October 31, 2019

The tools you use to trade do not make you the money

Extract from an ebook which is there on vfm for ages...

If we placed 100 consistently profitable traders in a room and asked each to discuss his or her trading style and techniques in five sentences or less, in my experience, whilst each person would use different tools and styles, they would all be trying to achieve the same goal – that is, to generate profits.

Every time you speak with another trader (regardless of whether he or she is successful), every time you read a trading book, every time you receive advice, there will always be new information to take in – usually about an entry technique, or a new style, method or indicator. Everyone has an opinion. There are many successful traders – or at least people who have had just one profitable trade – and they have achieved this success even though they all use different tools and techniques.

Out of our sample of 100 consistently profitable traders, 40 may use fundamental analysis, 40 may use technical analysis and 20 may just use intuition or gut feel. Even then, the 40 who use fundamental analysis may use different aspects of that field. Some may rely on various ratios, while others may not take any ratios into account and rely solely on insider activity. The list and combinations are infinite.

Of the technical traders, some will rely on moving averages, some on an RSI or other indicator, while others will rely only on price patterns and volume. Yet again, the pieces to the puzzle can be infinite. My point is that each profitable trader will use a different technique, style, investment time frame, information sources and tools.

If all of the 100 traders are profitable through using different techniques, the common denominator cannot be the tools being used. It must be something else.

If you agree with the above, it becomes easier to suggest that it will not matter which indicator, tool, time frame or software package is superior, and it's certainly not a tightly held secret or insider knowledge that makes them all profitable. All indicators, all technical analysis techniques, all fundamental analysis techniques, all software – everything you use to trade and invest – are nothing but tools.

The tools you use to trade do not maketh the money!

From http://www.vfmdirect.com/info/successful_stock_trading.pdf

If we placed 100 consistently profitable traders in a room and asked each to discuss his or her trading style and techniques in five sentences or less, in my experience, whilst each person would use different tools and styles, they would all be trying to achieve the same goal – that is, to generate profits.

Every time you speak with another trader (regardless of whether he or she is successful), every time you read a trading book, every time you receive advice, there will always be new information to take in – usually about an entry technique, or a new style, method or indicator. Everyone has an opinion. There are many successful traders – or at least people who have had just one profitable trade – and they have achieved this success even though they all use different tools and techniques.

Out of our sample of 100 consistently profitable traders, 40 may use fundamental analysis, 40 may use technical analysis and 20 may just use intuition or gut feel. Even then, the 40 who use fundamental analysis may use different aspects of that field. Some may rely on various ratios, while others may not take any ratios into account and rely solely on insider activity. The list and combinations are infinite.

Of the technical traders, some will rely on moving averages, some on an RSI or other indicator, while others will rely only on price patterns and volume. Yet again, the pieces to the puzzle can be infinite. My point is that each profitable trader will use a different technique, style, investment time frame, information sources and tools.

If all of the 100 traders are profitable through using different techniques, the common denominator cannot be the tools being used. It must be something else.

If you agree with the above, it becomes easier to suggest that it will not matter which indicator, tool, time frame or software package is superior, and it's certainly not a tightly held secret or insider knowledge that makes them all profitable. All indicators, all technical analysis techniques, all fundamental analysis techniques, all software – everything you use to trade and invest – are nothing but tools.

The tools you use to trade do not maketh the money!

From http://www.vfmdirect.com/info/successful_stock_trading.pdf

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.3% in positive at 11881

- AD was 2:1

- pattern formed - doji showing tussle between bulls and bears

- this tussle is clearly reflected in intraday charts

- expect more of this around 12000 levels

- trend is up on daily charts

- today nifty closed 0.3% in positive at 11881

- AD was 2:1

- pattern formed - doji showing tussle between bulls and bears

- this tussle is clearly reflected in intraday charts

- expect more of this around 12000 levels

October 30, 2019

This is very good news - SEBI may lower margin requirements for hedged trades in F&O segment

A recent study by EY showed that margins on derivative trades in India are up to 500 times higher compared to global exchanges.

SEBI-appointed Risk Management Review Committee (RMRC) met on October 16 and agreed to most recommendations of the sub-working group. This group had proposed lower margins for hedged positions and status quo on unhedged derivative positions.

A hedged position consists of two opposing trades in the same security. This reduces risk, but at the same time also limits profits.

For instance, in a put-call parity arbitrage trade, which involves buying the call option and selling a put option of the same strike price (say 11,500 on the Nifty) and selling the Nifty futures, a trader currently has to pay Rs 1.16 lakh as margin. Under the proposed margin structure, the margin applicable to this combined trade will fall to Rs 5,000.

If there is only one leg of the trade, then the present margin rules will apply.

Read more at https://www.moneycontrol.com/news/business/sebi-may-lower-margin-requirements-for-hedged-trades-in-fo-segment-4586591.html

SEBI-appointed Risk Management Review Committee (RMRC) met on October 16 and agreed to most recommendations of the sub-working group. This group had proposed lower margins for hedged positions and status quo on unhedged derivative positions.

A hedged position consists of two opposing trades in the same security. This reduces risk, but at the same time also limits profits.

For instance, in a put-call parity arbitrage trade, which involves buying the call option and selling a put option of the same strike price (say 11,500 on the Nifty) and selling the Nifty futures, a trader currently has to pay Rs 1.16 lakh as margin. Under the proposed margin structure, the margin applicable to this combined trade will fall to Rs 5,000.

If there is only one leg of the trade, then the present margin rules will apply.

Read more at https://www.moneycontrol.com/news/business/sebi-may-lower-margin-requirements-for-hedged-trades-in-fo-segment-4586591.html

Market outlook

Daily charts:

- trend is up on daily charts

- today markets closed 0.5% in positive at 11844

- AD was 5:4

- hanging man formed

- trend is up on daily charts

- today markets closed 0.5% in positive at 11844

- AD was 5:4

- hanging man formed

October 29, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 1.4% in positive at 11787

- AD was 10:7

- this was a nice breakout day

- Friday's bar was an excellent indication

- expect more upsides but a pause around 12000

- higher swing low defined at 11450 spot

- however VIX was up 5%

- ideally this should have dropped down substantially

- trend is up on daily charts

- today nifty closed 1.4% in positive at 11787

- AD was 10:7

- this was a nice breakout day

- Friday's bar was an excellent indication

- expect more upsides but a pause around 12000

- higher swing low defined at 11450 spot

- however VIX was up 5%

- ideally this should have dropped down substantially

Excellent thread on option trading by @PRSundar64

Lot of misintrepreations, lot of negativities, lot of 'seizing the opportunity' by many people, jumping into the fray.

I may take a break from social media or i may completely withdraw from social media.

What ever I have gain by this media, I have already gained.

(1/n)

I am here now for others gain.

That I may have review.

Before doing that I wish to open up my mind.

As usual, will start with a story.

(2/n)

Whwn my son was 4 years old, my wife wanted him to go to kirana shop and buy something for Rs 20. She gave him Rs 100. He insisted she should give only Rs 20. My wife did not have Rs 20 note, insisted he should take Rs 100. He started crying. My wife was puzzled.

(3/n)

She asked for reason, he replied, "If I have Rs 100, I am sure in addition to what you ask me to buy, I will be tempted to buy a chocolate and late will get scolding from you" 😂😂😂

When my wife told me this I told her he has bright future.

(4/n)

Everyone has some short coming, if you your short coming, sure you will have bright future. If you are arrogant, not to accept your short coming, that is where you miss the life.

(5/n)

When I started my journey in stock market, for that matter when I started thinking of doing any business, first thing that came to my mind, I should be making money, even if I am stupid.

(6/n)

The reason is I know I am not an intelligent. For that matter nobody is intelligent in stock market.

That is why I have chosen to be an option seller.

Let me tell you once again, Option selling is the game of stupids.

If you do not agree, look at the comments in Twitter.

(7/n)

When most of the option buyers claim to be intelligents, naturally, counter parties, i.e. option sellers will have to be stupids.

But here the point is not who is intelligent and who is stupid, point here is who is making money?

Read more at https://twitter.com/PRSundar64/status/1188788275554615297

I may take a break from social media or i may completely withdraw from social media.

What ever I have gain by this media, I have already gained.

(1/n)

I am here now for others gain.

That I may have review.

Before doing that I wish to open up my mind.

As usual, will start with a story.

(2/n)

Whwn my son was 4 years old, my wife wanted him to go to kirana shop and buy something for Rs 20. She gave him Rs 100. He insisted she should give only Rs 20. My wife did not have Rs 20 note, insisted he should take Rs 100. He started crying. My wife was puzzled.

(3/n)

She asked for reason, he replied, "If I have Rs 100, I am sure in addition to what you ask me to buy, I will be tempted to buy a chocolate and late will get scolding from you" 😂😂😂

When my wife told me this I told her he has bright future.

(4/n)

Everyone has some short coming, if you your short coming, sure you will have bright future. If you are arrogant, not to accept your short coming, that is where you miss the life.

(5/n)

When I started my journey in stock market, for that matter when I started thinking of doing any business, first thing that came to my mind, I should be making money, even if I am stupid.

(6/n)

The reason is I know I am not an intelligent. For that matter nobody is intelligent in stock market.

That is why I have chosen to be an option seller.

Let me tell you once again, Option selling is the game of stupids.

If you do not agree, look at the comments in Twitter.

(7/n)

When most of the option buyers claim to be intelligents, naturally, counter parties, i.e. option sellers will have to be stupids.

But here the point is not who is intelligent and who is stupid, point here is who is making money?

Read more at https://twitter.com/PRSundar64/status/1188788275554615297

October 27, 2019

Big VIX Options Trade Braces for a 2008-Like Volatility Surge

Someone is betting big that the U.S. stock market is on track for the kind of turbulence not seen since the global financial crisis.

Trading in call options on the Cboe Volatility Index, known as the VIX, outweighed puts by more than 2-to-1 on Friday with the index at its lowest level since July as stocks rallied. The standout trade was one block of 50,000 April $65 calls that were bought for 10 cents. Those contracts would imply a surge in the VIX of almost 500% from its current level.

While the magnitude of the strike price is remarkable, Macro Risk Advisors derivatives strategist Maxwell Grinacoff said the April expiration date is even more interesting. That time frame could capture the impact of a potential recession, a breakdown in U.S.-China trade talks and a variety of political risks linked to the Democratic presidential primary and impeachment proceedings against Donald Trump, he said in an interview

Read more at https://www.bloomberg.com/news/articles/2019-10-25/big-vix-options-trade-braces-for-2008-like-volatility-surge

Trading in call options on the Cboe Volatility Index, known as the VIX, outweighed puts by more than 2-to-1 on Friday with the index at its lowest level since July as stocks rallied. The standout trade was one block of 50,000 April $65 calls that were bought for 10 cents. Those contracts would imply a surge in the VIX of almost 500% from its current level.

While the magnitude of the strike price is remarkable, Macro Risk Advisors derivatives strategist Maxwell Grinacoff said the April expiration date is even more interesting. That time frame could capture the impact of a potential recession, a breakdown in U.S.-China trade talks and a variety of political risks linked to the Democratic presidential primary and impeachment proceedings against Donald Trump, he said in an interview

Read more at https://www.bloomberg.com/news/articles/2019-10-25/big-vix-options-trade-braces-for-2008-like-volatility-surge

October 26, 2019

October 25, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed flat at 11584

- AD was 7:10

- today markets were volatile

- it broke recent supports, sold off, took support at 11500 and recovered

- VIX dropped 6% during all this

- option writing support 11500 resistance 12000

- overall bias is bullish and

- 11500 is a good support

- trend is up on daily charts

- today nifty closed flat at 11584

- AD was 7:10

- today markets were volatile

- it broke recent supports, sold off, took support at 11500 and recovered

- VIX dropped 6% during all this

- option writing support 11500 resistance 12000

- overall bias is bullish and

- 11500 is a good support

October 24, 2019

RBI shuts down another business... and this was how VFMDirect started

- for the record, I started off as a Direct Selling Agent for the financial services industry

- at the age of 32

- I had 7-8 years experience in this industry so the SWOT analysis was propah

- the VFMDirect stands for Value for Money and Direct is for Direct Marketing

- I shut this business in less than 6 months but I retained the name

- stoploss hit

- all this was some time in 1997-98

- then later evolved into other businesses... no planning.. just take the road when it comes

- RBI's action will have a huge impact - expect DSAs to shut down and employees to lose their jobs

- on the plus side, banks will be forced to create their own direct selling teams on their payrolls

- but this can increase overall costs

- either way, the consumer will suffer

Read more at https://economictimes.indiatimes.com/markets/stocks/news/rbi-banks-use-of-agents-to-chase-loans/articleshow/71699214.cms

- at the age of 32

- I had 7-8 years experience in this industry so the SWOT analysis was propah

- the VFMDirect stands for Value for Money and Direct is for Direct Marketing

- I shut this business in less than 6 months but I retained the name

- stoploss hit

- all this was some time in 1997-98

- then later evolved into other businesses... no planning.. just take the road when it comes

- RBI's action will have a huge impact - expect DSAs to shut down and employees to lose their jobs

- on the plus side, banks will be forced to create their own direct selling teams on their payrolls

- but this can increase overall costs

- either way, the consumer will suffer

Read more at https://economictimes.indiatimes.com/markets/stocks/news/rbi-banks-use-of-agents-to-chase-loans/articleshow/71699214.cms

Death of the TELCOs

It is quite possible that the SC has passed the death sentence to the telcos, banks and the economy in one single order. https://t.co/P2XYw5F4bI— V. Anand | வெ. ஆனந்த் (@iam_anandv) October 24, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.2% in negative at 11583

- AD was 4:5

- above 11700, expect move to 12000

- trend is up on daily charts

- today nifty closed 0.2% in negative at 11583

- AD was 4:5

- above 11700, expect move to 12000

October 23, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today markets closed flat at 11604

- AD was flat

- first lower high lower low formed today

- some few more is welcome

- trend is up on daily charts

- today markets closed flat at 11604

- AD was flat

- first lower high lower low formed today

- some few more is welcome

October 22, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.6% in negative at 11590

- AD was flat

- note prev swing high around 11700

- and rally from 11200 to current levels was always with a higher low

- formation of "lower high lower low" for 2-3 days is healthy for any rally

- this has not happened so far and it does, it will be good for the market

- highest OI for this weekly series is at 11700 CE

- next highest OI is at 11600 PE

- tight trading range?

- trend is up on daily charts

- today nifty closed 0.6% in negative at 11590

- AD was flat

- note prev swing high around 11700

- and rally from 11200 to current levels was always with a higher low

- formation of "lower high lower low" for 2-3 days is healthy for any rally

- this has not happened so far and it does, it will be good for the market

- highest OI for this weekly series is at 11700 CE

- next highest OI is at 11600 PE

- tight trading range?

Why the tide that lifts Sensex and Nifty leaves small, mid-cap stocks untouched

Even though there may be nothing fundamentally wrong with a number of small and mid-cap stocks, they continue to be victims of a SEBI norm with regard to restructuring of equity schemes of mutual fund that has killed buying interest in them.

Recent data shows that more than 77 per cent of the total investments by mutual funds and insurance companies is concentrated only in India’s top 50 listed companies (those in the Nifty index).

Mutual funds, insurance companies and other domestic financial institutions (FIs) hold stocks worth more than Rs 20 lakh crore (nearly $300 billion) on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), out of which the share of investm..

Read more at https://www.thehindubusinessline.com/markets/stock-markets/why-small-mid-cap-stocks-dont-rally-like-sensex-nifty/article29755521.ece

Recent data shows that more than 77 per cent of the total investments by mutual funds and insurance companies is concentrated only in India’s top 50 listed companies (those in the Nifty index).

Mutual funds, insurance companies and other domestic financial institutions (FIs) hold stocks worth more than Rs 20 lakh crore (nearly $300 billion) on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), out of which the share of investm..

Read more at https://www.thehindubusinessline.com/markets/stock-markets/why-small-mid-cap-stocks-dont-rally-like-sensex-nifty/article29755521.ece

INFOSYS charts... insider trading?

- stock is in weekend news due to some whistleblower complaint

- let us see what charts tell

- on 30 min, trend is clearly down

- on daily charts, one would be out of long in SEP

- the big bar in OCT failed to draw repeat buying

- now support around 760... will this break today?

- now here is the kicker

- the whistleblower letter is dated 20th SEP... same day as the longs got stopped out

- but the letter has come in public domain only recently

Charts:

- let us see what charts tell

- on 30 min, trend is clearly down

- on daily charts, one would be out of long in SEP

- the big bar in OCT failed to draw repeat buying

- now support around 760... will this break today?

- now here is the kicker

- the whistleblower letter is dated 20th SEP... same day as the longs got stopped out

- but the letter has come in public domain only recently

Charts:

October 21, 2019

October 20, 2019

What is fascism and why ....

Read more at https://simple.m.wikipedia.org/wiki/Fascism and in detail at https://en.wikipedia.org/wiki/Fascism

October 19, 2019

It may be both, may not be both; may be partly one or may be partly the other

Sitharaman waffled when asked if the current economic slowdown was because of cyclical or structural factors — an issue on which there has been fierce debate among economists.

“It may be both, may not be both; may be partly one or may be partly the other,” Sitharaman said. “I’m not getting into that at this stage. I don’t have the luxury of sitting and looking at which way it is going.”

The Union finance minister conceded that the economy wasn’t growing as fast as it once did. “It’s not 8 per cent. It’s not seven. It’s come down to six and so on…. But I don’t want to underestimate the potential that India is showing even in this adverse circumstance,” Sitharaman said.

Read more at https://www.telegraphindia.com/india/nirmala-sitharaman-and-piyush-goyal-dream-team-worthy-of-nobel/cid/1712685

“It may be both, may not be both; may be partly one or may be partly the other,” Sitharaman said. “I’m not getting into that at this stage. I don’t have the luxury of sitting and looking at which way it is going.”

The Union finance minister conceded that the economy wasn’t growing as fast as it once did. “It’s not 8 per cent. It’s not seven. It’s come down to six and so on…. But I don’t want to underestimate the potential that India is showing even in this adverse circumstance,” Sitharaman said.

Read more at https://www.telegraphindia.com/india/nirmala-sitharaman-and-piyush-goyal-dream-team-worthy-of-nobel/cid/1712685

October 18, 2019

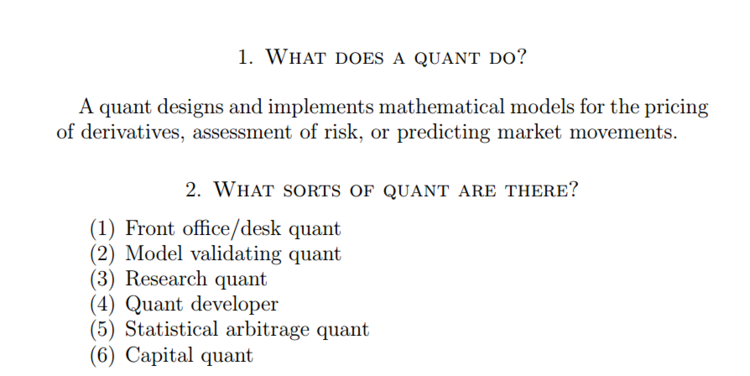

What constitutes Quant Trading and what does not?

The operative word here is “mathematical models”. Of course this can include probabilistic and statistical models as well.

So to sum it up, Quant trading is the application of Mathematics, Statistics and Probability theory in the area of trading.

For example, if you are looking at a simple Moving Average Cross over system, you may want to calculate the Conditional Probability and the Probability Distribution for various outcomes in terms of price. But merely trading a Moving Average Cross over system without having done the statistical work does not qualify as Quant trading.

Read more at https://www.niftyscalper.com/blogs/2019/10/18/what-constitutes-quant-trading-and-what-does-not

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.65% in positive at 11661

- AD was 11:5

- resistance around 11700-800

- 11700 is an important swing high

- trend is up on daily charts

- today nifty closed 0.65% in positive at 11661

- AD was 11:5

- resistance around 11700-800

- 11700 is an important swing high

Consumption in rural India hits a 7-year low

Rural household consumption slumped to a seven-year low in the September quarter, in a sign that the prolonged agrarian distress and near-stagnant rural incomes have eroded demand for consumer goods, market researcher Nielsen said.

Consumption of packaged consumer goods by rural households also grew at a slower pace than in urban areas for the first time in seven years, Nielsen said in a quarterly report on Thursday.

The rural economy has been plagued by falling crop prices and declining incomes, resulting in a severe slump in demand. Falling income has not only singed farmers but also landless wage workers, who together account for two-thirds of all rural households.

Read more at https://www.livemint.com/industry/retail/consumption-in-rural-india-hits-a-7-year-low-11571334835256.html

Consumption of packaged consumer goods by rural households also grew at a slower pace than in urban areas for the first time in seven years, Nielsen said in a quarterly report on Thursday.

The rural economy has been plagued by falling crop prices and declining incomes, resulting in a severe slump in demand. Falling income has not only singed farmers but also landless wage workers, who together account for two-thirds of all rural households.

Read more at https://www.livemint.com/industry/retail/consumption-in-rural-india-hits-a-7-year-low-11571334835256.html

Urban Highway Removal: To Your Health

The famed U.S. intellectual Lewis Mumford once said, “Forget the damned motor car and build the cities for lovers and friends.” A recently released report on freeway removal from by the Institute for Transportation and Development Policy and EMBARQ (producer The City Fix) seems to be getting a bit closer to that ideal, providing case studies on cities that have successfully removed freeways tearing their cities asunder or separating waterfronts from the enjoyment of residents.

The report notes that cities are undertaking these highway removal projects to foster economic development and offer better solutions to meet mobility needs. One additional key aspect to consider is the effect of these highways on quality of life and public health—from air pollution to traffic crashes to limiting the ability of residents to be active in their daily lives. These considerations will need further research, but several positive benefits can be observed from what already exists.

Removing a freeway and replacing it with a greener boulevard or park can reduce the “urban heat island” effect and air pollution. In Seoul, Korea, when the city turned the Cheonggyecheon Expressway into a 5.8-kilometer linear park and daylighted stream, this led to a reduction of the heat island effect by as much as 8 degrees Celsius, according to summertime measurements in comparison to nearby paved roadway conditions.

Read more at https://nextcity.org/daily/entry/urban-highway-removal-to-your-health

The report notes that cities are undertaking these highway removal projects to foster economic development and offer better solutions to meet mobility needs. One additional key aspect to consider is the effect of these highways on quality of life and public health—from air pollution to traffic crashes to limiting the ability of residents to be active in their daily lives. These considerations will need further research, but several positive benefits can be observed from what already exists.

Removing a freeway and replacing it with a greener boulevard or park can reduce the “urban heat island” effect and air pollution. In Seoul, Korea, when the city turned the Cheonggyecheon Expressway into a 5.8-kilometer linear park and daylighted stream, this led to a reduction of the heat island effect by as much as 8 degrees Celsius, according to summertime measurements in comparison to nearby paved roadway conditions.

Read more at https://nextcity.org/daily/entry/urban-highway-removal-to-your-health

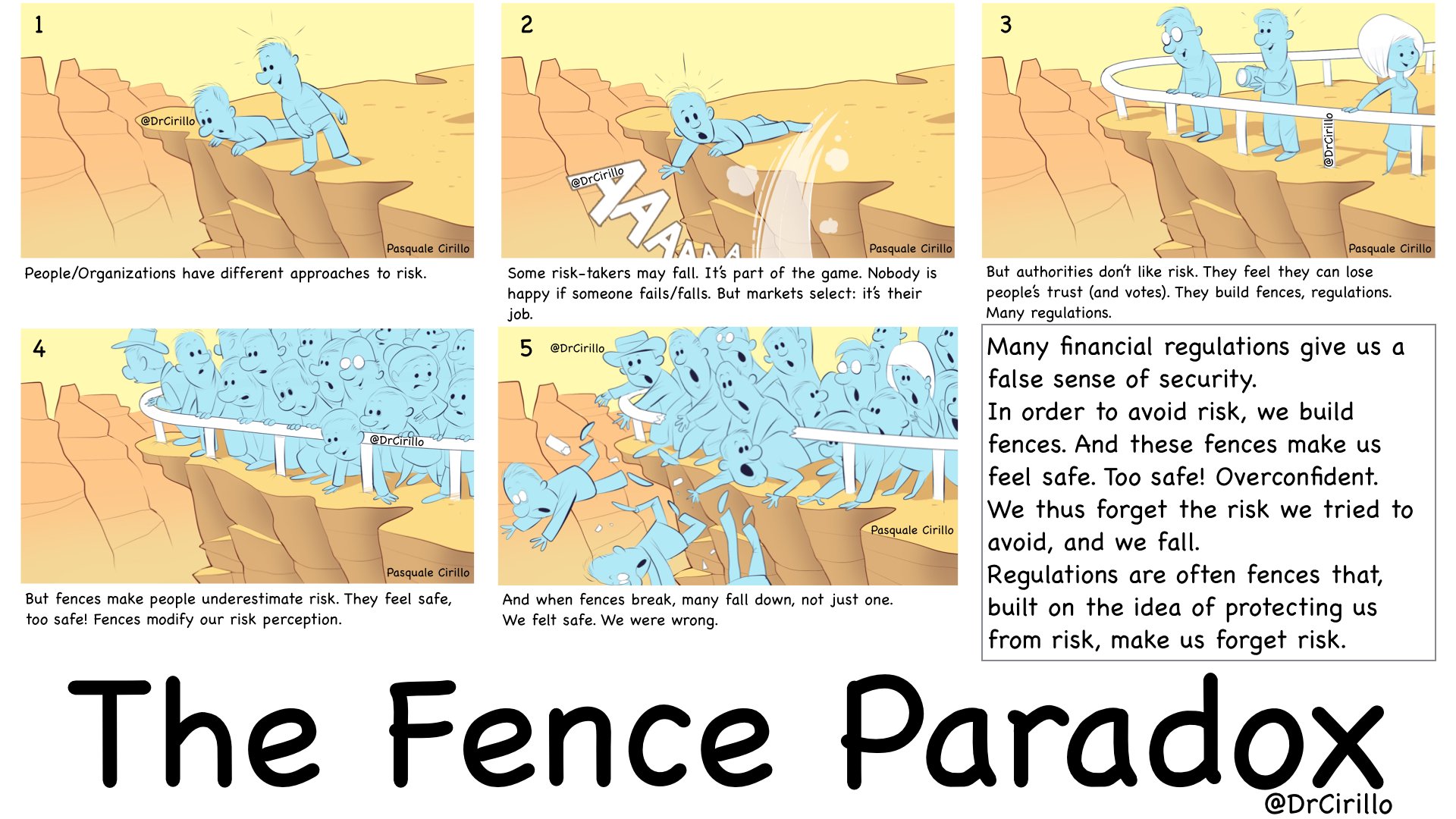

Good Things Happen, Because Bad Things Are Allowed To: Karachi Stock Exchange Version

Markets are going to be volatile, because that’s by design. If you curtail volatility, forcibly, it doesn’t end well.

Oh, and people have tried.

In Pakistan in 2008, they framed a rule: markets cannot go down. Meaning, stocks prices would have a lower bound, limited to the price of the previous day. You couldn’t bid the price down below that price. This was set by the SECP, the securities regulator of Pakistan.

This soothed some fears as the Karachi Stock Exchange index had already plunged from 15,000 to 9000, with a 15% drop in a week. If you don’t allow prices to go down further, then life would be so much better!

A strange thing happened. There were just no buyers for stocks. People wanted to buy, no doubt, but not at current prices. And without a buyer, there was nothing a seller could do but to place his orders at the lowest possible number – the high of the previous day.

Between September and December 2008, as the world was crashing and burning (the NSE Nifty fell about 40% in this period) the Karachi Index was at exactly the same level, because no one was willing to buy higher, and you were not allowed to sell lower.

When reality dawned, and apparently it took three months then, the authorities decided to remove the price “freeze”. Consequently the stock market dropped another 40% and only then stabilised and returned to go up more than 10x from the lows.

Read more at https://www.capitalmind.in/2019/10/good-things-happen-because-bad-things-are-allowed-to-karachi-stock-exchange-version/

Oh, and people have tried.

In Pakistan in 2008, they framed a rule: markets cannot go down. Meaning, stocks prices would have a lower bound, limited to the price of the previous day. You couldn’t bid the price down below that price. This was set by the SECP, the securities regulator of Pakistan.

This soothed some fears as the Karachi Stock Exchange index had already plunged from 15,000 to 9000, with a 15% drop in a week. If you don’t allow prices to go down further, then life would be so much better!

A strange thing happened. There were just no buyers for stocks. People wanted to buy, no doubt, but not at current prices. And without a buyer, there was nothing a seller could do but to place his orders at the lowest possible number – the high of the previous day.

Between September and December 2008, as the world was crashing and burning (the NSE Nifty fell about 40% in this period) the Karachi Index was at exactly the same level, because no one was willing to buy higher, and you were not allowed to sell lower.

When reality dawned, and apparently it took three months then, the authorities decided to remove the price “freeze”. Consequently the stock market dropped another 40% and only then stabilised and returned to go up more than 10x from the lows.

Read more at https://www.capitalmind.in/2019/10/good-things-happen-because-bad-things-are-allowed-to-karachi-stock-exchange-version/

October 17, 2019

Stocks at 52 week high

ADANIGREEN - ADHUNIKIND - AGROPHOS - ATUL - BAJFINANCE - BERGEPAINT - DOLAT - HDFCLIFE - HINDUNILVR - HNDFDS - ICICIPRULI - IMPAL - ITDC - MOLDTKPAC - NESTLEIND - PAISALO - SBILIFE - SIEMENS - WHIRLPOOL -

Market outlook

Daily charts:

- trend is up on daily charts

- today markets closed 1.1% in positive at 11586

- AD was 11:7

- trend is up on daily charts

- today markets closed 1.1% in positive at 11586

- AD was 11:7

October 16, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today nifty closed 0.4% in positive at 11471

- AD was flat

- trading range was very small

- small hanging man formed

- trend is up on daily charts

- today nifty closed 0.4% in positive at 11471

- AD was flat

- trading range was very small

- small hanging man formed

Nice thread on bull and bear markets

This small/midcap bear market is our 2nd most brutal in history. In 1992 you knew the Harshad was caught. In 2000 NASDAQ was bleeding & Ketan had been trapped. This time it was the system cracking - a box full of fire crackers catching fire. You don’t know which one bursts when!

Post the fall in 1992, EOUs, FMCG and software took over the leadership. Anything to do with ‘EOU’ was bid up. Post 2000 the large pharma companies like Dr Reddy’s starting moving and so did a lot of PSU divestment candidates.

Though the Govt. sold only a handful of PSUs the rally spread across the sector far and wide SCI, BEL, BEML, EIL, CONCOR & more were the shining stars till 2003. Companies that were debt free available at single digit P/Es with a dividend yield of 7% to 10% went up 10 to 30x.

Read more at https://threadreaderapp.com/thread/1184261729036861440.html

Post the fall in 1992, EOUs, FMCG and software took over the leadership. Anything to do with ‘EOU’ was bid up. Post 2000 the large pharma companies like Dr Reddy’s starting moving and so did a lot of PSU divestment candidates.

Though the Govt. sold only a handful of PSUs the rally spread across the sector far and wide SCI, BEL, BEML, EIL, CONCOR & more were the shining stars till 2003. Companies that were debt free available at single digit P/Es with a dividend yield of 7% to 10% went up 10 to 30x.

Read more at https://threadreaderapp.com/thread/1184261729036861440.html

October 15, 2019

Stocks gaining more than 5% today

ADANIENT - ADANITRANS - BANDHANBNK - BFINVEST - BFUTILITIE - ITDC - JAICORPLTD - JAYBARMARU - JSWENERGY - NRBBEARING - RIIL - STAR - TAKE - V2RETAIL -

Market outlook

Daily charts:

- trend is up on daily charts (from today)

- today nifty closed 0.8% in positive at 11428

- AD was flat

- VIX down 4%

- increased put writing seen at 11300 strike

- trend is up on daily charts (from today)

- today nifty closed 0.8% in positive at 11428

- AD was flat

- VIX down 4%

- increased put writing seen at 11300 strike

October 14, 2019

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.2% in positive at 11330

- AD was flat

- stiff resistance seen near 11400

- this level was earlier swing low which broke on 1st OCT

- trend is down on daily charts

- today nifty closed 0.2% in positive at 11330

- AD was flat

- stiff resistance seen near 11400

- this level was earlier swing low which broke on 1st OCT

Method to measure economic development in different countries

Method to measure economic development in different countries:— 24 x 7 x 365 Days (@BrainandMoney) October 14, 2019

America : growth rate

Britain : Job creation

Germany : Per capita income

India: Box office collection

Method to win votes:

America : Economy, invasions

Britain : Economy, taxes

Germany: Economy

India: Photoshoots

October 13, 2019

October 12, 2019

October 11, 2019

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.6% positive at 11301

- AD was flat

- trend is down on daily charts

- today nifty closed 0.6% positive at 11301

- AD was flat

What slowdown? Online food delivery may touch $12.53 billion by 2023

According to analysts, Swiggy and Zomato jointly delivered about 96 million orders in the year — April 2017 till March 2018. The report said Zomato and Swiggy have about 63% share in terms of app installs in food-tech sector.

Earlier this month, Zomato said said its revenues increased by about 225% to $205 million on year in the six months to September 2019. Food delivery that generates bulk of the revenue — about 75% (according to Zomato’s FY19 annual report) saw about 290% jump in order volumes in H1FY20 compared to the year-ago period.

“In addition to wider internet penetration, the growth in per capita income of India is also a driving force behind the growth in demand for online food delivery in India,” according to the report.

Read more at https://www.financialexpress.com/industry/online-food-delivery-may-touch-12-53-billion-by-2023/1732353

Earlier this month, Zomato said said its revenues increased by about 225% to $205 million on year in the six months to September 2019. Food delivery that generates bulk of the revenue — about 75% (according to Zomato’s FY19 annual report) saw about 290% jump in order volumes in H1FY20 compared to the year-ago period.

“In addition to wider internet penetration, the growth in per capita income of India is also a driving force behind the growth in demand for online food delivery in India,” according to the report.

Read more at https://www.financialexpress.com/industry/online-food-delivery-may-touch-12-53-billion-by-2023/1732353

October 10, 2019

Google trends for "multibagger stocks"

- good indicator of market tops and bottoms

- supports my view that retail is bullish at tops and bearish at bottoms

- supports my view that retail is bullish at tops and bearish at bottoms

Market outlook

Daily charts:

- trend is down on daily charts

- today markets closed 0.7% in negative at 11234

- AD was 1:2

- trend is down on daily charts

- today markets closed 0.7% in negative at 11234

- AD was 1:2

BANK NIFTY technicals

- trend is down

- however volatility is extremely high

- BNF has moved from 26800 to 30500 in 2 days

- now trading around 28800 (after a 4% intraday move)

- current ATR is 820 points or 3%

- this calls for min SL of 1600 points or 6%

- note my average SL for any positional trade in a stock is 10%

with kplswing indicator

- however volatility is extremely high

- BNF has moved from 26800 to 30500 in 2 days

- now trading around 28800 (after a 4% intraday move)

- current ATR is 820 points or 3%

- this calls for min SL of 1600 points or 6%

- note my average SL for any positional trade in a stock is 10%

with kplswing indicator

October 9, 2019

When Warren Buffet called customer care to invest USD 5 billion

This is amazing. Buffett wanted to invest $5 billion to save Bank of America and called the bank’s customer service line. https://t.co/z615lOoIfK pic.twitter.com/RLzeRxqvCS— Morgan Housel (@morganhousel) October 9, 2019

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 1.7% in positive at 11313

- AD was 5:4

- VIX down 4%

- note size of intraday moves has increased substantially in past few months

- average swings of 100-200 points are becoming very common

- but nifty is still today where it was 6 months ago

- so on daily charts there is almost no trend

- a trend may last max for few days before another wild swing comes

- as a trader you will need to adopt to this "new normal"

- however, a directionless market in one timeframe can be a trending market in another

- so learn to capture the moves

- as of now, this is an excellent day traders market

- an EOD trader has missed nothing if he was on a Europe tour of 6 months

- trend is down on daily charts

- today nifty closed 1.7% in positive at 11313

- AD was 5:4

- VIX down 4%

- note size of intraday moves has increased substantially in past few months

- average swings of 100-200 points are becoming very common

- but nifty is still today where it was 6 months ago

- so on daily charts there is almost no trend

- a trend may last max for few days before another wild swing comes

- as a trader you will need to adopt to this "new normal"

- however, a directionless market in one timeframe can be a trending market in another

- so learn to capture the moves

- as of now, this is an excellent day traders market

- an EOD trader has missed nothing if he was on a Europe tour of 6 months

Why the RBI monetary policy has become useless

Why the RBI monetary policy has become useless.— शिक्षित बेरोज़गार (@kaul_vivek) October 8, 2019

As RBI has cut repo rate, the bank lending rates have gone up.

The non-food credit has collapsed since April 2019. https://t.co/gycFcX61RV

My piece @newslaundry

October 8, 2019

What would happen by the end of the decade

PS: you can get rich getting only 1 collapse right.— Nassim Nicholas Taleb (@nntaleb) October 8, 2019

October 7, 2019

Market outlook

Daily charts:

- trend is down on daily charts

- today nifty closed 0.4% in negative at 11126.4

- AD was 1:2

- trend is down on daily charts

- today nifty closed 0.4% in negative at 11126.4

- AD was 1:2

October 5, 2019

Anatomy of a new scam. Don't fall prey to this

Anatomy of a new scam. Don't fall prey to this— Nagpal Manoj (@NagpalManoj) October 3, 2019

1. You get a call saying ur PayTm (or any other wallet/bank) KYC is invalid

2. Caller says u can do it online in 2 min and ur wallet will be active again

3. Says give guide u

All ok till now. Now the scam begins

(1/n)

October 4, 2019

Market outlook

Daily charts:

- trend is down on daily charts (from yesterday)

- I missed marking this yesterday but

- I am marking this today as rally is corrected by 50%

- now support zone is 11100 to 11200 spot where recovery can happen

- and 11000 is also a big round number

- AD was 7:11 - not bad

- trend is down on daily charts (from yesterday)

- I missed marking this yesterday but

- I am marking this today as rally is corrected by 50%

- now support zone is 11100 to 11200 spot where recovery can happen

- and 11000 is also a big round number

- AD was 7:11 - not bad

Helicopter money Bernanke style?

Source: http://alphaideas.in/2019/10/04/as-long-as-it-is-necessary/

October 3, 2019

Market outlook

Daily charts:

- trend is up on daily charts (down on hourly charts)

- today nifty closed 0.4% in negative at 11314

- AD was 7:11

- VIX up 6%

- good support around 11100-11200 spot

- trend is up on daily charts (down on hourly charts)

- today nifty closed 0.4% in negative at 11314

- AD was 7:11

- VIX up 6%

- good support around 11100-11200 spot

The butterfly effect: how a journalist's killing led to the bursting of the Silicon Valley bubble

1/ One year ago this week, Saudi dissident and journalist Jamal Khashoggi was killed in his country’s consulate in Istanbul. At the time, we wrote about the butterfly effect—how this will eventually lead to the bursting of the Silicon Valley bubble. Read on. 🤔— Jawad Mian (@jsmian) October 1, 2019

October 2, 2019

Identifying Capitulation: How to Tell We've Hit Bottom

There are two important features that identify climax selling. The first is the rapid acceleration in the speed of the market fall. Like a Stuka dive-bomber, the market first rolls over slowly and then plunges in a vertical dive. This is fear at work.

The second feature is a massive increase in volume. This is panic. Ordinary people are desperate to get out of the market. Generally the funds and institutions got out of the long-side of the market many months ago.

Read more at https://www.cnbc.com/id/27154015

The second feature is a massive increase in volume. This is panic. Ordinary people are desperate to get out of the market. Generally the funds and institutions got out of the long-side of the market many months ago.

Read more at https://www.cnbc.com/id/27154015

October 1, 2019

Market outlook

Daily charts:

- trend is up on daily charts

- today markets closed 1% in negative at 11360

- the index was down almost 2% at one time till recovery came in

- recent gap around 11300-11500 is filled

- AD was 4:15

- VIX up 6% to 16.7

- good support around 11200 levels

- trend is up on daily charts

- today markets closed 1% in negative at 11360

- the index was down almost 2% at one time till recovery came in

- recent gap around 11300-11500 is filled

- AD was 4:15

- VIX up 6% to 16.7

- good support around 11200 levels

Listen to unpleasant truth, Subramanian Swamy tells PM Modi

"I am afraid the economists that the government has recruited seem so frightened to tell the truth to the prime minister, while the prime minister himself is focused only on the micro-projects," Swamy said

Swamy also blamed the demonetisation, especially the role of RBI and the finance ministry in not properly flagging the real issues, and the hasty introduction of GST for the present crisis in the economy.

BJP leader Subramanian Swamy on Monday advised prime minister Narendra Modi to develop a “temper” to listen to the unpleasant truth and stop “frightening” his government’s economists, if he wants to drive the economy out of the crisis. “The way Modi runs the government is that very few people can step out of the line. He should encourage people to tell to his face that no this can’t be done. But I think he has not yet developed that temper,” Swamy said.

The comments from the ruling party’s Upper House member come at a time when growth has slipped to a six-year low and the government is trying various unconventional measures, including massive tax giveaways, to prop-up growth. Swamy also blamed the demonetisation, especially the role of RBI and the finance ministry in not properly flagging the real issues or preparing well, and the hasty introduction of GST for the present crisis in the economy. He also said the government has not understood the policies required for higher growth.

Read more at https://www.financialexpress.com/india-news/listen-to-unpleasant-truth-subramanian-swamy-tells-pm-modi/1722470/

Swamy also blamed the demonetisation, especially the role of RBI and the finance ministry in not properly flagging the real issues, and the hasty introduction of GST for the present crisis in the economy.

BJP leader Subramanian Swamy on Monday advised prime minister Narendra Modi to develop a “temper” to listen to the unpleasant truth and stop “frightening” his government’s economists, if he wants to drive the economy out of the crisis. “The way Modi runs the government is that very few people can step out of the line. He should encourage people to tell to his face that no this can’t be done. But I think he has not yet developed that temper,” Swamy said.

The comments from the ruling party’s Upper House member come at a time when growth has slipped to a six-year low and the government is trying various unconventional measures, including massive tax giveaways, to prop-up growth. Swamy also blamed the demonetisation, especially the role of RBI and the finance ministry in not properly flagging the real issues or preparing well, and the hasty introduction of GST for the present crisis in the economy. He also said the government has not understood the policies required for higher growth.

Read more at https://www.financialexpress.com/india-news/listen-to-unpleasant-truth-subramanian-swamy-tells-pm-modi/1722470/

Biggest beneficiaries of the cut in corporate tax rates

"The biggest beneficiaries of the cut in corporate tax rates are companies with a combination of high ROCE + high reinvestment rate + high tax rate."https://t.co/k2j52u40GO— D.Muthukrishnan (@dmuthuk) October 1, 2019

There is no substitute for high savings

Inadequate savings forces people to chase high returns. They make not one but two mistakes of saving less and risking more. Need to remember that there is no substitute for high savings.— D.Muthukrishnan (@dmuthuk) October 1, 2019

Subscribe to:

Posts (Atom)