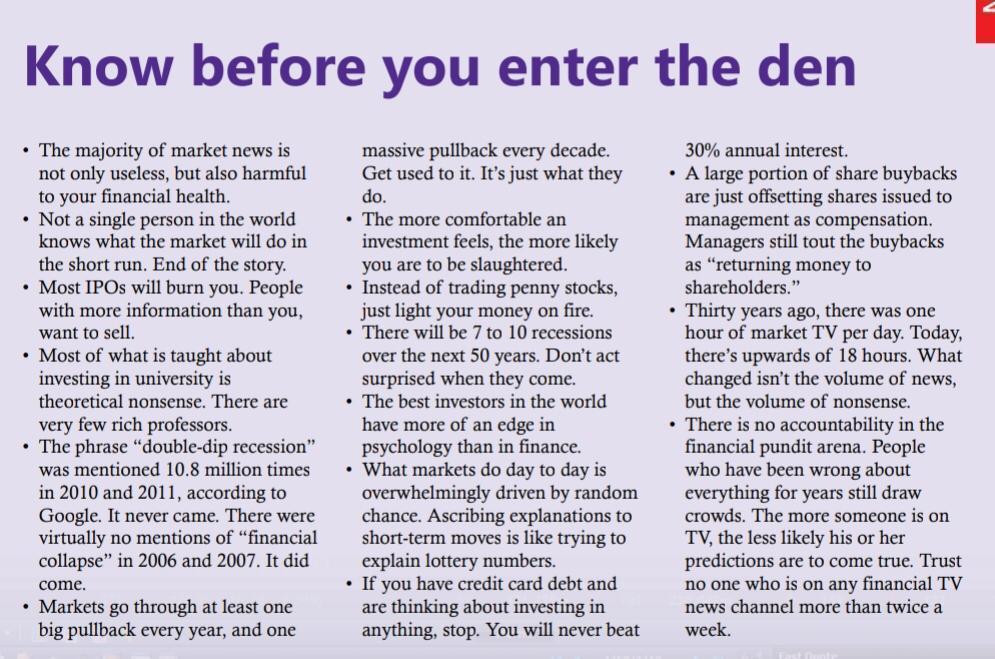

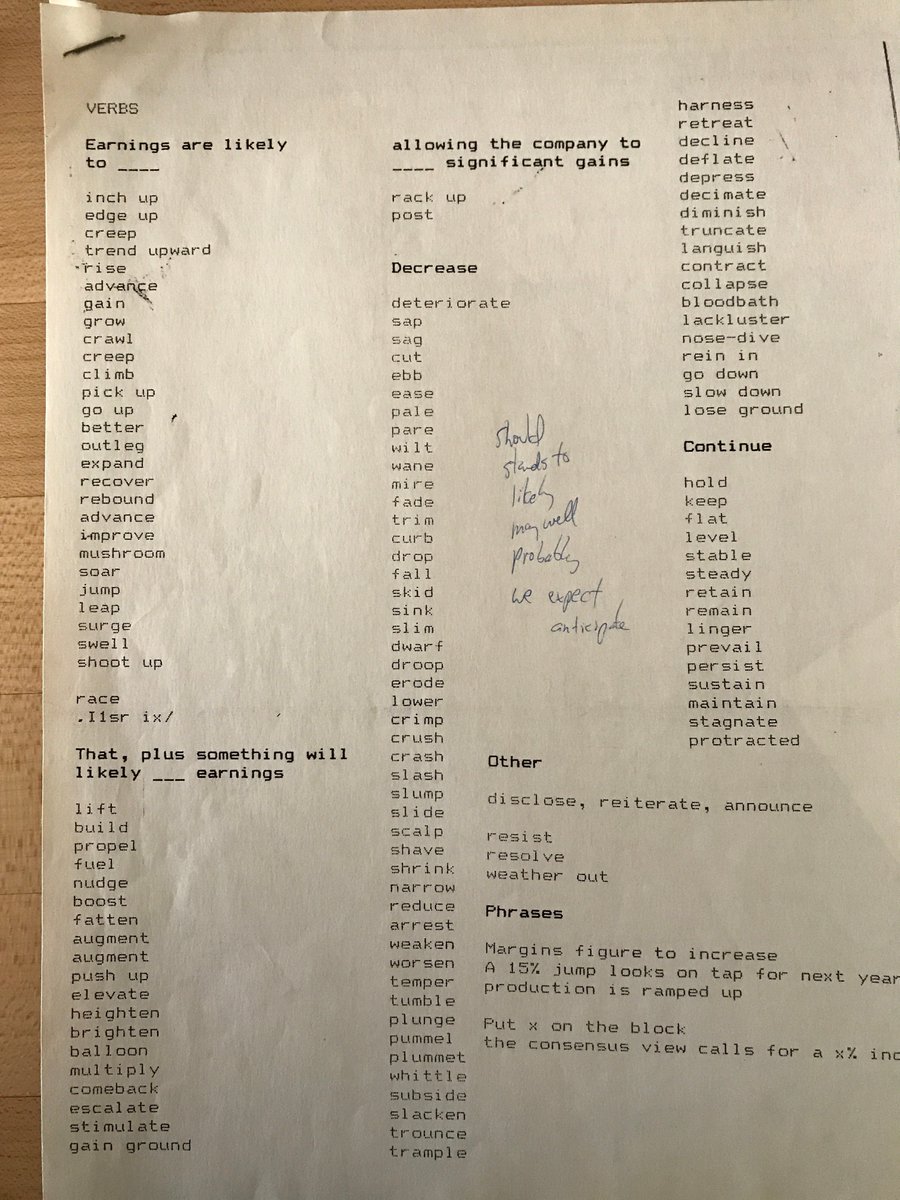

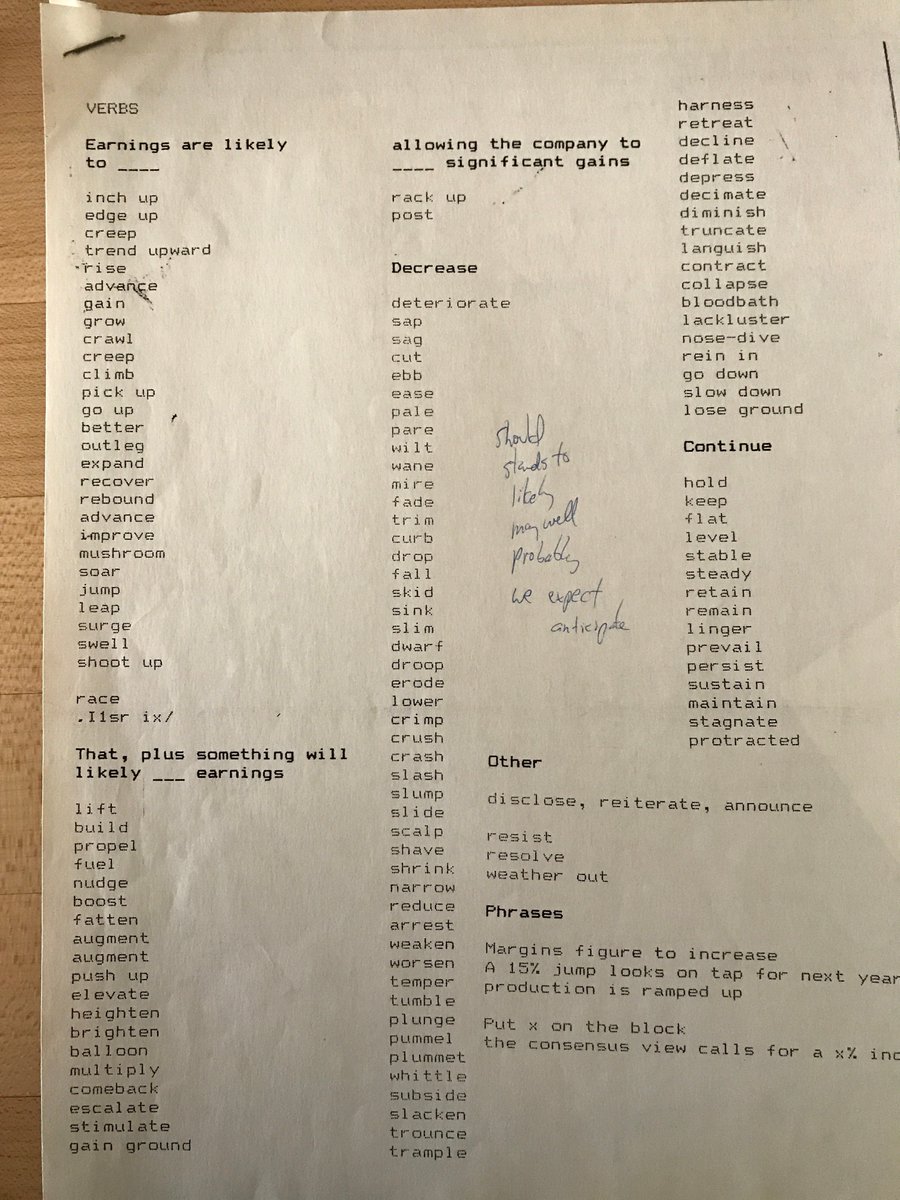

Cheat sheets for a financial research analyst/ writer

Special thanks to @bhavanisankar. Source: @nsbarr

Subscribe to:

Posts (Atom)